In just the past year, Cleveland has gained a major casino, a world-class aquarium, and a state-of-the-art convention center. What does the city’s lodging market stand to gain in terms of performance and new supply?

Cleveland’s population has suffered declines over the past decade, but industry abounds along the city’s Waterfront district and technology corridors. Leisure attractions that opened in 2012, including Ohio’s first casino and the Greater Cleveland Aquarium, are expected to draw hundreds of thousands of visitors. Cleveland’s healthcare and technology sectors also account for millions of dollars in economic impact and a sizable amount of the city’s hotel demand. The following article details major developments that are reshaping Cleveland’s lodging market and fulfilling the city’s motto of “Progress and Prosperity.”

Development Update

Greater Cleveland’s revitalization over the past several years is most notable in its ascension as a global force in healthcare and technology. Recent developments include the following:

- More than $1 billion in investment capital over the past ten years has spurred extraordinary growth in Cleveland’s Health-Tech Corridor (HTC), which spans 1,600 acres in the area bookended by the Gateway District and University Circle. The concentration of the HTC’s more than 600 healthcare and biomedical technology companies and start-ups allows for joint collaboration and innovation, which has helped drive the corridor’s rapid expansion; research initiatives in the HTC amount to more than $600 million each year.

- Cleveland’s expanding healthcare sector both increased and satisfied the city’s need for a modern convention facility. The $465-million Global Center for Health Innovation (formerly the Cleveland Medical Mart) in Downtown Cleveland showcases innovations in healthcare and biomedical technology and offers substantial meeting and exhibition space to host large-scale conventions. The center opened in June of 2013; Positively Cleveland expects the facility to attract an additional 300,000 to 400,000 visitors annually.

New tourism and leisure projects are bringing new life to the hospitality industry, with nearly $12 billion in capital investments made in Greater Cleveland over the past three years. Major projects include the following:

- Ohio’s first casino, the Horseshoe Cleveland, opened in the spring of 2012. The 300,000-square-foot casino brought 1,600 jobs and serves as a major leisure demand generator to hotels in the downtown area. The casino is expected to draw some five million visitors and generate $100 million in gaming tax revenue each year. Plans for a Hard Rock Casino complex overlooking the Cuyahoga River, including multiple retail and restaurant outlets, are currently in the design phase.

- The Greater Cleveland Aquarium, located near the Waterfront, also opened in 2012 and has created 50 full- and part-time jobs with a payroll of $1.6 million. The aquarium is expected to attract up to half a million visitors and produce between $9.6 and $27.2 million in local economic impact annually.

- Phase I of the Flats East Bank redevelopment project, completed in the summer of 2013 along the waterfront, houses Cleveland’s first new high-rise office tower in 20 years, as well as a 150-room Aloft hotel, three restaurants, numerous entertainment venues, and a health club. Phase II will add a 140-unit waterfront residential complex, as well as additional restaurants and entertainment options.

Economy Overview

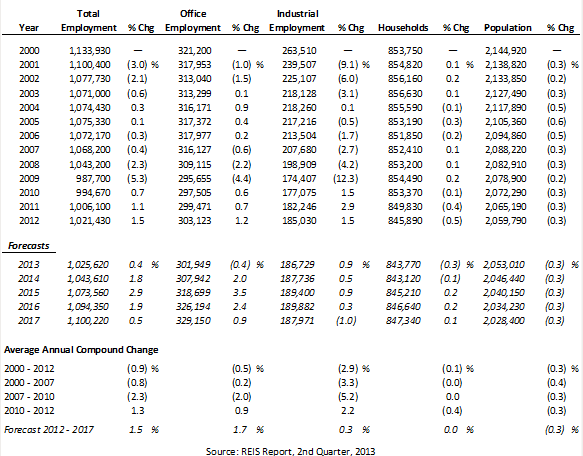

The following table illustrates historical and projected employment, households, population, and average household income data as provided by REIS for the overall Cleveland market.

HISTORICAL & PROJECTED EMPLOYMENT, HOUSEHOLDS, POPULATION, AND HOUSEHOLD INCOME STATISTICS

Total employment decreased by an average annual compound rate of -2.3% during the recession of 2007 to 2010, followed by an improvement of 1.3% from 2010 to 2012. Total employment is expected to expand by 0.4% in 2013 and improve at an average annual compound rate of 1.5% through 2017. Cleveland’s population has contracted at an average annual compounded rate of -0.3% since 2000, a trend consistent with the decline of the American manufacturing industry.

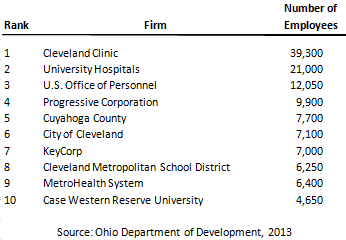

The following table lists the top ten employers in Cleveland in 2013.

GREATER CLEVELAND’S TOP EMPLOYERS

Eight Fortune 500 companies are headquartered in Greater Cleveland, including Eaton Corporation, Progressive, Parker Hannifin, Sherwin-Williams, TravelCenters of America, Aleris, and KeyCorp. Though diminished from its heyday, the manufacturing industry still accounts for 12% of the workforce in the Cleveland-Elyria-Mentor Metropolitan Statistical Area. Current manufacturing output has returned to levels comparable to 1990, fueled by a disciplined transition from traditional to more advanced production and management techniques. Hence, even with fewer employed in manufacturing, the sector remains a cornerstone of Cleveland’s economy.

In contrast, the number of jobs in Metro Cleveland’s healthcare sector continues to grow. The Cleveland Clinic, the area’s top employer, is widely regarded as the best cardiology and heart surgery center in the U.S. Part of the HTC, the clinic’s neighbors include the University Hospitals Case Medical Center, the MetroHealth System, and Case Western Reserve University, which collectively employ more than 71,000. The rapid growth of institutions in and around University Circle continues to inspire growth in other districts within the Health-Tech Corridor.

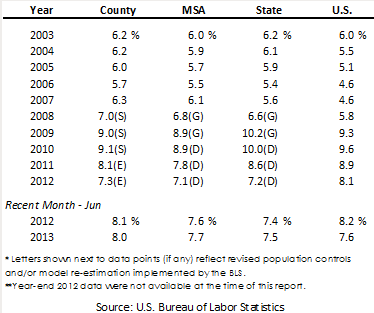

The following figures illustrate unemployment trends in Cleveland over the past ten years.

UNEMPLOYMENT STATISTICS

Unemployment rates in Cuyahoga County have fallen considerably since 2010, mirroring state and national trends. Despite job losses in manufacturing, the region has realized significant growth in other economic sectors such as healthcare, technology, and tourism. This growth has been offset somewhat by declines in the government, hospitality, and business and professional services sectors over the past year, largely due to government sequestration; however, with continued expansion and capital investment in the healthcare, biomedical, and technology sectors, the overall employment outlook for Cleveland is optimistic.

Outlook on Market Occupancy and Average Rate

Hotel occupancy levels in the Cleveland market have rebounded since the recession. Occupancy should continue to strengthen gradually, exceeding its pre-recession peak in the next two years with the aid of demand generated by the city’s strong healthcare, biomedical, technology, and tourism industries. Average rate stumbled in 2009 and 2010, but bounced back in 2011; the push for higher average rates should bring stronger RevPAR growth over the next several years.

Hotel Construction Update

In step with the advance of new and expanding demand generators, two major hotel projects have recently been completed in Cleveland, with several others in the pipeline, as summarized below:

- University Circle Inc. (UCI) collaborated with University Hospitals, the Snavely Group, and Concord Hospitality to build a $27-million, 150-room Courtyard by Marriott in University Circle. The hotel opened in April of 2013.

- The aforementioned Flats East Bank project features a new Aloft hotel; the 150-room project was completed in June of 2013.

- Value Place LLC recently announced plans to seek land to develop six new Value Place hotels in the Greater Cleveland area over the next two years.

- The former Crowne Plaza Cleveland Downtown is undergoing a $70-million renovation and conversion to the Westin Cleveland Convention Center. The luxury hotel will feature LEED-certified green construction across 484 rooms, including 40 suites. The hotel’s conversion is expected to be complete in April of 2014.

- CRM Companies recently announced its resumption of work, in collaboration with Kimpton Hotels & Restaurants, on the historic Schofield Building. The renovations will turn the property into a 122-room boutique hotel and 55 luxury residences. Construction is expected to be complete by late 2014.

- Drury Hotels recently emerged as the winning bidder for the highly sought after Cleveland Board of Education building; the company is planning to redevelop the building into a 180-room Drury Plaza hotel.

- Cleveland’s apartment market reported a remarkable occupancy rate of over 96% as of year-end 2012. The K&D Group, Inc. purchased the Embassy Suites Cleveland Downtown in late 2012 and has begun a $3-million renovation to transform the hotel’s 252 suites into 232 apartments. The removal of the Embassy Suites’ inventory of hotel rooms should aid the absorption of new supply in the near term.

Recent Hotel Transactions

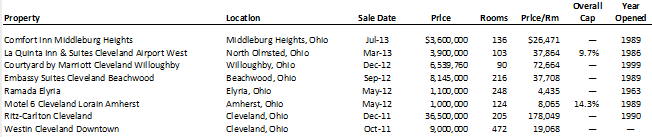

The following table summarizes hotel transactions in Ohio since October of 2011.

REVIEW OF HOTEL TRANSACTIONS

Transactions ranged from the $1 million limited-service Motel 6 to the $36.5-million sale of the full-service, luxury Ritz-Carlton Cleveland hotel. These sales represent hotels built between 1963 and 1999; hence, major renovations are expected to take place over the next several years to modernize many of the properties.

Conclusion

The success of Cleveland’s transition from an economy hinged on manufacturing to a diverse collective comprising medicine, biotech, and tourism is evidenced in new points of interest in the city such as the Horseshoe Cleveland, the Greater Cleveland Aquarium, and the Global Center for Health Innovation. These venues, along with established attractions like the Rock and Roll Hall of Fame, promote a positive outlook for the local lodging market, which is expected to realize continued growth in league with greater demand.