An electrified high-technology sector, with Microsoft and Amazon at its core, has been the force behind making Seattle one of the nation’s strongest metro economies in recent years. This growth has brought Seattle’s lodging market beyond historic peak levels of performance and value, spurring an unprecedented amount of proposed supply.

The following report examines historical hotel operations, major employers and demand generators, unemployment, the office market, convention activity, and tourism in Seattle. We also provide in-depth information and analysis of how the recent expansion of the local economy has affected hotel values, performance, and transactions, as well as how hotel stakeholders can expect market dynamics to trend going forward.

Hotel Market Performance

Overview of Historical Occupancy and Rate Trends

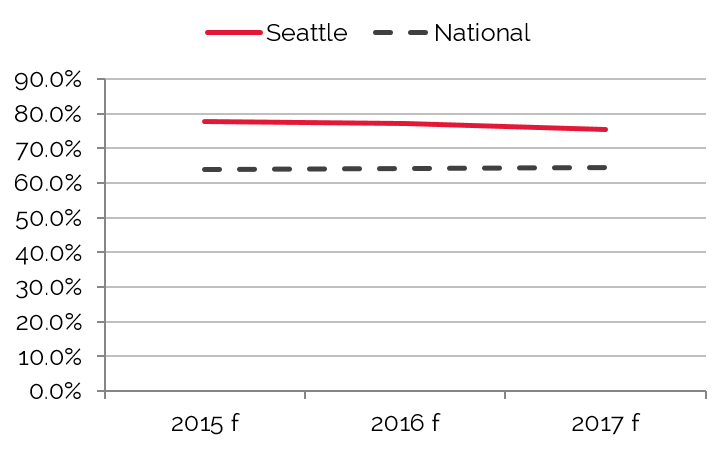

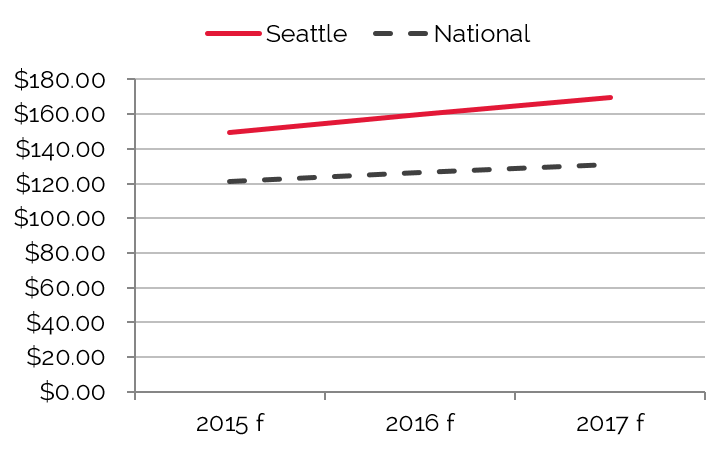

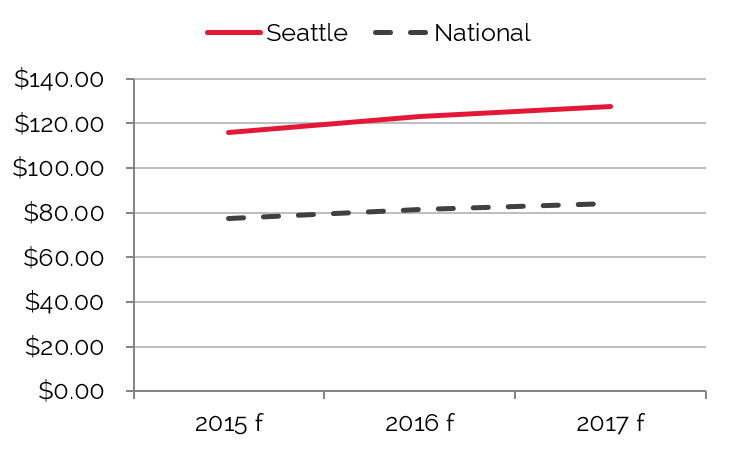

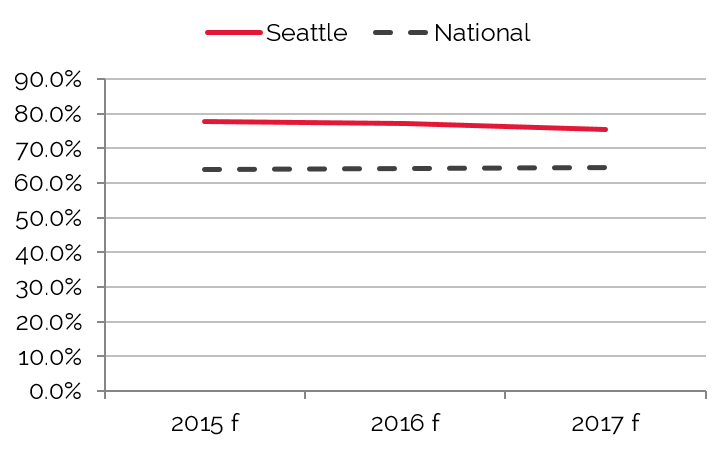

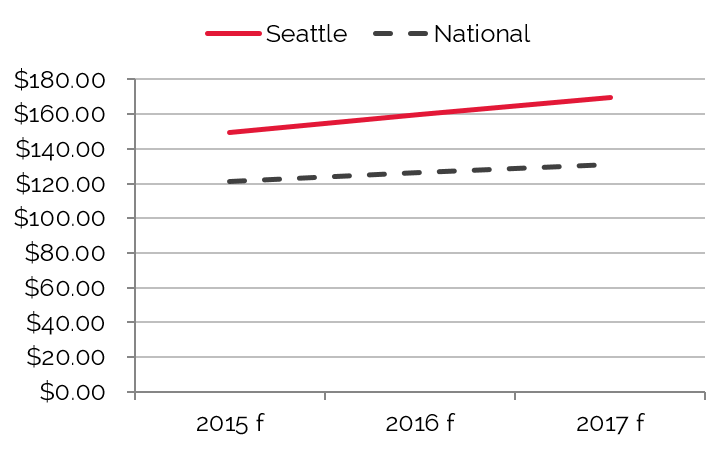

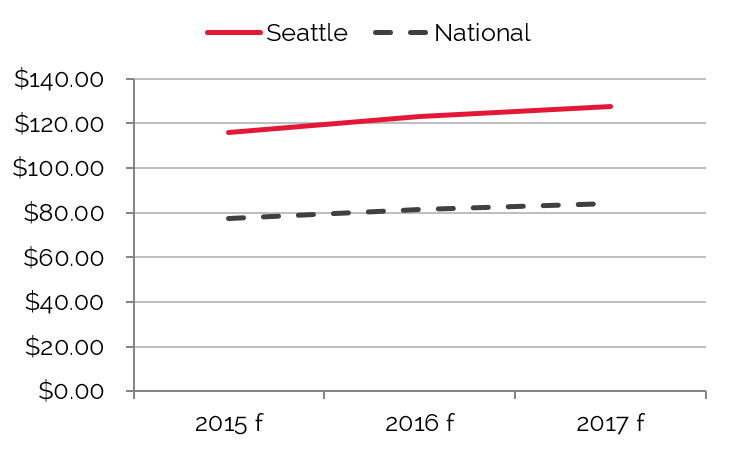

The following charts illustrate trends in forecasted occupancy, average rate, and RevPAR for Seattle hotels from 2015 to 2017.

Occupancy Expected to Stabilize; Average Rate and RevPAR Forecast to Continue Growth

Seattle’s Occupancy Grew through 2014

Seattle’s Average Rate Outpaces Nation’s

Seattle’s RevPAR Soars ahead of Nation’s

Source: HVS

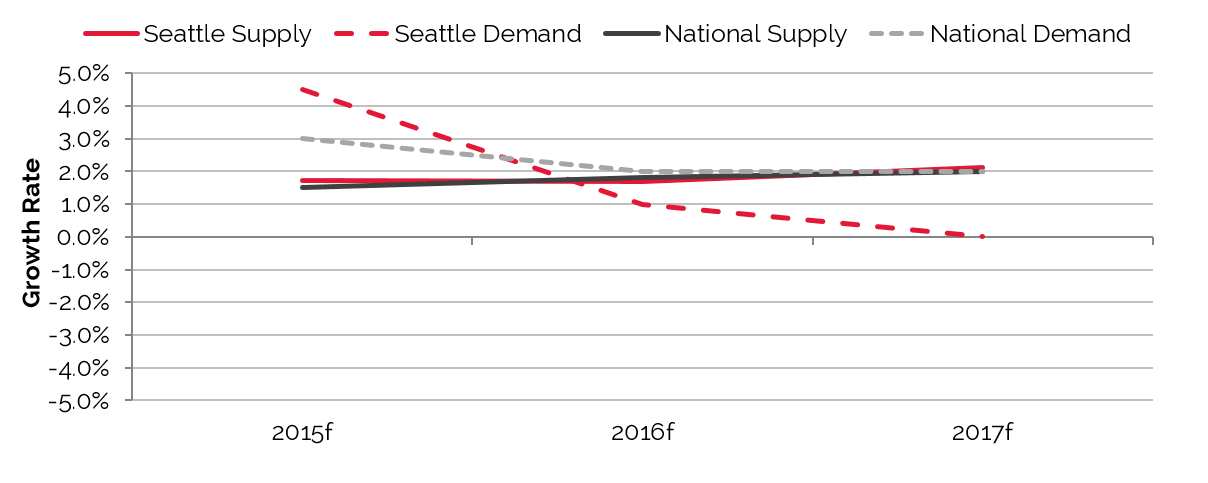

Trends in occupancy, average rate, and RevPAR for Seattle hotels have fluctuated over the last ten years. A strengthening economy after the recession of the early 2000s sustained year-over-year occupancy growth between 2004 and 2007. Seattle was hit hard during the 2008/09 recession; with the entrance of new supply and the failure of Washington Mutual in 2009, occupancy fell to unprecedented lows. Average rates fared the same, with a nearly 20% rate decrease in 2009. Fortunately, in the years since, Seattle’s hotel industry has recouped much of the loss. A slew of new employers, strong corporate balance sheets, increased tourism, and the return of group travel have all contributed to major gains in occupancy and average rate levels. Furthermore, new supply has been muted since 2009, which has allowed for more pronounced growth in these performance metrics.

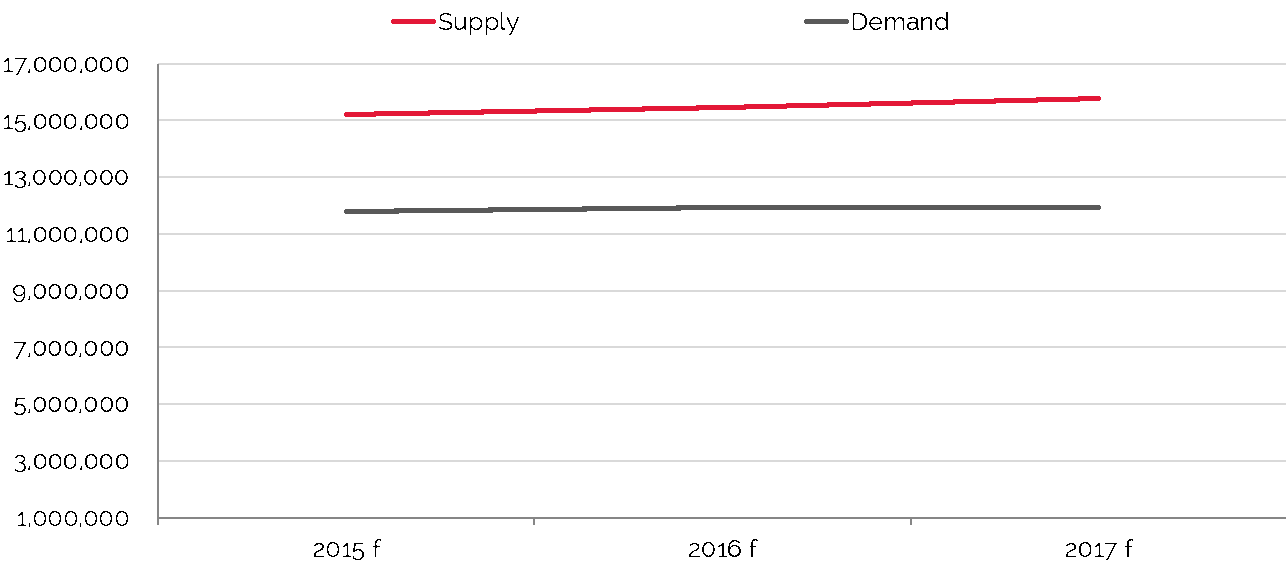

Seattle Supply and Demand to Reach Equilibrium in Early 2016

Source: HVS

The city’s growing professional sports and entertainment culture, anchored by the Seattle Seahawks, has contributed to strong shoulder season occupancy and average rate growth, much of which was not anticipated by local hoteliers. Year-to-date trends for demand growth have surpassed expectations, pushing summertime occupancy levels well over 90% and average rate increases near the mid-teens.

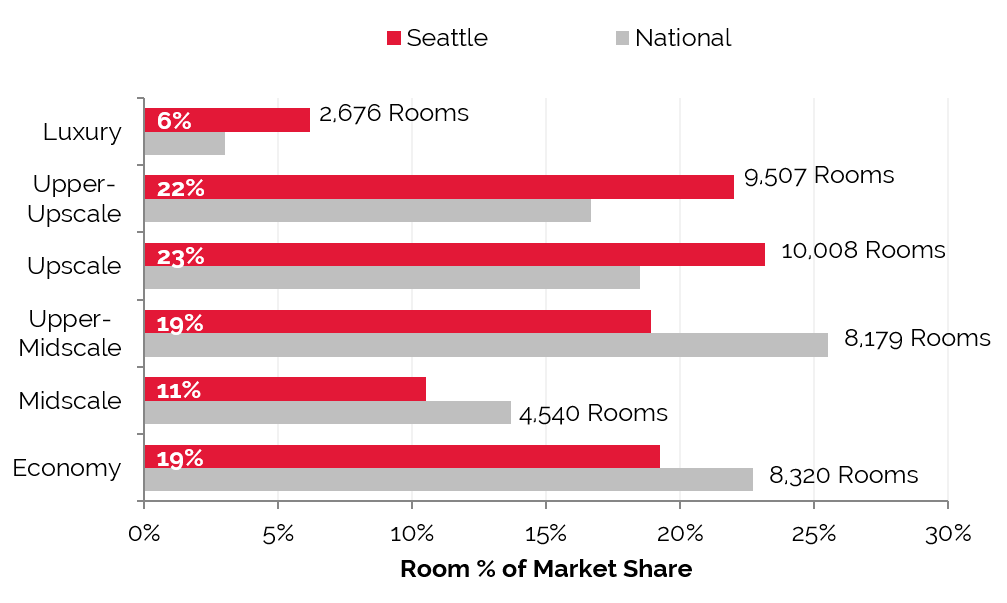

Existing Supply Breakdown by Brand and Scale

Seattle’s existing level of supply, like in many highly corporate-driven secondary markets, is saturated with branded limited- and select-service hotels. The full-service and boutique sector is growing, as traction in average rate growth coupled with extraordinary demand levels increases the feasibility of new projects. The barriers to entry are extremely high, partially because of Seattle’s geographic positioning between Lake Washington and the Puget Sound, but also because of lengthy and challenging entitlement processes. Furthermore, Amazon’s entry into Seattle’s Lake Union neighborhood is expected to ultimately create 35,000 new jobs. Many of these incoming “Amazonians” are looking for urban homesteads, making the demand for high-density residential development extremely high and potentially profitable in Seattle. Hence, hotel developers are being outbid by developers looking to build apartments. All the while, it appears that the luxury sector in Seattle is somewhat underrepresented. As Seattle gains traction as a top-tier city and investment opportunity, HVS anticipates increased interest for the development of ultra high-end properties.

Upscale Class Represents Largest Portion of Rooms in Seattle; Upper-Midscale Class Leads the Nation

Source: STR

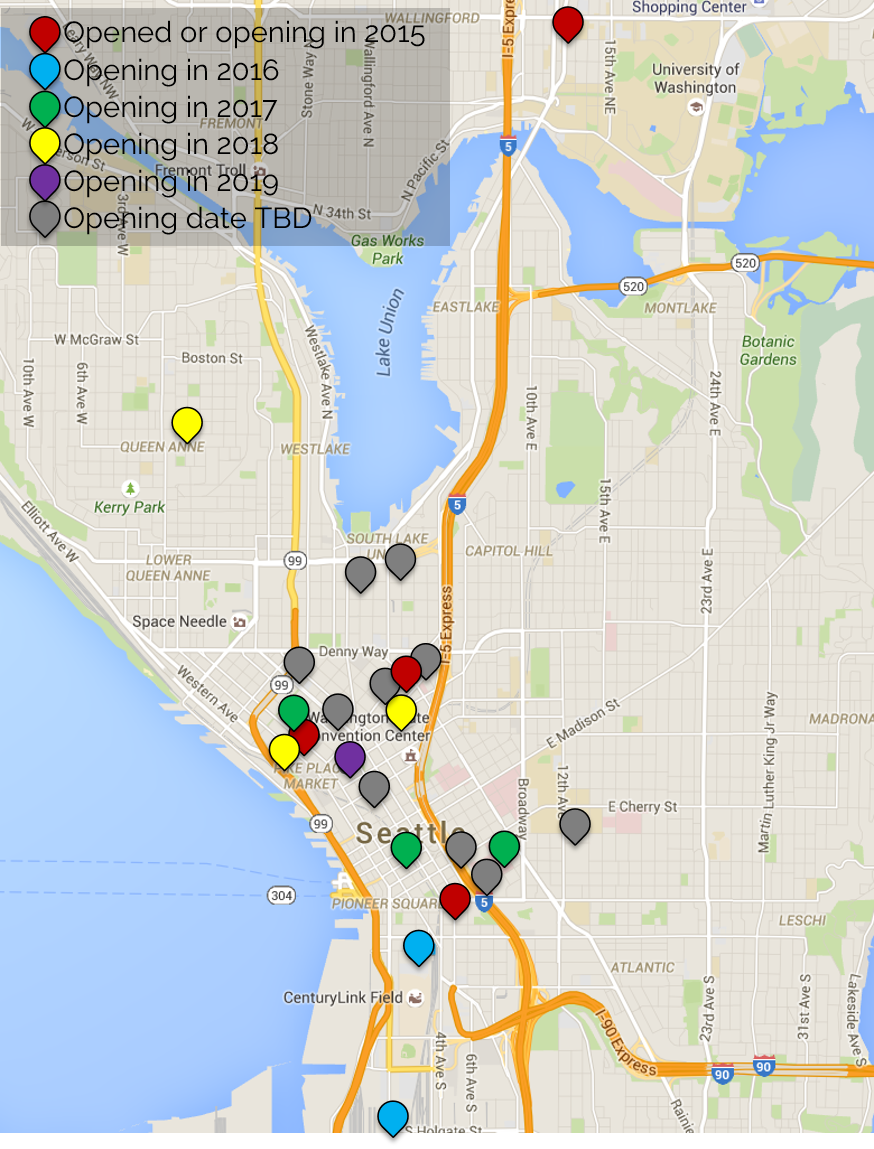

New Supply Pipeline

The greater Seattle metro area is poised to receive a major influx of new supply over the next few years. The majority of hotels entering the market fall in the upscale and upper-upscale categories, with upscale accounting for more than 10% of the room count increase, followed by upper upscale at just over 7%. Economy hotels are also making a wave in the new supply pool, with nearly 6% of the new inventory hitting the market coming from this category. Hotels belonging to the upscale and upper-upscale are expected to dominate the new supply pipeline in 2015 and 2016, driven by the needs of existing and expanding commercial and leisure demand generators in Seattle. This is especially apparent in the city’s downtown core, which tends to generate a wealth of higher-rated clientele. Developers are taking advantage of the higher rates these hotels command, given the number of travelers to Seattle with the means to pay for a centrally situated, higher-class hotel.

The new hotels would bring an increase of over 5,000 rooms, in addition to one proposed property with an undetermined room count, to the existing supply of 26,809 rooms in Seattle; there are also numerous planned projects in the city, which do not factor into our room-count increase. The documented developments represent an approximate supply increase of 7.6%.

Majority of New Hotels are Expected in the City’s Urban Core

Source: HVS

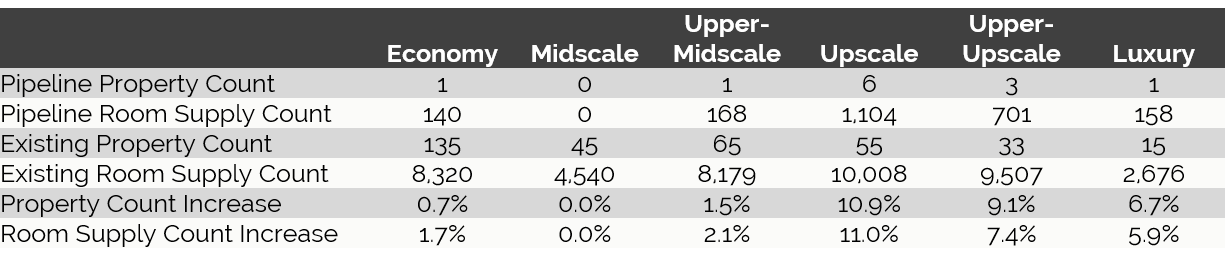

Of the property classes and room counts that have been determined, the following chart illustrates the class breakdown of the new supply.

Seattle’s Upscale Hotel Room Inventory set to Increase by More Than 10%,

Followed by Upper -Upscale at Over 7%*†

Source: HVS,STR, and BuildCentral, Inc.

* Only includes properties with room counts and class designations

† Only the lowest value in the rooms range is considered

Lodging Room Supply Expected to Increase 2015–2017

Source: HVS

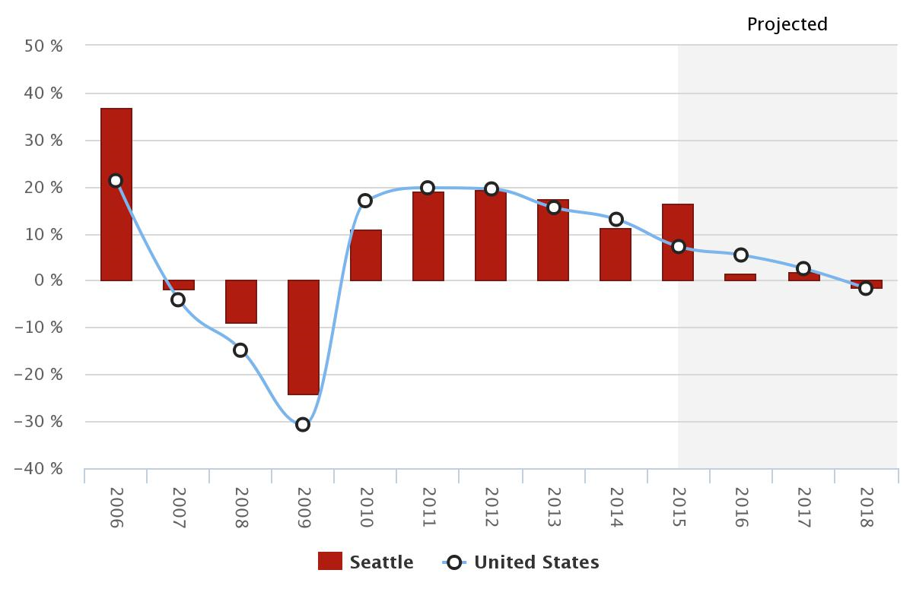

Hotel Valuation Expectation

The annual Hotel Valuation Index (HVI) compiles data derived from over 4,500 hotel appraisal assignments each year, providing for analysis of performance and forecasts for hotel markets nationwide.

The Seattle hotel market achieved annual RevPAR growth of roughly 9.5% from 2011 through 2013—a remarkable achievement that places Seattle among the top markets for growth in the nation. Market-wide occupancy surpassed 70% in 2012, and average rate fell just shy of the $121 mark for that year. Prior to 2013, occupancy in Seattle had surpassed the 70% level only once since 1997, and the city’s average daily rate for 2014 has never been higher.

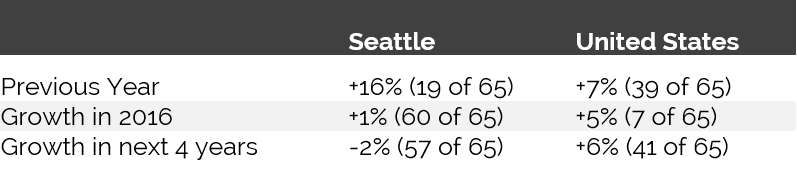

The HVI also provides insight into hotel values. In 2014, Seattle ranked in the top 20 among 65 major U.S. cities in hotel value growth; hotel values in Seattle rose by more than 10% in that year, but failed to keep pace with growth in the nation as a whole, partially because of the strong increases noted in prior years. Seattle has realized double-digit RevPAR growth as of year-to-date 2015, and the city’s hotel values are anticipated to rise by more than 15% for the year, far stronger than what is anticipated for the nation. The following chart illustrates the trajectory of hotel values in Seattle from 2006 through 2018.

After Years of Strong Growth, Values set to Taper in 2016 and 2017, Declining Slightly in 2018

Ratings are comparable to 65 major U.S. cities evaluated in the HVS HVI.

Source: HVS & STR

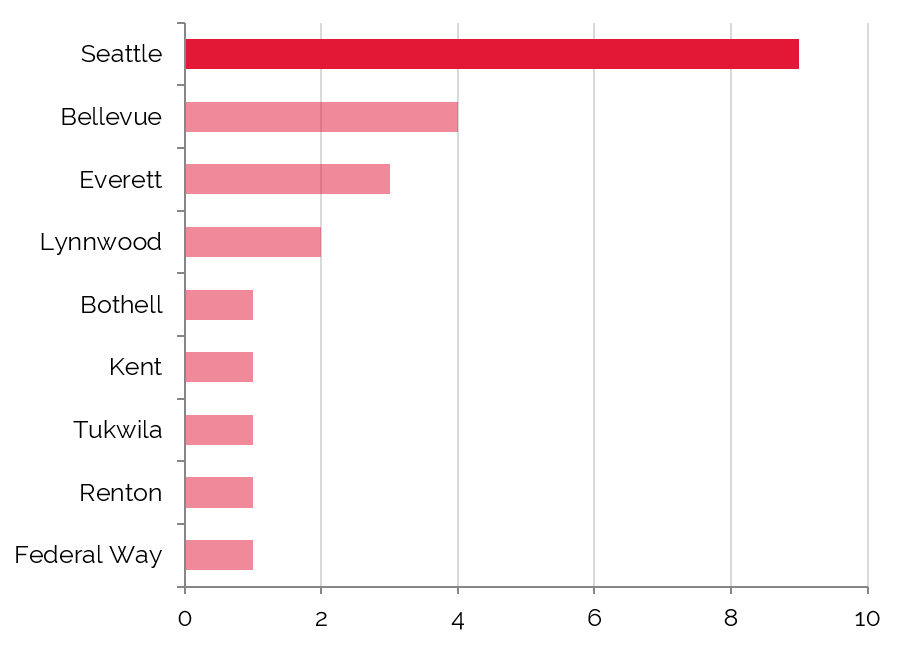

Recent Hotel Transactions

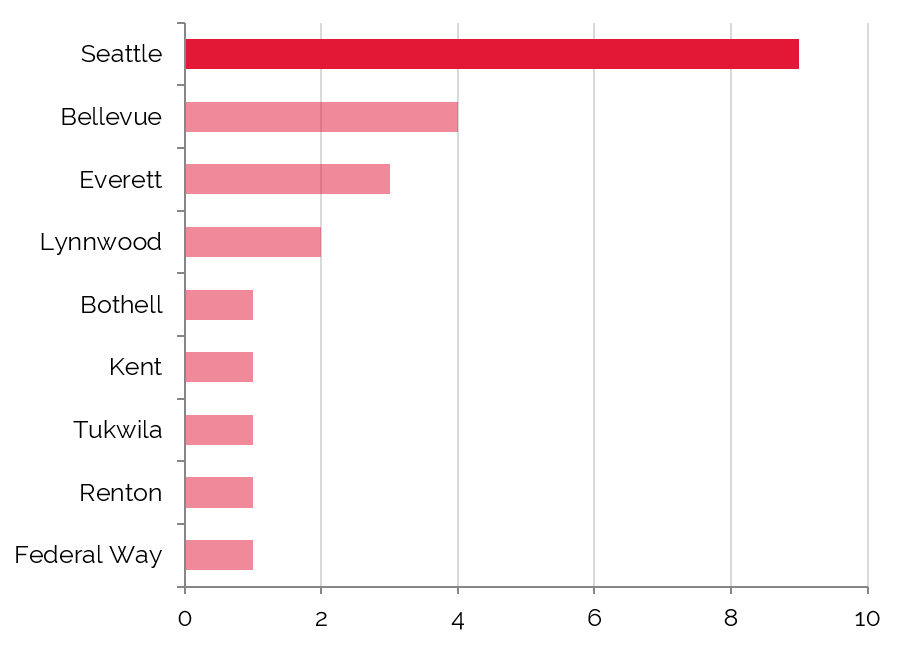

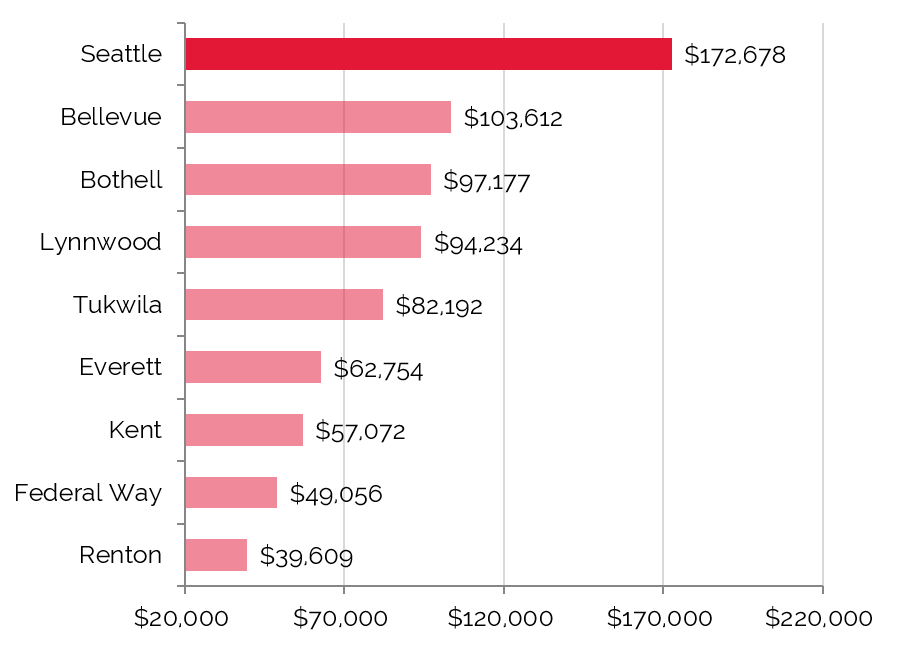

The following graphs detail the number of sales and average price per room for confirmed hotel transactions in the Seattle MSA since 2013.

Several High-Profile Transactions Contribute to $516 Million in Sales Volume in Greater Seattle

Number of Sales

Source: HVS & RCA

Average Price per Room

Source: HVS & RCA

The sales above, which total just over $516 million in transaction volume, include such high-profile assets as the boutique Heathman Hotel in nearby Kirkland; the property was part of a portfolio of hotels purchased by LaSalle Hotel Properties that also included the historic Heathman Hotel in Portland, Oregon. In addition, the former Red Lion flagship hotel in Downtown Seattle was purchased after undergoing a $25-million renovation and rebranding to the Motif Hotel; this was the largest transaction in the last three years in the market, totaling just under $127 million, or $397,912 per key. In addition, Provenance and NBP Capital purchased the Hotel Roosevelt in February 2015.

Interest among investors remains high and continues to put downward pressure on capitalization rates, particularly in high barrier-to-entry submarkets such as the CBD and Bellevue. The high level of investor interest, Seattle’s thriving economy, and growing demand generated by the high-tech sector support a positive outlook for the city’s hotel industry overall, with values set to rise through 2017.

Across the nation, according to Real Capital Analytics, the lowest-priced confirmed hotel sale for the preceding three years was the Hotel Seagate in the Toledo, Ohio CBD at $2,830 per key. The next two lowest-priced sales occurred in Chicago and Atlanta. The highest-priced confirmed sale, at $1.85 million per key, was the purchase of the Park Hyatt Hotel in the Manhattan Midtown West neighborhood. The next runner up was the Hollywood St. Louis in Missouri at $1.22 million.

Number of Major U.S. Sales

($10 Million and above)

Average U.S. Key Price per Room

Source: RCA

Key Economic Indicators

Economic and Demographic Review

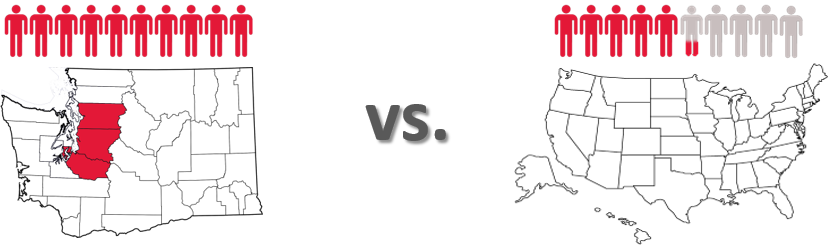

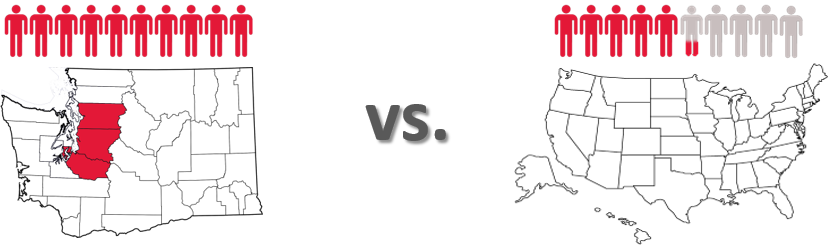

The U.S. population grew at an average annual compounded rate of 0.9% from 2010 through 2014; it is forecast to increase at 1.0% into 2020. For those same periods, King County’s population growth stands ahead of the country at 1.5% and 1.4%, respectively. The Seattle-Tacoma-Bellevue MSA is slightly below the county, with a compounded average annual growth rate of 1.4% from 2010 to 2014 and 1.3% into 2020. This upward trend is being spurred in part by strong job growth in Seattle and Bellevue, which will be discussed in more detail later in this report.

The average annual compounded growth rate of per-capita personal income for the county between 2010 and 2014 of 1.2% aligns with the national average of 1.2%. Anticipated growth into 2020 for the county is 1.1%, versus 1.3% for the nation. Anticipated growth into 2020 for the Seattle-Tacoma-Bellevue MSA stands at 1.2%, slightly ahead of that for King County.

The national wealth index trended flat from 2000 to 2014; it is anticipated to remain flat into 2020. King County and the Seattle-Tacoma-Bellevue MSA are expected to experience a slight contraction of -0.2% and -0.1% over the next five years.

Population Growth in the Seattle MSA registers 47% higher than that of the nation.

Average annual compounded growth rate of per-capita personal income for the MSA was 7% lower than that of the nation in the 2010-2014 period.

Food and beverage sales in the county grew at an annual compounded rate of 2.5%, with $4.079 billion in 2010 and $4.497 billion in 2014. Through 2020, the pace of growth is expected to moderate slightly to 1.9% for the county. The Seattle-Tacoma-Bellevue MSA reflected more robust sales, with $6.069 billion in 2010, $6.713 billion in 2014, and a predicted $7.534 billion in sales in 2020. This reflects average annual compounded growth rates of 2.6% from 2010 to 2014 and 1.9% from 2014 to 2020.

The retail sales sector for the Seattle-Tacoma-Bellevue MSA outpaced that of the King County. The MSA demonstrated an average annual compounded growth rate of 3.1%, with $59.917 billion in 2010 and $67.806 billion in 2014. This sector is expected to remain strong—16% higher than the national average—with a 2.3% growth rate into 2020.

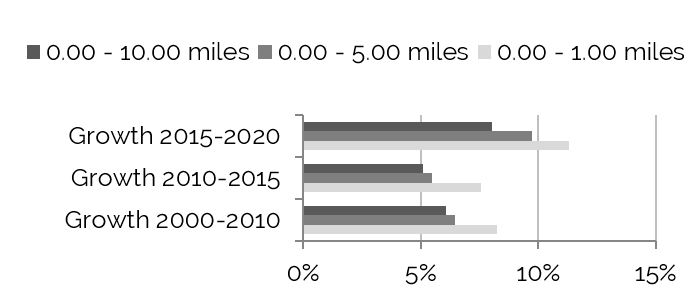

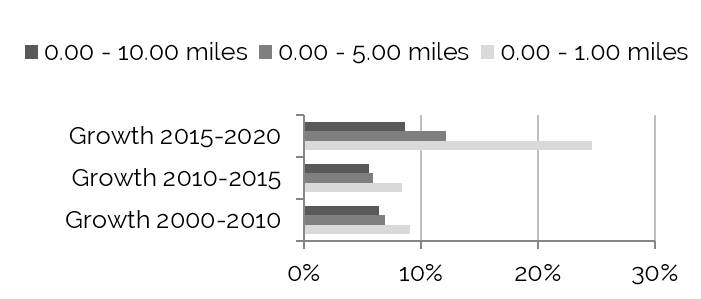

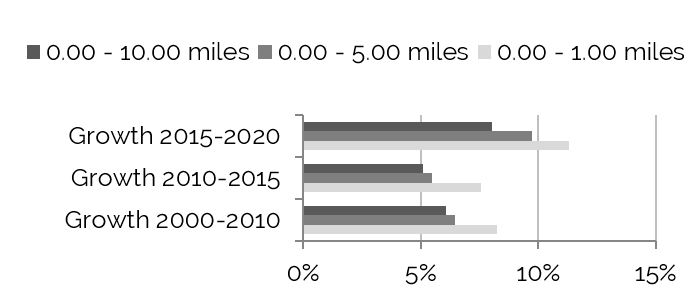

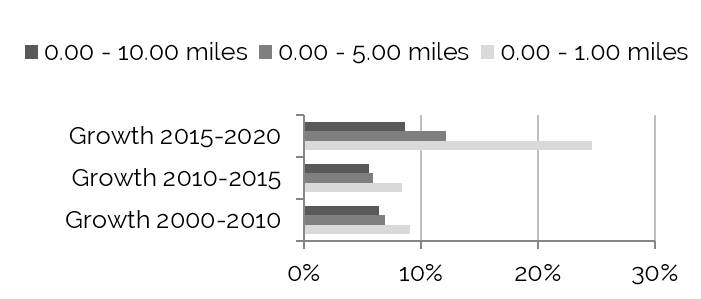

Radial Demographic Indicators

The following table reflects radial demographic trends for the market area, measured by three points of distance from the center of Downtown Seattle.

Demographics by Radius from the Center of Town

Population Growth to Decline within

One-Mile Radius 2010–2015

Source: The Nielsen Company

Household Growth Most Stable within

Five-Mile Radius 2010–2015

Source: The Nielsen Company

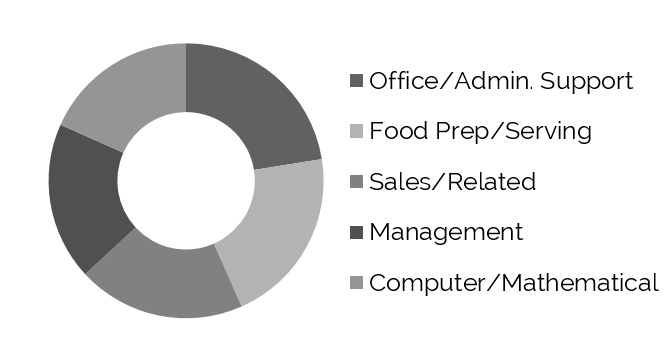

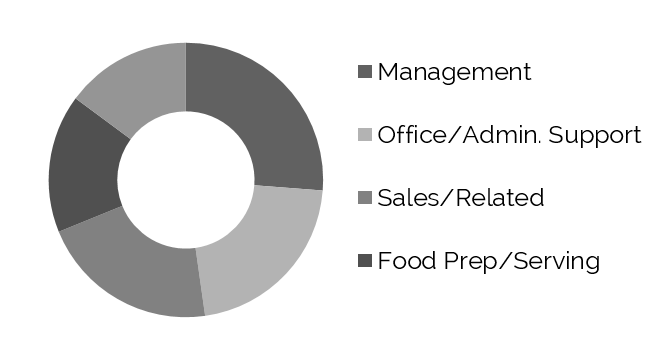

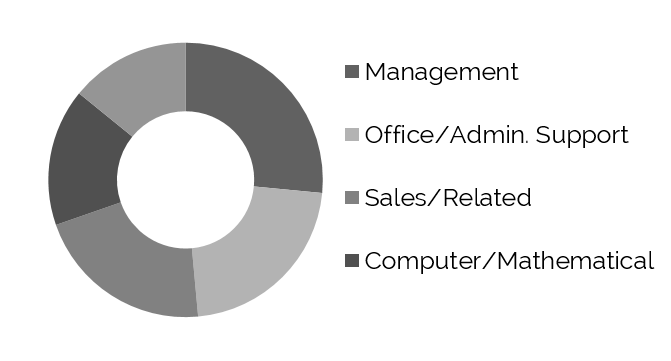

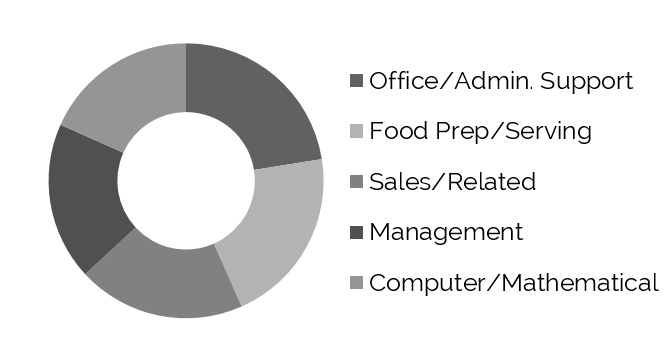

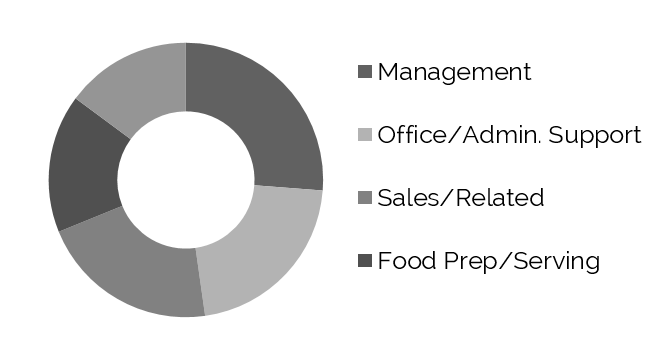

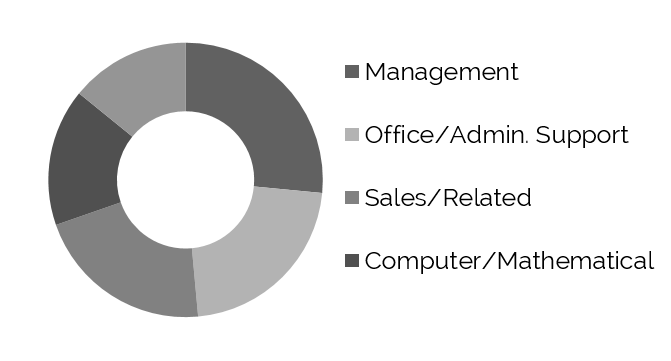

Top Five Occupations – Estimated for 2015

Within One-Mile Radius

Within Five-Mile Radius

Within Ten-Mile Radius

Source: The Nielsen Company

Population growth within one mile of the center of downtown was a significant 11.3% from 2000 to 2010, whereas the greater area experienced a less pronounced yet still healthy growth rate of 8.0% during the same period. Although the overall growth rate slowed to 5.1% from 2010 to 2015, projected growth is anticipated to continue at about 6.1% per year into 2020. Households are expected to grow at a rate of 6.4% per year into 2020.

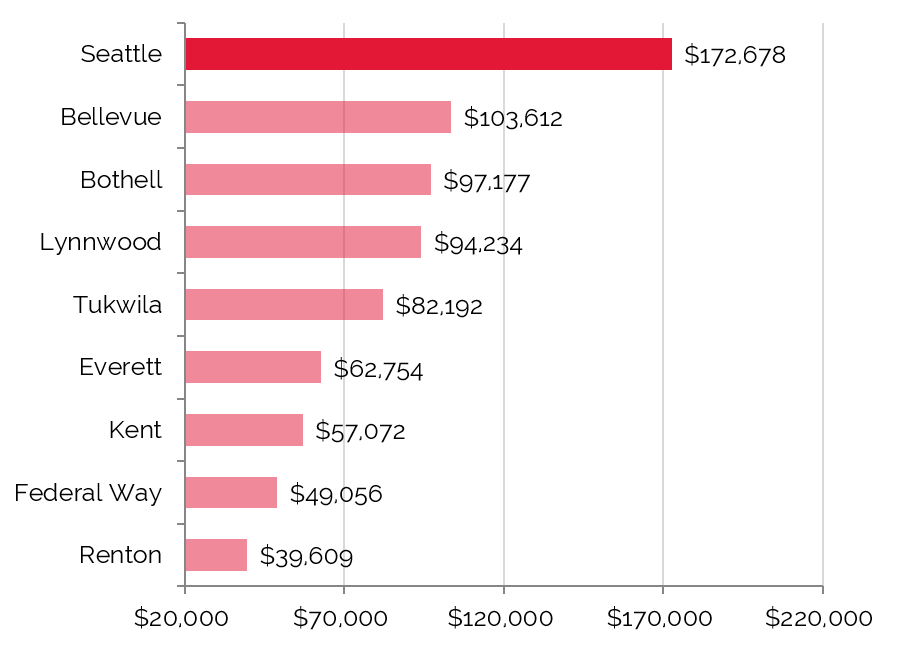

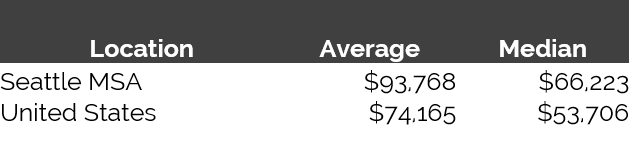

Seattle’s forecasted 2015 average and median household incomes are over 20% higher than the national averages, which is typical for a major city located on the West Coast.

2015 Forecast - Average and Median Household Income

Source: The Nielsen Company

Workforce Characteristics

The characteristics of an area’s workforce provide an indication of the type and amount of transient visitation likely to be generated by local businesses. Sectors such as finance, insurance, and real estate [FIRE]; wholesale trade; and services produce a considerable number of visitors who are not particularly rate-sensitive. The government sector often generates transient room nights, but per-diem reimbursement allowances often limit the accommodations selection to budget and mid-priced lodging facilities. Contributions from manufacturing, construction, transportation, communications, and public utilities [TCPU] employers can also be important, depending on the company type.

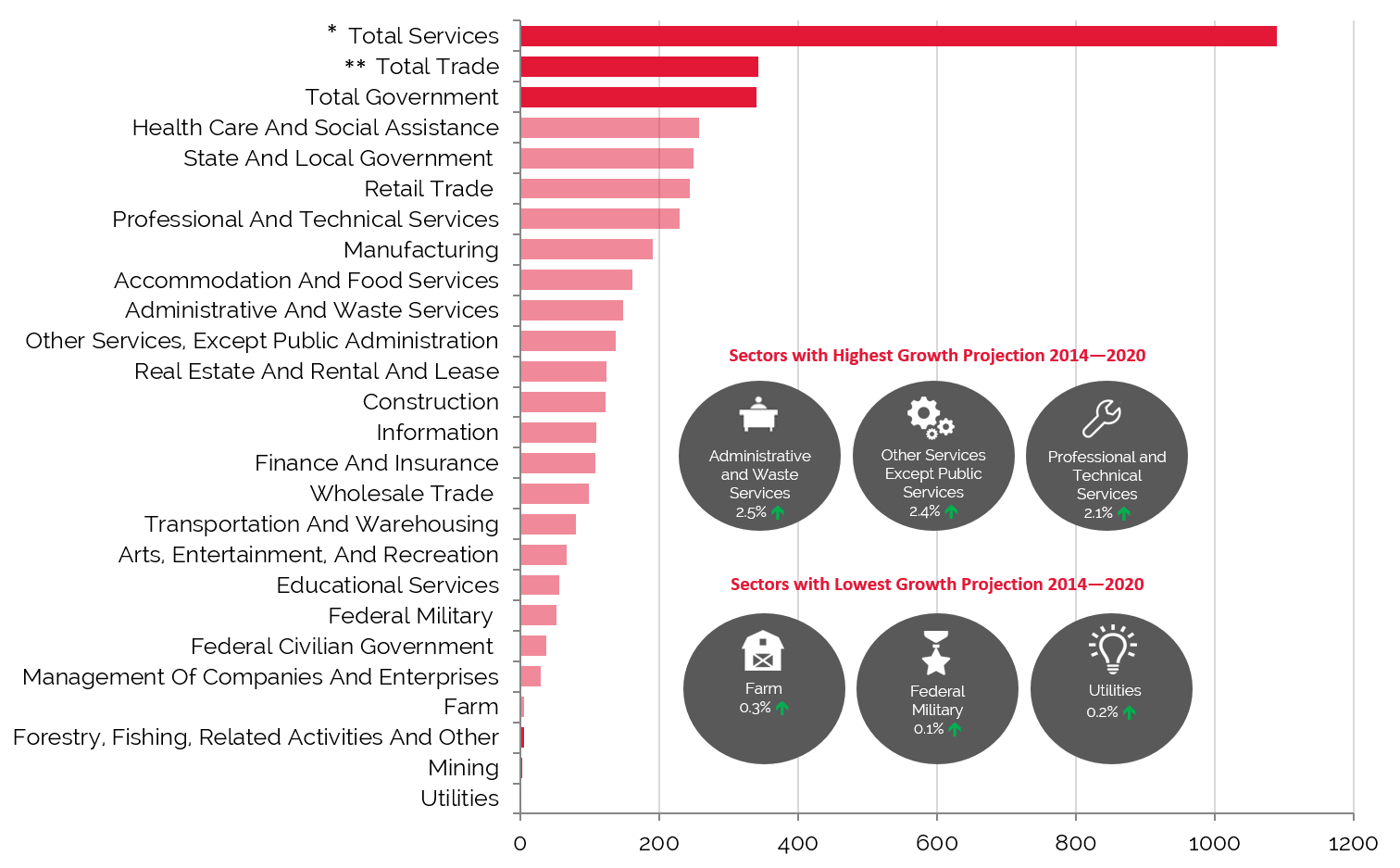

From 2000 to 2010, total employment in the county grew at an average annual rate of 1.6%. This rate was below the growth rate recorded by the MSA, but outpaced the national average. The pace of employment growth in the county declined slightly to 1.5% on an annual average from 2010 to 2014. Woods & Poole Economics, Inc. anticipates total employment in the county to change by 1.9% on average annually through 2020. The county trend is 46% more robust than the forecasted rate of change of 1.3% for the U.S. as a whole.

The finance, insurance, and real estate [FIRE]; wholesale trade; and services employment sectors represented 64.7% of total employment in King County in 2014, with an average annual compounded growth rate expected to be approximately 12% into 2020; as stated above, these sectors are important drivers of demand to higher-rated hotels. Total Trade, the second-largest primary employment sector in 2014, tends to generate demand for economy properties, as per-diem rates limit travelers to lower-priced hotels.

The largest primary sector was Total Services, which recorded the highest rise (29,400) in number of employees during the period from 2010 to 2014. Of the various sub-sectors included in Total Services, Health Care and Social Assistance and Accommodation and Food Services were the largest employers.

Employment Projections through 2020 Show Impressive Growth in Total Services and Total Trade

Source: Woods & Poole Economics, Inc.

* Total Services include: Professional and Technical Services; Management of Companies and Enterprises; Administrative and Waste Services; Educational Services; Healthcare and Social Assistance; Arts, Entertainment, and Recreation; Accommodation and Food Services; and Other Services, except Public Administration

** Total Trade includes Wholesale Trade and Retail Trade

Woods & Poole Economics, Inc. reports that during the period from 2000 to 2010, total employment in the MSA expanded at an average annual rate of 0.2%; the national average for this period was 0.7%. The MSA’s pace of employment growth jumped to 1.7% from 2010 to 2014. Looking ahead to 2020, the MSA’s pace is predicted to decrease slightly to 1.6%, a rate 23% higher than the national average.

As stated above, finance, insurance, and real estate [FIRE]; wholesale trade; and services are employment sectors that drive upper-midscale through luxury room nights. These sectors combined represented 13.5% of total employment in 2014, with an average annual compounded growth rate for the group expected to be approximately 0.212% into 2020.

The largest primary sector was Total Services. Within Total Services, Educational Services and Administrative and Waste Services recorded the highest increase in number of employees during the period from 2010 to 2014, each sector increasing by 3.0%. Of the various sub-sectors included in Total Services, Health Care and Social Assistance was the largest.

Considered a room-night driver for economy hotels, the Total Government sector’s growth rate contracted from 1.4% for the decade preceding 2010 to 0.3% from 2010 to 2014; the sector, which currently employs approximately 14% of the area’s workforce, is expected to realize growth of 0.8% into 2020.

Employment

Seattle’s entertainment venues, variety of attractions, and institutions of higher education serve as a platform for the city’s diverse workforce. In addition, the University of Washington and Bellevue College has continually supplied the local labor pool with young, well-educated workers. In 2015, Seattle ranked sixth on Forbes’ annual list of “America’s Best Places for Business and Careers.”

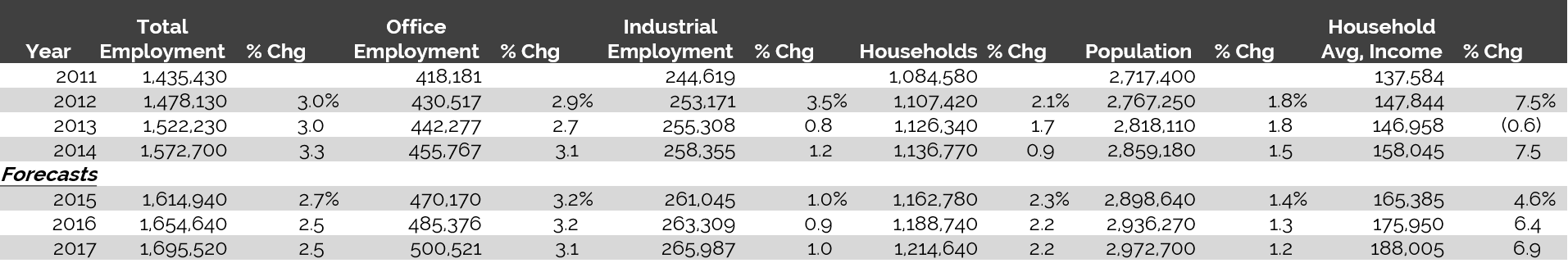

The following table illustrates historical and projected employment, population, and income data for the overall Seattle market, as presented by REIS.

Historical & Projected Employment, Households, Population, and Household Income Statistics for Seattle

Source: REIS Report, 3rd Quarter, 2015

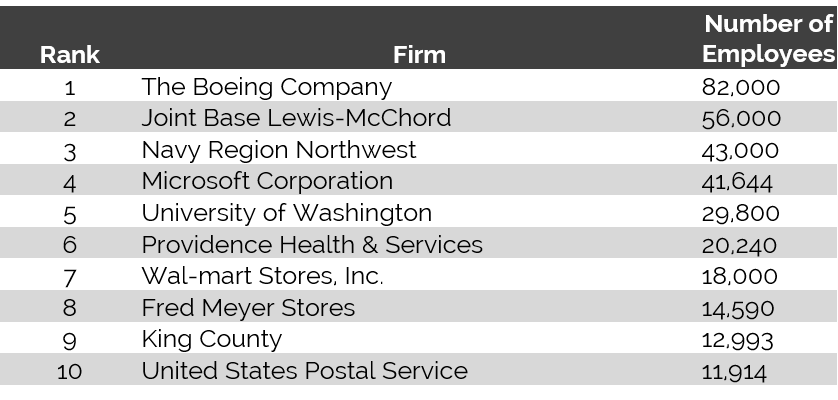

Top Industries In Seattle

High-Tech, Aerospace Industries Top Major Employers List in Seattle

Source: Puget Sound Business Journal, 2014

Greater Seattle’s economy thrives on the strength of the high-tech sector. Microsoft Corporation, headquartered in nearby Redmond, has ramped up activity with renewed hiring efforts and contractor work. Amazon is rapidly expanding into the South Lake Union neighborhood of Seattle. In 2012, the company purchased 1.7 million square feet of office space in South Lake Union, with plans to develop 3.3 million square feet of office space over the next eight years. In 2013, Amazon acquired The Washington Post, announced its entry into the online grocery business, and revealed that it has been testing drones as a potential method of package delivery. As of mid-year 2015, the company employed about 15,000 people in Seattle; its three new towers will reportedly create approximately 12,000 new jobs.

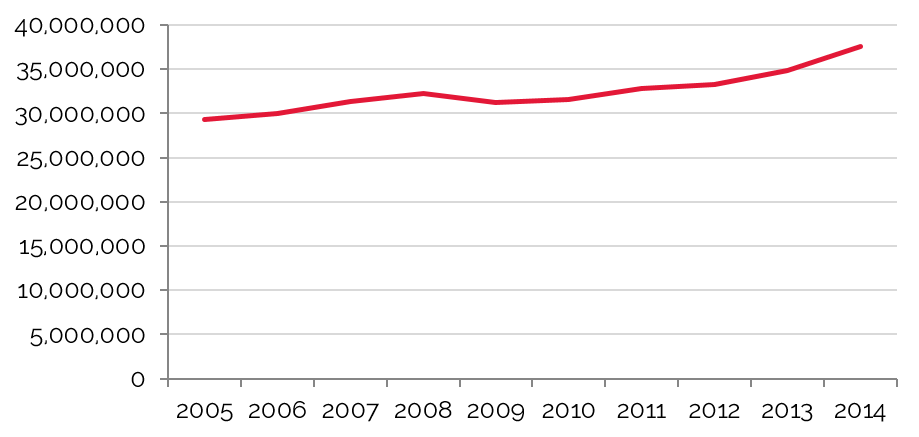

The Port of Seattle is the eighth-largest container seaport in the United States in terms of twenty-foot-equivalent units (TEU). The port can accommodate ships up to 1,400 feet in length and provides extensive warehouse space. Two transcontinental railroads and more than 170 motor freight carriers regularly transport goods to and from Seattle. In 2014, the Port of Seattle handled 35,082,915 metric tons of cargo, up from 32,103,948 metric tons in 2013. The Alaskan cruise industry also underpins Seattle’s economy, generating approximately $372 million in annual business revenue and responsible for approximately 3,934 jobs. In 2014, 179 vessel calls originated from Seattle's cruise terminals. Seattle's central waterfront, which stretches nearly two miles along the west side of the city, is in the beginning stages of a multibillion-dollar revamping project. One of the major components is the replacement of the Alaskan Way Viaduct, a double-deck highway that poses significant safety risks in the event of an earthquake, with a 1.7-mile tunnel that will run below Downtown Seattle. In addition, the existing seawall, which also does not meet current safety standards, will be replaced. These two projects will create a significantly different landscape, with a pedestrian promenade connecting the waterfront, currently obstructed by the viaduct, to Downtown Seattle.

The Boeing Company, an aerospace and defense corporation, is the largest global aircraft manufacturer by revenue and the second-largest defense contractor in the world based on 2014 revenues. Boeing recently developed a new airline prototype, the Boeing 787 Dreamliner, a mid-sized, wide-body, twin-engine airliner. The Dreamliner completed flight-testing mid-year 2011 and entered commercial service late that year. Boeing chose Charleston, South Carolina as a second final assembly site for the 787 Dreamliner. In late 2011, Boeing announced it would maintain production of the highly popular, fuel-efficient 737 MAX airliner in Renton. In October 2014, Boeing announced that it would build the 777X airframe and wings in the Seattle area after workers agreed to a new labor contract, while other parts would be manufactured in other areas of the country. The construction of the new 1.3-million-square-foot manufacturing facility in Everett for the 777X airframe and wings began in February 2015; the facility is scheduled for completion in 2016. In June 2015, Boeing announced that an order for the 747 jets estimated to be worth $3.8 billion had been made by Volga-Dnepr Group.

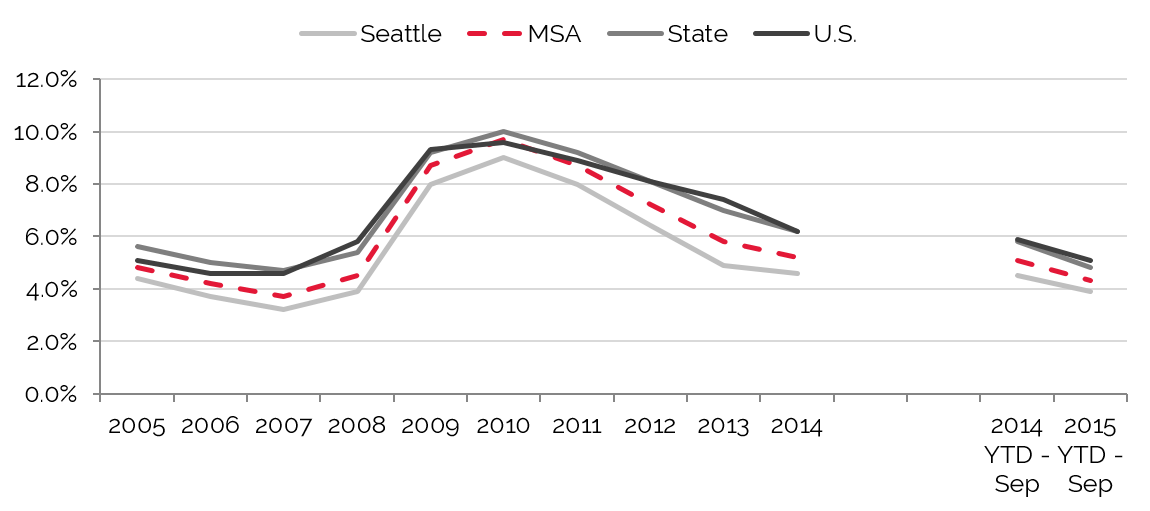

Unemployment

After showing year-over-year improvement, unemployment rates began to rise in 2008, and this trend continued through 2010, with unemployment figures more than doubling from the low point in 2007. The Puget Sound area experienced significant layoffs from companies such as Microsoft, Boeing, and Starbucks, as well as Washington Mutual, which failed in September 2008. However, in 2011, the economy and local employment started to recover, and this positive trend continued through 2014. Furthermore, the most recent comparative period shows a marked improvement in the unemployment rate, according to the latest available data for 2015, due in part to hiring efforts and company relocations to the area. Our interviews with economic development officials reflect a positive outlook, as employers are adding jobs.

Unemployment in Seattle on the Decline Since 2010

Source: HVS & RCA

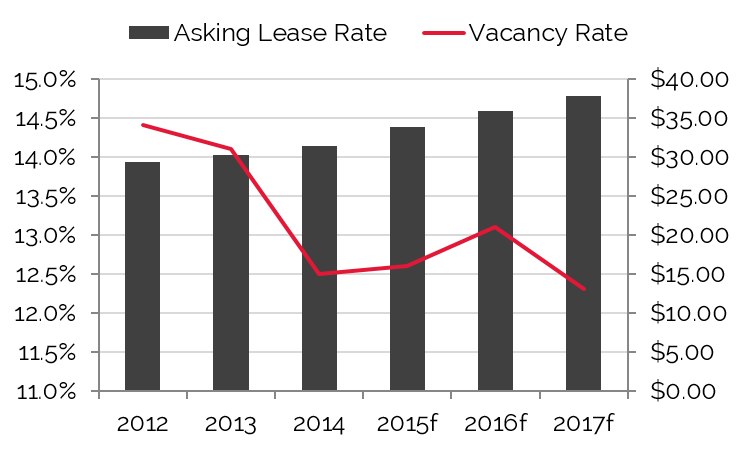

Office Space

Trends in occupied office space are typically among the most reliable indicators of lodging demand, as firms that occupy office space often exhibit a strong propensity to attract commercial visitors. Thus, trends that cause changes in vacancy rates or in the amount of occupied office space may have a proportional impact on commercial lodging demand and a less direct effect on meeting demand. The following table details office space statistics for the pertinent market area.

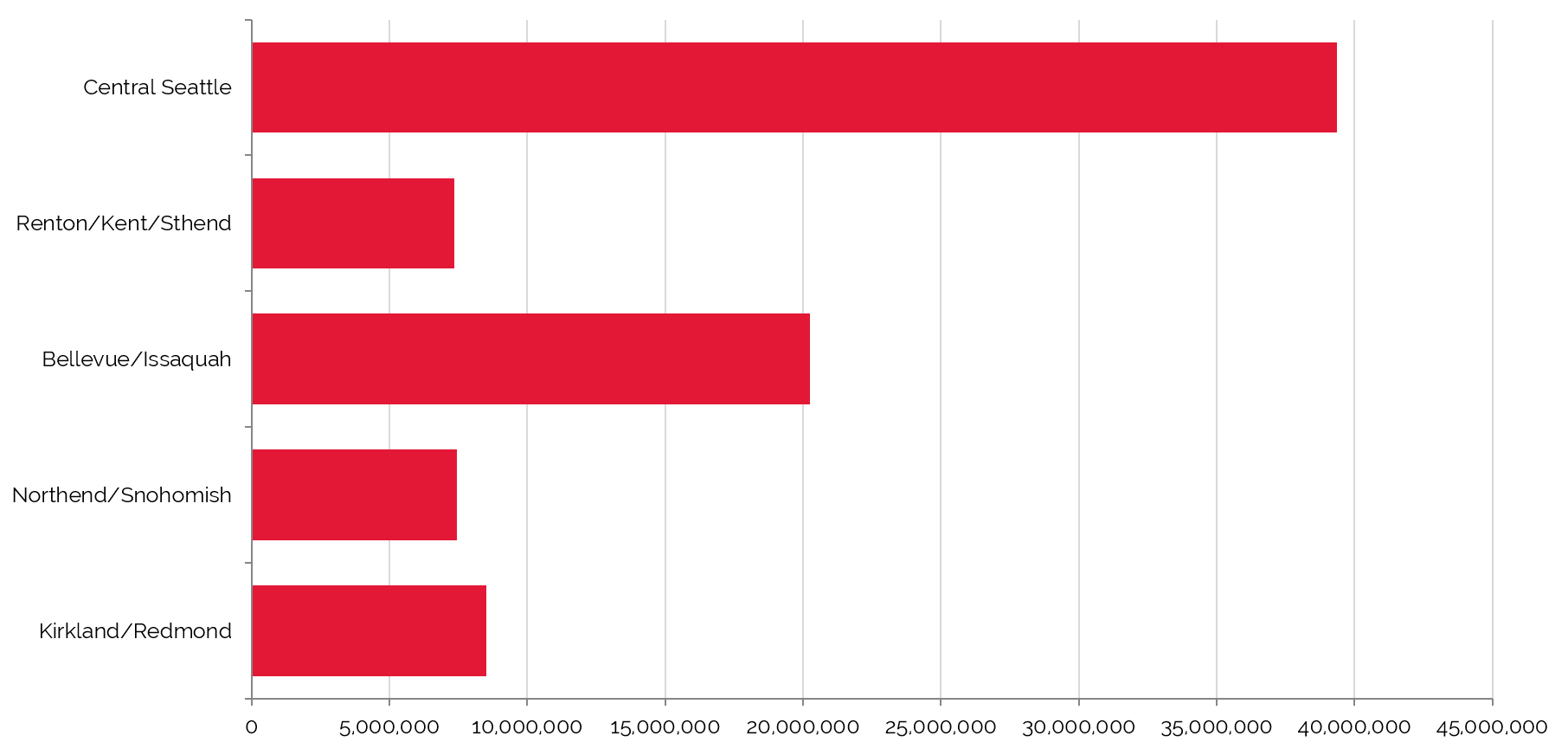

Office Space Highly Concentrated in Central Seattle Submarket

Source: REIS Report, 3rd Quarter, 2015

Greater Seattle’s 82.3 million square feet of office space registered an overall vacancy rate of 12.5% and an average asking rent of $32.77 for the third quarter of 2015. The high-tech industry is driving office demand in the Seattle market, which is especially evident in the form of the Amazon campus under development in the South Lake Union neighborhood. The campus will be constructed in three phases, each consisting of one million square feet. The first phase is expected to come online in December 2015, the second in December 2016, and the third phase by year-end 2017. In addition, Facebook leased 274,000 square feet in the Lake Union area in 2015. Lastly, Expedia announced it was moving its headquarters from east Bellevue to the Seattle waterfront after purchasing the former Amgen headquarters building. The move is expected to be complete in 2019.

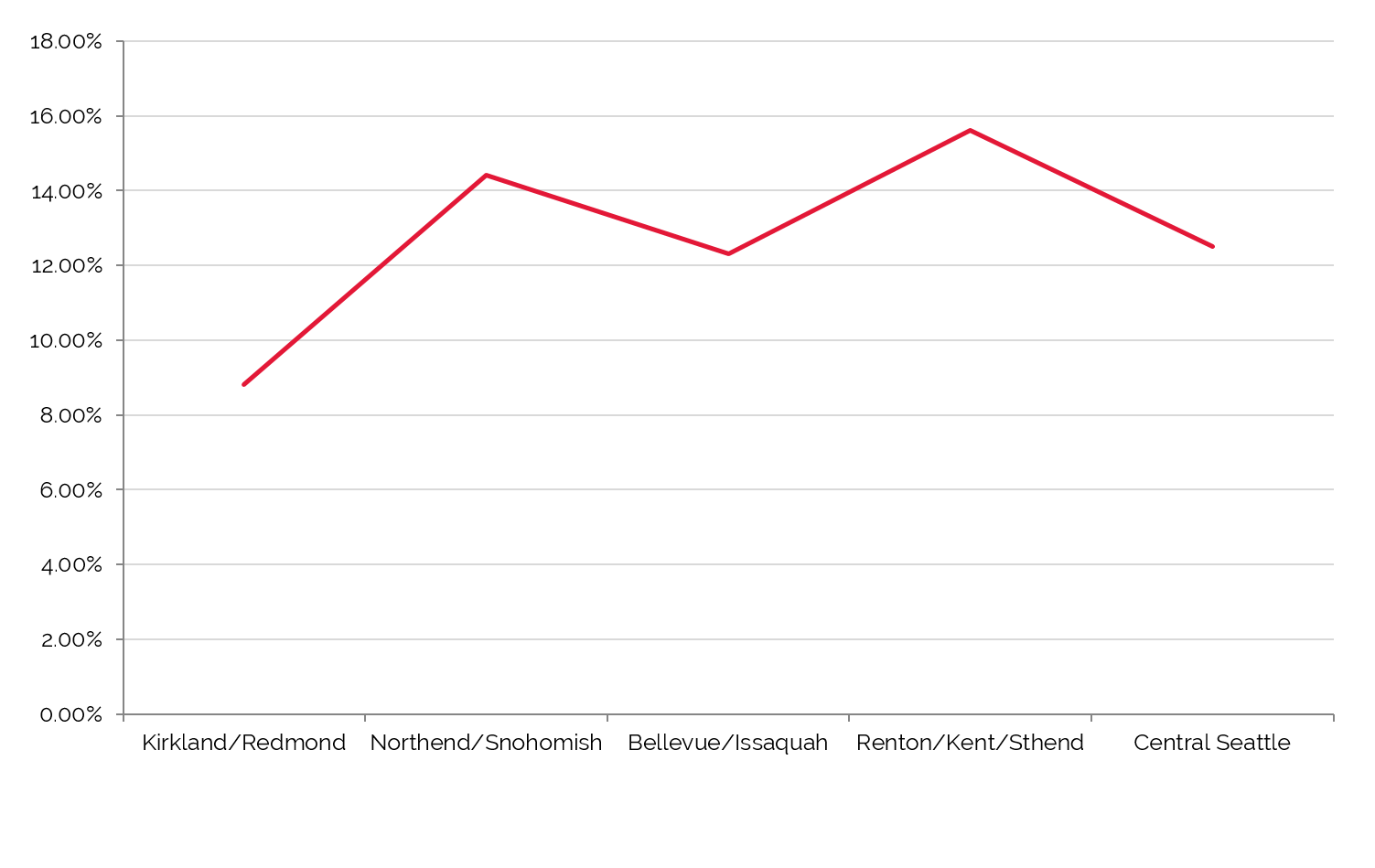

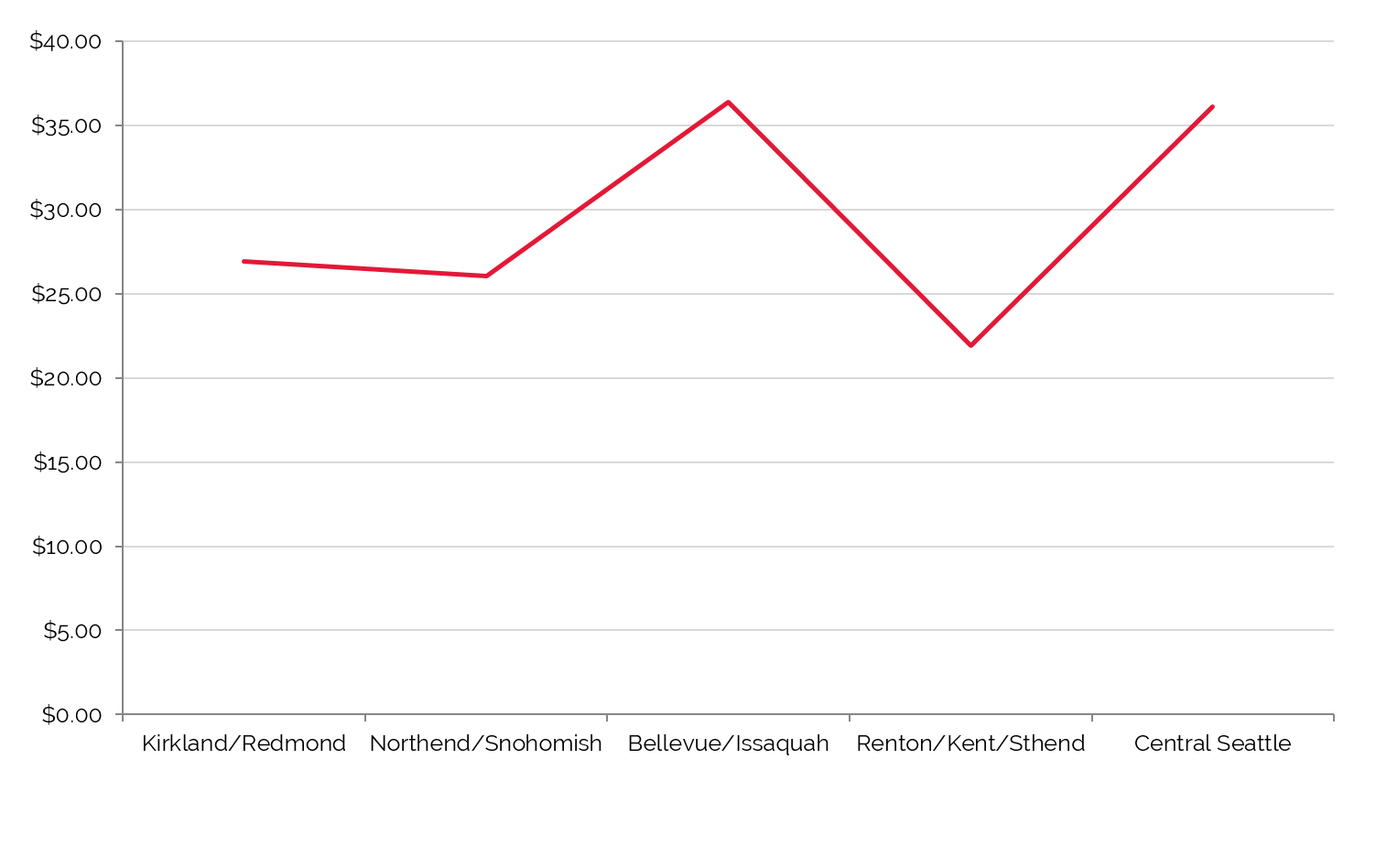

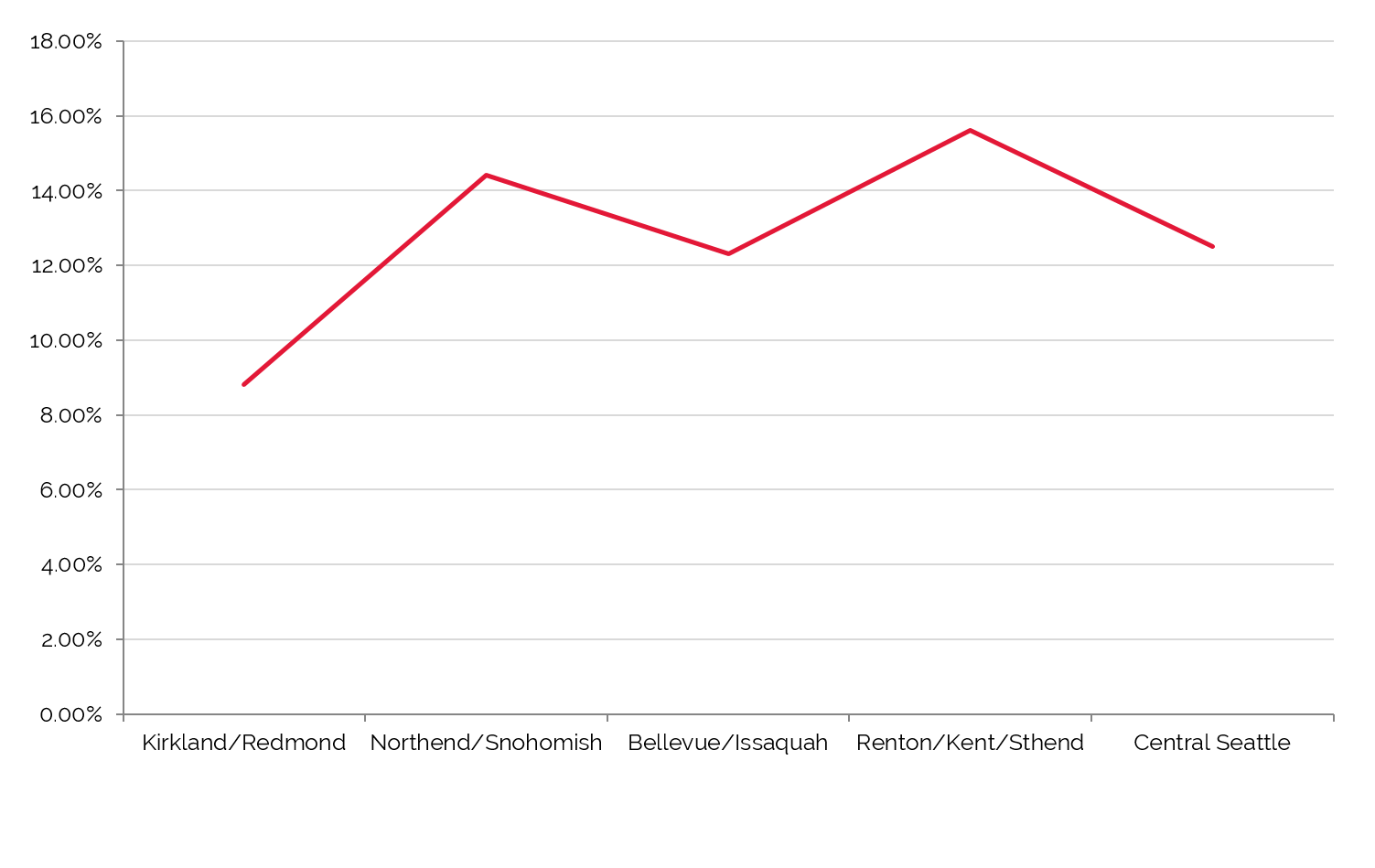

Kirkland/Redmond Exhibits the Lowest

Vacancy Rate

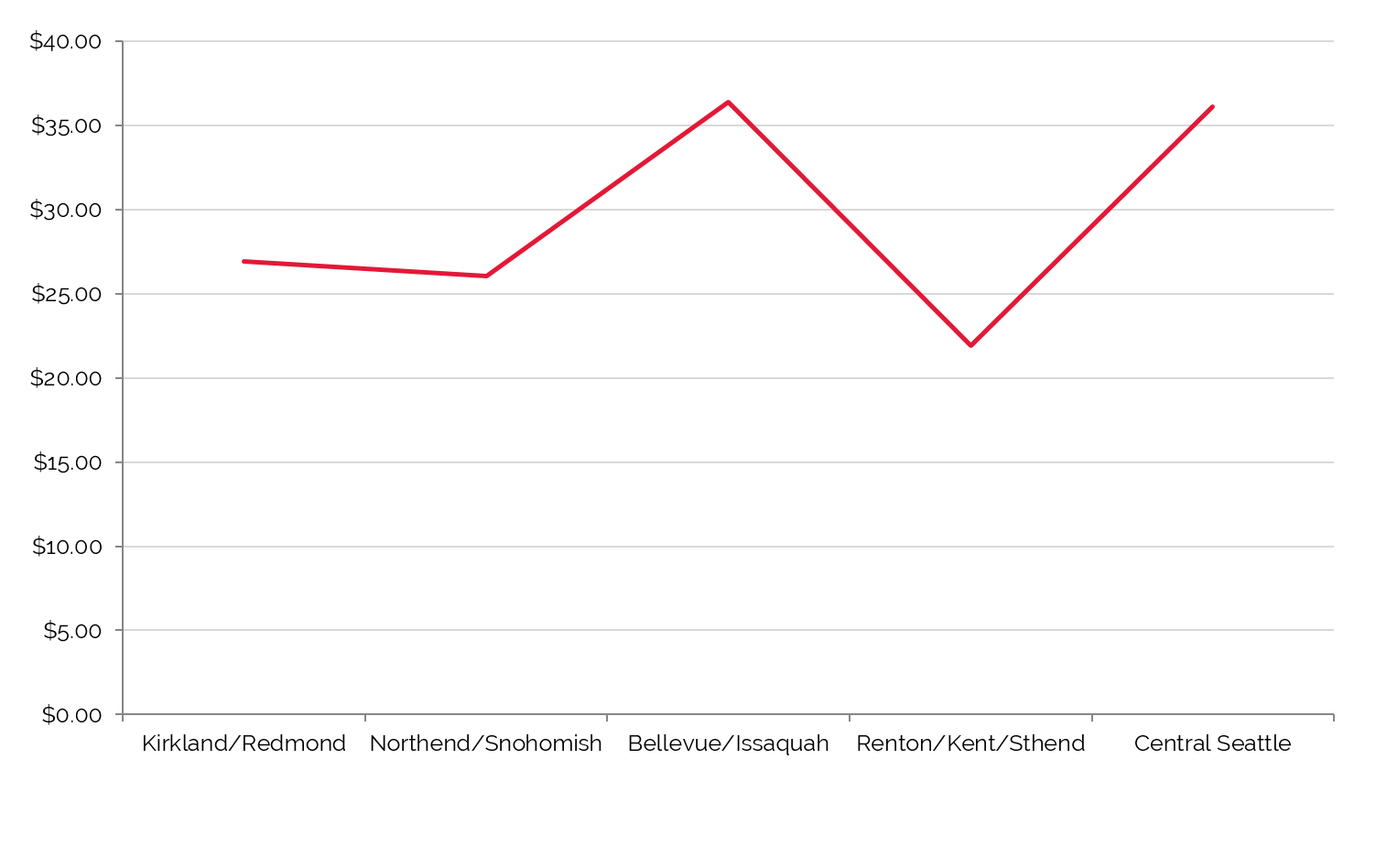

Central Seattle Leads Average Asking

Lease Rate

Source: REIS Report, 3rd Quarter, 2015

The Bellevue office market, already affected by the exit of Expedia, now faces the vacating of at least some space by its largest occupant: Microsoft. In June 2015, Microsoft announced that it would vacate 166,900 square feet of space in Downtown Bellevue. The space is a fraction of the more than 2.3 million square feet that Microsoft occupies in Bellevue; however, some market participants speculate that Microsoft could be preparing to move workers to its 500-acre Redmond headquarters campus, where the company owns ten million square feet of space and is in the process of developing more facilities. Two towers are currently under construction in Bellevue, the 462,000-square-foot Nine Two Nine Office Tower set to open in December 2015, and the Centre 425 tower, due to come online in July 2016.

The Kirkland/Redmond market is a major hub for the high-tech industry, as Microsoft’s corporate campus is located in Redmond, while Google’s suburban campus is based in Kirkland. This submarket is characterized by a large office inventory and low vacancy rates; however, the average asking lease rate is considered a less-expensive alternative to the urban areas of Seattle and Bellevue. In April 2015, Google completed construction of an 180,000-square-foot owner-occupied campus.

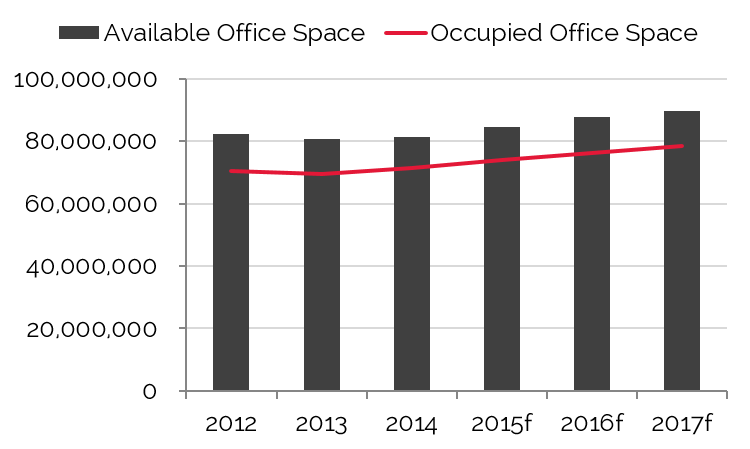

The inventory of office space in the Seattle market increased at an average annual compound rate of 1% from 2002 through 2014, while occupied office space grew at an average annual rate of 1.3% over the same period. From 2014 to 2019, the inventory of occupied office space is forecast to increase at an average annual compound rate of 2.7%, with available office space expected to increase 2.4%; this would result in an anticipated vacancy rate of 10.4% as of 2019, the lowest level in a decade.

Central Seattle Leads Average Asking Lease Rate

Source: REIS Report, 3rd Quarter, 2015

Projected gains in the greater Seattle market are expected to support the significant amount of new office supply, particularly in Central Seattle and Bellevue. The new Amazon campus is the most prominent development pushing strong office market dynamics; however, a variety of other development projects also signals the overall health of the greater market area.

Convention Activity

Convention centers generate significant levels of demand for area hotels, particularly those within a radius of three miles. Convention headquarters hotels command premium rates and, in addition to capturing event-related demand, can also benefit from hosting related banquet events. Major conventions also push demand to peripheral hotels in the market.

The 726,800-square-foot Washington State Convention & Trade Center (WSCTC) features roughly 205,700 square feet of exhibition space; 61 meeting rooms (totaling roughly 105,000 square feet); a 45,000-square-foot ballroom; and ancillary facilities, including retail stores, a health club, and a public gallery. The current size of the WSCTC allows it to compete nationally for large conventions with such facilities as the San Diego Convention Center, the San Francisco Convention Center (Moscone Center/Moscone West), the Las Vegas Convention Center (and mega-hotels), and the Anaheim Convention Center.

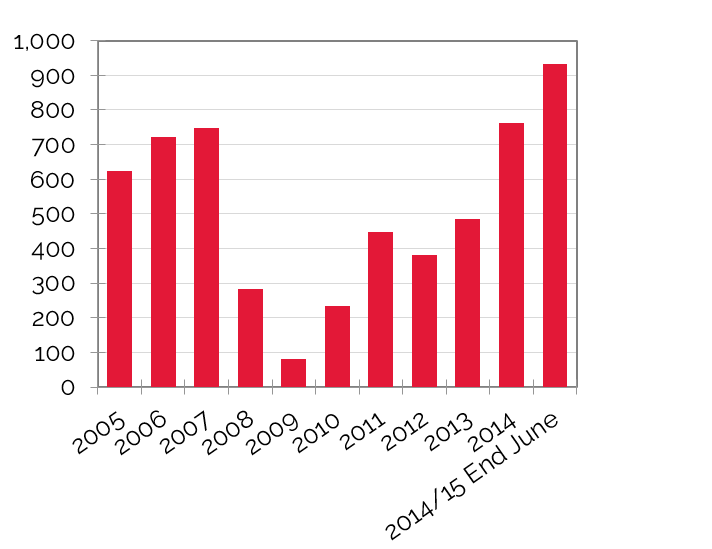

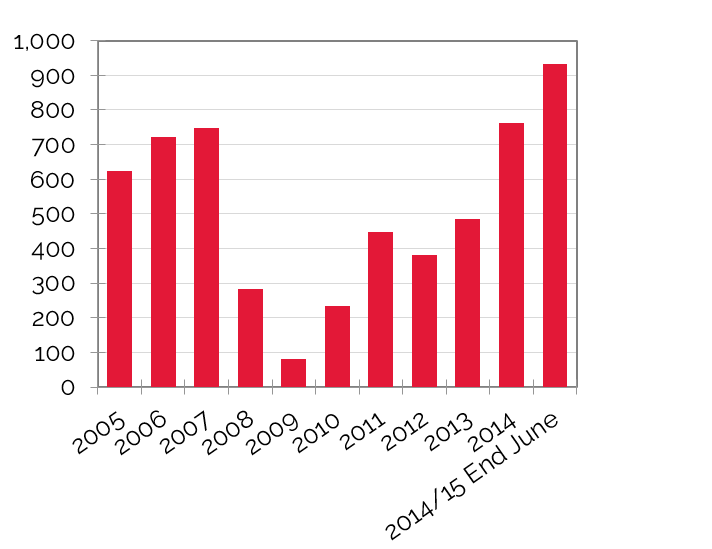

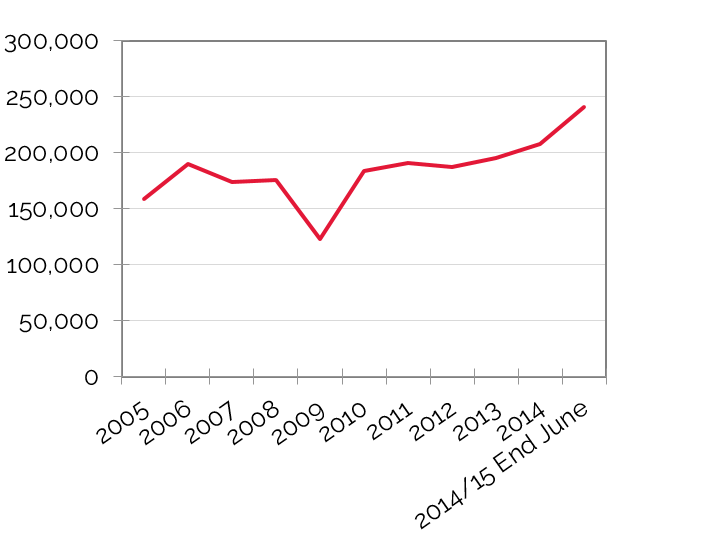

Affected by Off Years and the Recession, Annual Convention Delegate Counts Have Fluctuated

Source: Washington State Convention & Trade Center

In 2009, the proposed expansion of the WSCTC was placed on hold, and in 2011, the Washington State legislature voted against a tax increase that would have aided the expansion. Development plans gained momentum in 2013, and construction is expected to begin in early 2017, with a completion date in 2020. A new convention center hotel (spanning more than 1,200 rooms) is expected to open two years prior to the completion of this expansion. The addition of so many new rooms without the immediate benefit from induced demand generated by a larger convention center has some hoteliers worried. The preliminary cost of the project is estimated at over $1 billion. It is important to note that within the city of Bellevue, the Meydenbauer Convention Center hosts a variety of meeting and group events throughout the year. The center offers 54,000 square feet of meeting space and is owned and operated by the Bellevue Convention Center Authority.

At the WSCTC, the number of convention delegates has fluctuated in the historical period due to the "off-year" booking schedule of conventions in Seattle. Notably, 2008/09 represented an “off” year, but events and attendees were also down because of the sluggish economic conditions associated with the recession. Convention activity increased in 2009/10, indicating the beginning of a recovery. In 2011/12, the number of conventions increased more than 8% over the previous year. However, conventions and attendance dropped again in 2012/13 because of an increase in national and international shows that reportedly attracted fewer attendees and displaced regional and local shows that are more heavily attended. In 2013/14, the number of events remained relatively stable, while there was an uptick in the number of attendees. The WSCTC is expected to continue to host events that produce significant room nights for local hotels; however, until the expansion is complete, the center will not be able to support larger groups.

Airport Traffic

Airport passenger counts are important indicators of lodging demand. Depending on the type of service provided by a particular airfield, a sizable percentage of arriving passengers may require hotel accommodations. Trends showing changes in passenger counts also reflect local business activity and the overall economic health of the area.

The Seattle-Tacoma International Airport, the regional air hub of the Pacific Northwest, is served by various domestic and international commercial airlines. In 2010, Seattle-Tacoma International Airport completed a $4.2-billion upgrade that expanded the central terminal; enhanced transportation systems; and added a third runway, additional curbside and baggage check-in locations, and additional retail and concession areas. The project also involved the expansion of the Sound Transit Program to provide light-rail transportation between Seattle-Tacoma International Airport and Downtown Seattle. In addition, the North Sea-Tac Airport Renovation (NorthSTAR) of the airport's 40-year-old north satellite will reportedly begin in 2016, with completion scheduled for 2020.

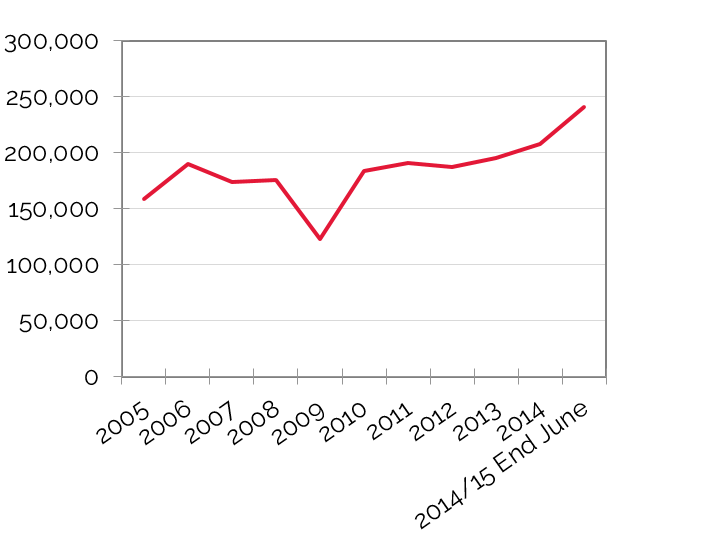

Airport Passenger Traffic has Achieved Steady Increases over the Past Decade

Source: Seattle-Tacoma International Airport

The increase in passenger traffic shown by the most recent data can be attributed in large part to Delta Air Lines, which announced that it would be increasing its flights at the airport, ultimately making it the airline’s West Coast hub.

In the past decade, passenger traffic through Seattle-Tacoma International Airport has grown from 29.289 million to 37.497 million travelers each year. Through June 2015, roughly 2.299 million more passengers were recorded than through the same period of 2014, a 13.3% increase. The annual average compounded percentage of change in the last decade is 2.8%. Growing passenger traffic means more visitation, and these figures speak indirectly to the strength of Seattle’s commercial, convention, government, and leisure sectors.

Tourist Attractions

More than 19.2 million overnight visitors came to Seattle in 2014, a reflection of the city’s growing popularity. The market benefits from a variety of tourist and leisure attractions, with the peak season for tourism from May to September, when the Pacific Northwest’s climate is most inviting. Many visitors also come to the area to embark on an Alaskan cruise during the summer months. Seattle also hosts a wide variety of cultural activities, concerts, bazaars, and festivals. During other times of the year, weekend demand comprises travelers passing through en route to other destinations, people visiting friends or relatives, and attendance at professional sporting events. The following details some of the Seattle area’s most prominent tourism attractions.

Pike Place Market, a lively marketplace on the waterfront, features a pageantry of produce merchants, fishmongers, shops and restaurants, craftspeople, and musicians. In 2012, the Seattle City Council approved redevelopment plans for Pike Place Market. The plans call for a 0.75-acre, low-rise, mixed-use development that will provide parking, retail, and restaurant space, as well as several stories of housing. Construction started in June 2014, with completion anticipated for 2016.

Safeco Field, home to the Seattle Mariners baseball team, and

CenturyLink Field, a multi-purpose stadium that is home to the Seattle Seahawks, are the cornerstones of the SoDo neighborhood in Seattle’s Industrial District. Seahawks fans at CenturyLink Field hold the Guinness World Record for the loudest crowd roar at a sports stadium. On the collegiate level, the University of Washington, which draws a significant number of visitors during the football season, completed a $260-million renovation on its Husky Stadium in 2013.

The Seattle Space Needle

The Seattle Space Needle, a futuristic observatory, is the city's most recognizable landmark. It was built for the 1962 World’s Fair, during which time nearly 20,000 people a day used the elevators to access the Needle’s views of the Cascade and Olympic Mountains, Lake Union, and Downtown Seattle. In addition to the Observation Deck, the Space Needle features the SkyCity restaurant and a gift shop. Near the base of the Space Needle, the EMP Museum, founded by Microsoft co-founder Paul Allen in 2000, features 46 exhibits and hosts numerous events throughout the year related to music, technology, and pop culture.

The Port of Seattle welcomes approximately 200 cruise ship visits and over 780,000 passengers during each cruise season. Several major cruise lines, such as Norwegian Cruise Line, Celebrity Cruises, Princess Cruises, and Holland America Line, dock at the Port of Seattle and offer cruises to Vancouver, British Columbia, and Alaska. During the 2014 season, the Port of Seattle hosted 179 cruise ships and nearly 800,000 passengers.

Closing Remarks

Seattle’s economic pillars of technology, aerospace and defense, and health care are all undergoing significant growth, with Amazon's expansion into the South Lake Union neighborhood serving as the most prominent display. The Port of Seattle maintains high levels of cruise ship traffic, and its Central Waterfront revitalization plan will have a significant impact on the market. The Pike Place Market and Seattle Space needle tourist draws are the cornerstones of a tourism industry that realized its best year ever in 2014. Citywide, office vacancy and unemployment are diminishing as well.

The strengthening and expansion of Seattle’s economic drivers should help with the absorption of the more than 5,000 hotel rooms expected to arrive in the market over the next three years. Occupancy increases will temper, but the overall strength of the market’s fundamentals, coupled with the rate integrity of Seattle’s top-performing hotels, should keep hotel values and performance metrics on a trend of growth through the near term.

The sales above, which total just over $516 million in transaction volume, include such high-profile assets as the boutique Heathman Hotel in nearby Kirkland; the property was part of a portfolio of hotels purchased by LaSalle Hotel Properties that also included the historic Heathman Hotel in Portland, Oregon. In addition, the former Red Lion flagship hotel in Downtown Seattle was purchased after undergoing a $25-million renovation and rebranding to the Motif Hotel; this was the largest transaction in the last three years in the market, totaling just under $127 million, or $397,912 per key. In addition, Provenance and NBP Capital purchased the Hotel Roosevelt in February 2015.

The sales above, which total just over $516 million in transaction volume, include such high-profile assets as the boutique Heathman Hotel in nearby Kirkland; the property was part of a portfolio of hotels purchased by LaSalle Hotel Properties that also included the historic Heathman Hotel in Portland, Oregon. In addition, the former Red Lion flagship hotel in Downtown Seattle was purchased after undergoing a $25-million renovation and rebranding to the Motif Hotel; this was the largest transaction in the last three years in the market, totaling just under $127 million, or $397,912 per key. In addition, Provenance and NBP Capital purchased the Hotel Roosevelt in February 2015.

The 726,800-square-foot Washington State Convention & Trade Center (WSCTC) features roughly 205,700 square feet of exhibition space; 61 meeting rooms (totaling roughly 105,000 square feet); a 45,000-square-foot ballroom; and ancillary facilities, including retail stores, a health club, and a public gallery. The current size of the WSCTC allows it to compete nationally for large conventions with such facilities as the San Diego Convention Center, the San Francisco Convention Center (Moscone Center/Moscone West), the Las Vegas Convention Center (and mega-hotels), and the Anaheim Convention Center.

The 726,800-square-foot Washington State Convention & Trade Center (WSCTC) features roughly 205,700 square feet of exhibition space; 61 meeting rooms (totaling roughly 105,000 square feet); a 45,000-square-foot ballroom; and ancillary facilities, including retail stores, a health club, and a public gallery. The current size of the WSCTC allows it to compete nationally for large conventions with such facilities as the San Diego Convention Center, the San Francisco Convention Center (Moscone Center/Moscone West), the Las Vegas Convention Center (and mega-hotels), and the Anaheim Convention Center.

The Seattle Space Needle, a futuristic observatory, is the city's most recognizable landmark. It was built for the 1962 World’s Fair, during which time nearly 20,000 people a day used the elevators to access the Needle’s views of the Cascade and Olympic Mountains, Lake Union, and Downtown Seattle. In addition to the Observation Deck, the Space Needle features the SkyCity restaurant and a gift shop. Near the base of the Space Needle, the EMP Museum, founded by Microsoft co-founder Paul Allen in 2000, features 46 exhibits and hosts numerous events throughout the year related to music, technology, and pop culture.

The Seattle Space Needle, a futuristic observatory, is the city's most recognizable landmark. It was built for the 1962 World’s Fair, during which time nearly 20,000 people a day used the elevators to access the Needle’s views of the Cascade and Olympic Mountains, Lake Union, and Downtown Seattle. In addition to the Observation Deck, the Space Needle features the SkyCity restaurant and a gift shop. Near the base of the Space Needle, the EMP Museum, founded by Microsoft co-founder Paul Allen in 2000, features 46 exhibits and hosts numerous events throughout the year related to music, technology, and pop culture.