HVS recently held its 6th annual Caribbean Hotel Investment Conference and Operating Summit (CHICOS) at the Ritz-Carlton in San Juan, Puerto Rico. Hotel developers, investors, operators, lenders, brand representatives, and government leaders came armed with questions and information on the prospects for the region’s hotel industry. Here are some key takeaways.

While the Zika virus has affected the region’s hotel performance in 2016, it appears that the worst is behind us.

Media coverage and perceptions of the mosquito-borne Zika virus have negatively affected the Caribbean hotel market in 2016, causing reduced travel and cancelations, particularly with groups and wedding business. The Caribbean was the only resort destination (out of a sample of seven) to experience RevPAR decline year-to-date 2016 (through September); however, it  remained the second highest in overall RevPAR, nearly $40 below Hawaii but surpassing Cancun, Mauritius, and Florida, among other markets.

remained the second highest in overall RevPAR, nearly $40 below Hawaii but surpassing Cancun, Mauritius, and Florida, among other markets.

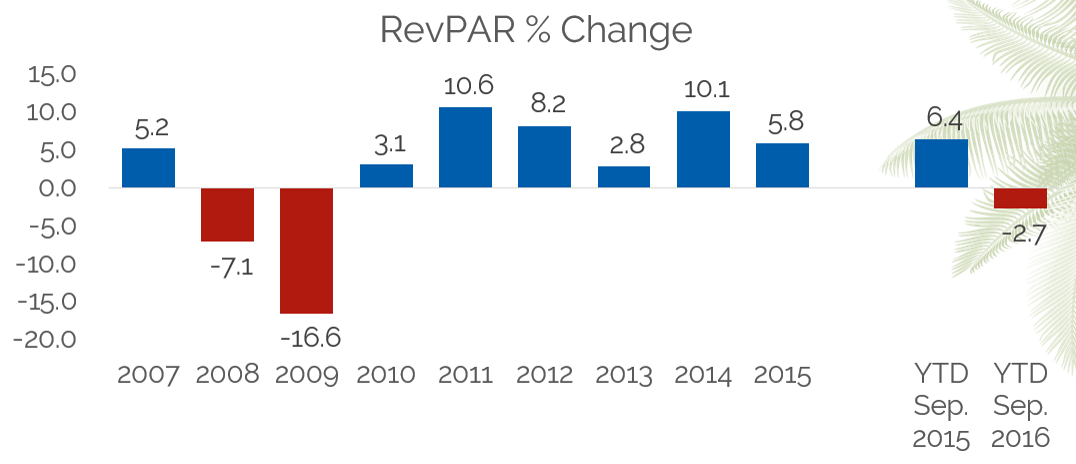

HVS Managing Director and CHICOS Chairman Parris Jordan noted that the RevPAR decline so far this year follows six consecutive years of RevPAR growth in the Caribbean. According to Mr. Jordan, hotel demand was down -0.6% year-to-date through September, with RevPAR down -2.7%. Data, however, show month-over-month increases in demand since June and rising total revenues since July. Given this trend, Mr. Jordan noted that demand should turn out flat or register moderate gains by the end of the year. Furthermore, concerns over the virus are beginning to shift to markets in the U.S.

The following chart shows RevPAR dynamics in the Caribbean since 2007.

Caribbean Metrics: % Change 2007 – YTD Sept.

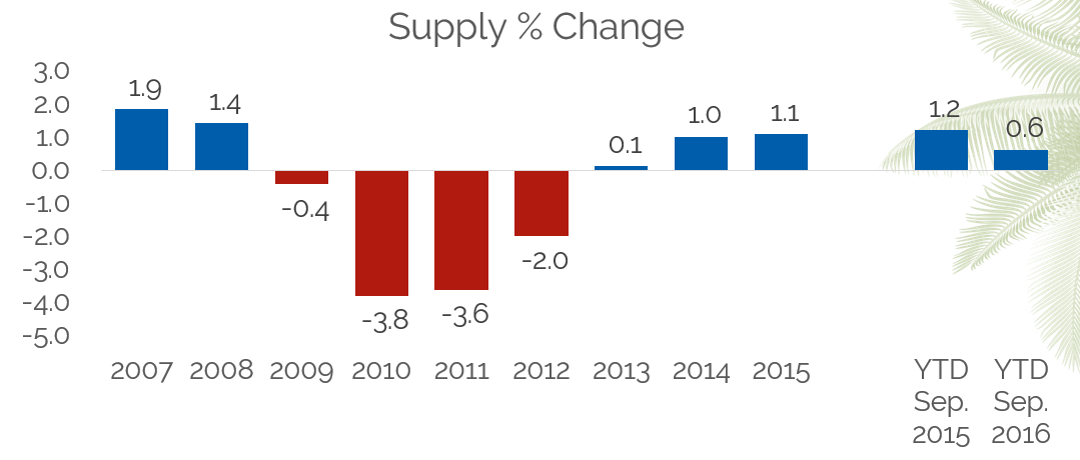

The development pipeline has become notably more active, with the most development activity now since prior to the recession of 2008/09.

Following the Global Economic Crisis, the Caribbean experienced an astonishing four consecutive years of declining supply levels, from 2009 through 2012. Supply growth did not gain traction until 2014; however, now, more hotel development is underway across the Caribbean than at any time since the peak in 2007. More than 50 proposed projects, under construction or in the planning stages, span nearly 10,800 new rooms. The largest of these is the 2,000-room Celebration Jamaica, a proposed resort and casino development to be built in Montego Bay.

Not surprisingly, some of the region’s most populous island nations, the Dominican Republic, Jamaica, and Cuba, dominate the 2016 development pipeline. The Dominican Republic is the current Caribbean leader in terms of RevPAR growth for 2016, further fueling its investment potential.

The following chart shows the course of supply change in the Caribbean since 2007.

Caribbean Metrics: % Change 2007 – YTD Sept.

Creative financing is key for the Caribbean, though conventional financing availability is improving for “A” projects with solid borrower profiles in strong markets.

The availability of financing has long been a challenge in the Caribbean. However, the strong development pipeline is an indicator that financing is becoming increasingly accessible, and several positive themes are taking place. Underwriting for hotel development has become more disciplined, and sources of institutional capital are recognizing the attractiveness of the Caribbean. As such, new equity and debt providers are participating in Caribbean hotel investment. Additionally, the marketability of portfolio deals in the region has broadened, attracting investors; development has shifted from conversions to new-build projects; and product design is evolving.

Financing is available for projects that contain the following criteria:

Other important aspects that sponsors need to consider include the following:

The Caribbean financing landscape and underwriting parameters are differentiated from the U.S. by some key investment criteria.

-

Success comes over the long term. Investors in Caribbean hotel projects need to be in it for the long haul, noted several experts. Given the volatility associated with Caribbean hotel markets, long-term holding periods—aka “patient money”—characterize the region’s real estate investment climate.

-

Lower loan-to-value (LTV) ratios are typical. A project needs a significant amount of equity to prove attractive for conventional financing, and LTV ratios typically range from 50 to 60% versus the typical U.S. range of 65 to 75%. Only the strongest Caribbean hotel projects can attain LTVs above 60%. In addition, debt coverage ratios (DCRs) should be a minimum of 1.4 to 1.5, which is higher than the typical 1.3 DCR in the U.S.

-

Cap rates are difficult to underwrite. Instead of cap rates, lenders in the region are looking more toward factors such as historical performance and replacement cost versus value.

-

Lenders and sponsors require higher returns than their U.S. counterparts. Analysts noted that interest rates for refinancing or new construction typically run at least 400 to 500 basis points over LIBOR (the one-year LIBOR rate as of November 2016 was 1.65); lenders echoed that returns to the debt side must be higher than the mid-single digits. Specialty lenders typically want 400 to 700 basis points above traditional lender requirements. Typically, in the Caribbean, sponsors require Internal Rates of Return (IRRs) in the mid-20s, at a minimum.

High-level hospitality leaders view the U.S. Election result as mostly positive for business.

With CHICOS occurring on the heels of the November 8th U.S. presidential election, the sensitive topic was discussed more during networking periods than collectively during sessions. Nevertheless, panelists offered some insights from the stage.

Speakers at the “Hospitality Leaders Outlook” session expressed a range of positive to neutral feelings regarding the Trump victory. The consensus ran that a Trump administration will be good for cash flow, with fewer restrictions and less regulation-constraining business, and that financial bailouts and debt rescue will be less likely to occur going forward.

and debt rescue will be less likely to occur going forward.

Clear development opportunity exists in Cuba; however, given that ownership structures must involve the Cuban government, many investors are hesitant and waiting to see how conditions progress in due time.

Cuba was referenced throughout the conference, and a dedicated panel on the country concluded the event’s sessions with an in-depth discussion of development and investment opportunities on the island. Arturo Garcia Rosa, President and Founder of South American Hotel & Tourism Investment Conference (SAHIC), put it simply: “If you want to do business in Cuba, it’s easy. They are waiting for you.”