Major factors contributing to our forecast are summarized as follows:

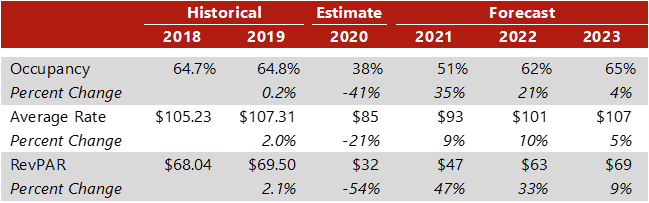

- On March 23, 2020, St. Louis City and St. Louis County officials implemented stay-at-home orders, imposed limits on gatherings and business activity, and limited travel to essential activities. Hotel demand plummeted in late March, and occupancy remained below 30% throughout April and May 2020. ADR levels also declined by over 35% during that period, as formerly higher-rated corporate, meeting, and event demand evaporated. Although stay-at-home orders were lifted on May 18, 2020, restrictions on business activity and group gatherings have remained in place. While a number of attractions, such as the St. Louis Zoo and new St. Louis Aquarium, have reopened with limited capacity, large meetings and events continue to be prohibited, including the conventions and public sporting events that typically provide a strong base of demand. Although hotel occupancy levels improved over the summer of 2020 to around 40%, and ADR declines have lessened, overall market performance remains severely impacted, with RevPAR less than half of the 2019 level.

- As of late 2020, the number of room nights expected to be generated by conventions in 2020 was down approximately 88% from 2019. Representatives of the America’s Center Convention Complex are tenatively projecting a modest recovery in 2021. Restrictions on large public gatherings have caused cancellations, postponements, and modifications through the first half of 2021. However, officials reported success in rescheduling canceled events for the second half of 2021 and beyond; the convention calendar for 2022 and 2023 should support a strong and swift recovery for the downtown market during those years. Furthermore, in September 2020, funding for $175 million in renovations and upgrades to the center was secured. The AC Next Gen project, which is planned for completion in 2023, is anticipated to include a new ballroom, expanded exhibit space, additional service space and loading docks, and exterior enhancements.

- A stronger market is expected for the summer of 2021, relative to 2020, as the nation is anticipated to emerge from pandemic restrictions and the distribution of vaccines should be widespread. Greater St. Louis had realized occupancies in the low 40% range by the end of the summer in 2020 (up from the April and May lows in the 20s); we expect summer 2021 occupancy levels to reach the low 60s across the St. Louis market. In the years immediately prior to the pandemic, Greater St. Louis experienced occupancy in the low-to-mid 70s, on average, during the peak summer season; the market is forecast to recover to that normalized level by 2023. As consumer sentiment and confidence improves, new attractions, including the MLS stadium and St. Louis Aquarium, should help attract regional visitation.

- Assuming that meeting and social-distancing restrictions are eased by mid-year 2021, corporate demand is expected to rebound relatively swiftly in the following twelve months. Although elevated unemployment levels and general economic recovery may present some headwinds, we anticipate that pent-up demand for client meetings and in-person training will foster a healthy rebound in the region’s commercial demand base. Overall, the market’s diversity of employment sectors, with concentrations in healthcare, education, government, financial services, life sciences, and aerospace, should provide a strong base for economic recovery, allowing commercial demand to recover by 2023.

- Within the greater market, the impact of the pandemic on individual hotels and the outlook for recovery spans a wide spectrum. In general, the area’s budget/economy and extended-stay hotels have been less affected than other hotel types, showing some resiliency due to their typical demand bases. Hotels that have been able to maintain a somewhat stable demand mix have typically experienced more limited rate declines. On the other hand, full-service properties, particularly those in the urban core, have generally experienced the most severe effects of the downturn, due primarily to these properties’ reliance on demand from corporate sources and group events, which have been most severely limited. These hotels have been forced to discount rates to attract demand from leisure travelers and lower-rated commercial accounts. As demand from corporate sources and large events returns, full-service hotels, and the market in general, should experience strong ADR recovery.

- The transactions market has virtually ground to a halt in Greater St. Louis, with just two closed transactions since March. The former Drury Inn & Suites in Maryland Heights/Westport sold in March 2020; the buyer converted the hotel to a SureStay Plus by Best Western. Additionally, the Holiday Inn Express in Earth City/Riverport sold in August 2020.

For more information, contact our St. Louis team: Daniel McCoy and Zabada Abouelhana.

City of St. Louis COVID-19 Guideline Highlights (effective November 13, 2020)

Restaurants limited to 50% indoor dining capacity

All businesses limited to 50% capacity

Meetings limited to 50% capacity

St. Louis County’s COVID-19 Guideline Highlights (effective January 4, 2021)

Gatherings limited to the lesser of 10 people or 25% capacity

Restaurants limited to 25% indoor dining capacity and 10 PM closure

All businesses limited to 25% capacity

[1] Greater St. Louis is defined as St. Louis City and its immediately surrounding counties, from Fayette County, Illinois, to the east, Warren County to the west, Jefferson County to the south, and Lincoln County to the north.