Dallas, Texas has exhibited remarkable fortitude in the years since the recent recession. With a highly diverse economic structure led by the technology sector, the city is the leading commercial, marketing, and industrial center of the south-central U.S. Dallas’s major industries include defense, financial services, information technology and data, life sciences, telecommunications, tourism, and transportation, all of which play a major role in generating demand for Dallas hotels.

Economy Update

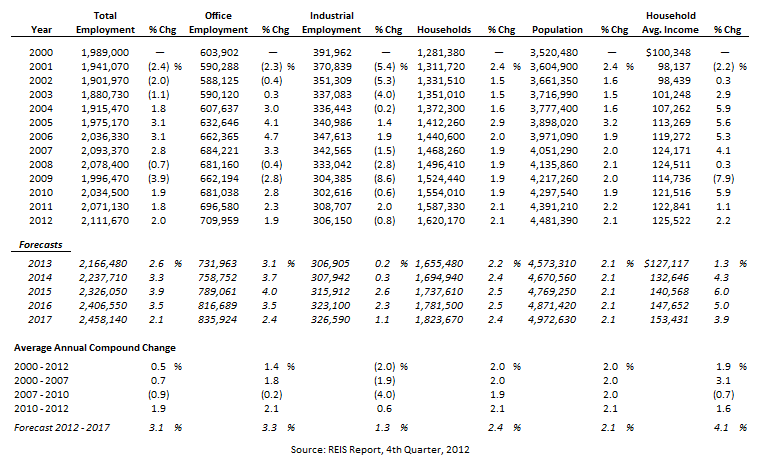

The following table illustrates historical and projected employment, population, and income data for the overall Dallas market.

HISTORICAL & PROJECTED EMPLOYMENT, HOUSEHOLDS, POPULATION, AND HOUSEHOLD INCOME STATISTICS

Approximately 50% of jobs in the Dallas/Fort Worth Metroplex are service-oriented, belonging to such fields as healthcare, recreation and tourism, and financing. The Dallas area’s workforce grew by 40,540 between 2011 and 2012, a 2.0% increase from the prior year and the third consecutive year of growth following the economic recession of 2009. The area’s population has realized consistent growth for more than a decade, a trend that is projected to extend through 2017.

The following table presents unemployment statistics for Dallas County, the Dallas/Fort Worth MSA, the state of Texas, and the U.S. from 2003 through 2012.

UNEMPLOYMENT STATISTICS

.png)

Unemployment in Dallas rose to its highest level in ten years in 2010, a result of job losses brought on by the national recession. Unemployment fell slightly in 2011 and again, more definitively, in 2012. The most recent comparative period illustrates further improvement. Local economic development officials noted that hiring has resumed within the financial sector, and corporate relocations to the area are expected to fuel employment growth over the long term. Interviews with economic development officials reflect a positive outlook for Dallas, primarily attributed to the diversity of corporate activity concentrated in the area.

Dallas, along with neighboring Fort Worth, has one of the largest concentrations of corporate headquarters in the U.S., which has helped the market strengthen and expand since the recession. According to a report published by Forbes in 2013, Dallas has realized the third-fastest rate of growth of any U.S. city in terms of population and economic output. Dallas is also one of a handful of cities that have recouped all recession-driven job losses. The area’s vast transportation network includes highways, commuter-rail service, a light-rail line, and two major airports.

The following summarizes major economic drivers in Dallas:

- New commercial, residential, retail, and cultural projects are under development or have been completed recently in Downtown Dallas and surrounding areas such as Uptown, Victory Park, and the Oak Lawn/Dallas Design District. The completion of the Margaret Hunt Hill Bridge in late 2011 and Klyde Warren Park in 2012, as well as the expansion of the Arts District, should continue to spur new development and revitalization efforts in the area.

- The wholesale merchandise industry is important to the Dallas economy and Dallas Market Center (DMC) is one of the largest hospitality demand generators in the city. The DMC conducts some 50 “markets” annually, attracting more than 200,000 retail buyers. The DMC complex includes the Dallas Merchandise Center, the World Trade Center, and the International Apparel Mart. More than $8 billion in wholesale transactions are conducted annually at the facility, and attendance to such markets as the Dallas Total Home & Gift Market, held in January of 2013, is reportedly growing.

- The University of Texas Southwestern Medical Center, part of Dallas‘s prominent healthcare industry, ranks among the top academic medical centers in the world. Affiliated hospitals include Parkland Memorial, Children’s Medical, Zale Lipshy University, and St. Paul University hospitals. A $114-million expansion is in the planning stages for Dallas’s Medical City, and significant expansions are underway at both Parkland Memorial Hospital and the UT Southwestern Medical Center. Both projects are slated to open in 2014/15 and represent $1.27-billion and $800-million investments, respectively.

- Projects expected to draw leisure visitors to Dallas in the coming years include the Perot Museum of Nature and Science in Victory Park and Klyde Warren Park. The latter is a $100-million, 5.2-acre urban park situated above Woodall Rodgers Freeway, which connects Uptown, Downtown, and the Arts District. Both the museum and the park opened in 2012.

- The Omni convention center hotel, which opened in November of 2011, has increased national interest in the Dallas Convention Center; this new hotel will aid the city in attracting meeting and group demand.

- The George W. Bush Presidential Center, which opened on the campus of Southern Methodist University earlier this year, includes the presidential library and museum, as well as the George W. Bush Policy Institute and the offices of the George W. Bush Foundation.

Several large suburbs act as major economic drivers for the Dallas market. Fundamentals and new developments in these suburban areas are summarized as follows:

- Irving continues to benefit from corporate relocations and expansions, as well as new commercial developments. Taleris, a joint-venture aviation company by Accenture and GE Aviation, opened its global headquarters in Irving in April of 2013. The opening of the $137-million, 275,000-square-foot Irving Convention Center in January of 2011 is expected to attract additional meeting and group business.

- High-tech data centers in Richardson occupy buildings comprising nearly one million square feet. In 2011, Ericsson expanded its local operations by leasing additional space in the former Nortel campus, and the company is expected to complete a 270,000-square-foot headquarters expansion in Plano in July of 2013. Other significant technology firms in Richardson and Plano include Raytheon, id Software, Cisco Systems, ViaWest, and FireHost. Major telecom companies include Samsung Mobile, MetroPCS, AT&T, and Tektronix Communications. In December of 2012, Dallas-based developer KDC purchased 186 acres of land along the border of Plano and Richardson to construct a $1.5-billion mixed-use development. This project, located at the intersection of North Central Expressway and President George Bush Turnpike, will include a 1.5-million-square-foot State Farm Insurance office campus and 3,900 multi-family residential units, as well as hotels, retail stores, and offices. Construction on the first phase of the project, which will include new training offices at State Farm, is expected to begin in the spring of 2013.

- The Frisco/Plano area is home to national and international headquarter operations for companies such as Bank of America, PepsiCo, and Encana. Sports and entertainment attractions in Frisco include Dr Pepper Ballpark, Dr Pepper Arena, and FC Dallas Stadium. The area also offers a wealth of shopping venues, including the Stonebriar Centre (a 1.6-million-square-foot, high-end shopping mall) and The Shops at Legacy.

- Allen and McKinney are growing communities. Raytheon operates a major facility in McKinney. In June of 2011, Traxxas broke ground on a $40-million corporate campus in the Craig Ranch community of McKinney. With a scheduled completion by the end of 2013, the project includes a 100,000-square-foot, three-story corporate office facility; a 75,000-square-foot auditorium and car museum; and a 90,000-square-foot distribution center. Emerson Process Management is currently building a new headquarters and research and development center in McKinney’s Gateway development. Allen’s 125,000-square-foot, $30-million Allen Event Center opened in January of 2010. The recent opening of Hydrous Wake Park is also expected to help boost leisure demand in the Allen market.

The Dallas market continues to attract global corporations, and the area’s combination of business anchors, telecommunications industry growth, and tourism has allowed the Metroplex to recover more quickly than most major markets.

Office Space Market Update

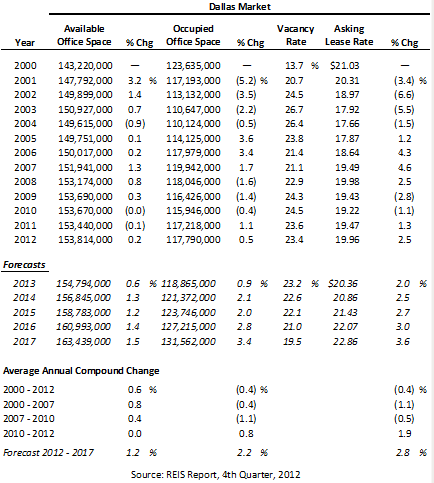

The following table details Dallas’s office space statistics, which are important indicators of the market’s propensity to attract commercial hotel demand.

OFFICE SPACE STATISTICS – MARKET OVERVIEW

.png)

Despite an upswing on several economic fronts, recovery for Dallas’s office market has been slower, primarily because of oversupply. The CBD market has weakened in recent years as other submarkets, particularly Frisco/Plano and nearby Uptown, have gained popularity.

The following table illustrates a trend of office space statistics for the overall Dallas market.

HISTORICAL AND PROJECTED OFFICE SPACE STATISTICS – GREATER MARKET

Vacancies remain relatively high across the market, though vacancy levels are forecast to drop moderately through 2017. Asking lease rates are likewise expected to realize modest gains over the next several years. Notably, a $100-million redevelopment of Patriot Tower in the Dallas CBD submarket is underway, which could help shift the dynamics of Dallas’s office market in the coming years.

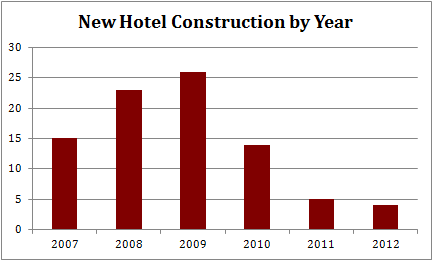

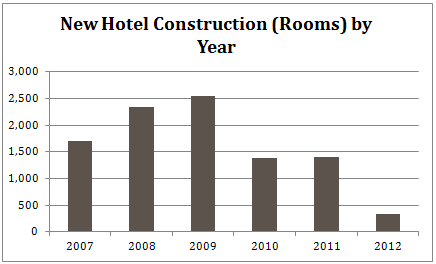

Hotel Construction Update

Prior to the onset of the Great Recession, the economic boom spurred significant hotel construction in Dallas. The following charts depict the new supply additions realized in the Dallas market from 2007 through 2012.

Four hotels opened in 2008, including the 231-room Hilton in Rockwall and the Aloft hotels in Las Colinas, Plano, and Frisco. In 2009, the 200-unit NYLO Hotel Dallas opened in Las Colinas. The opening of the Element Dallas-Fort Worth Airport North in 2009 represented the first property for this brand in the Metroplex. The Courtyard Dallas Allen at The John Q. Hammons Center added 228 rooms to the growing Allen market in 2010. Five hotels opened in 2011, including the 1,001-unit Omni Dallas Convention Center Hotel. Another four opened in 2012, including the market’s first Home2 Suites by Hilton in Frisco and the 76-room NYLO Hotel Dallas Southside. Overall, the most popular brands among new builds from 2007 to 2012 were La Quinta Inns & Suites (twelve hotels), Holiday Inn Express/Holiday Inn Express & Suites (eleven hotels), and Comfort Inn/Comfort Inn & Suites/Comfort Suites (ten hotels).

According to HVS research, one new hotel is currently under construction in the Dallas market:

- A 130-unit Homewood Suites by Hilton is under construction at 1025 Elm Street in the former United Fidelity Life Insurance Building. The hotel is scheduled to open in August of 2013 and is being developed by Lowen Hospitality Management LLC.

Proposed hotel projects include the following:

- Home2 Suites by Hilton – Irving

- Hyatt Place (proposed Southgate mixed-used development) – DFW Airport

- Full-Service Hotel - McKinney

- Hilton (conversion of Butler Brothers Building) – Dallas

- Holiday Inn & Suites (former Ramada Plaza) – Dallas

- TBD Five-Star Hotel (proposed Dallas Midtown mixed-used development) – Dallas

- Full-Service Hotel (former Dallas Grand Hotel/Statler Hilton) – 1914 Commerce Street – Dallas

- While lenders have loosened the reins on construction loans somewhat as the economy has improved, the pickup in hotel construction is expected to be modest in the near term, with a larger pipeline anticipated in 2014.

Outlook on Market Occupancy and Average Rate

The recession caused occupancy levels in Dallas to drop considerably. The area experienced cutbacks in employment and corporate travel in 2008 and 2009, although to a lesser extent than in other major metropolitan areas in the country. The overall strength of the local economy allowed occupancy to rebound in 2010. The pace of the recovery accelerated in 2011 and 2012, and occupancy strengthened further to just over 61%. In addition to expanded activity occurring at large telecommunication firms, energy companies, and banks, area medical centers continue to grow and increase room-night demand. As such, demand in Dallas has grown faster than the national average.

The recovery of the Dallas market is attributed to a rebound in corporate demand, an expanded convention market, and the overall economic strength of the Metroplex. Occupancy is expected to grow at a moderate pace as the city attracts more citywide events and discretionary spending increases; greater demand will also allow hoteliers to focus on growing average rates.

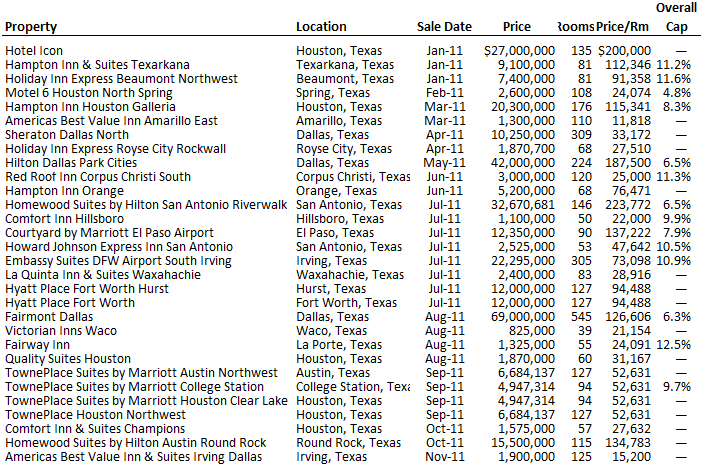

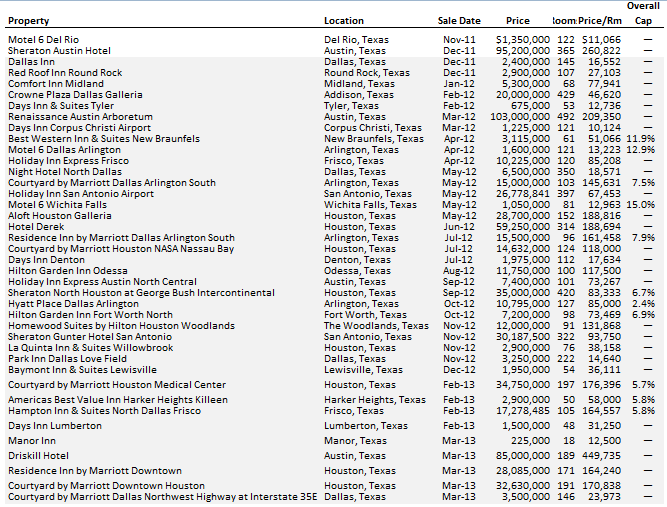

Recent Hotel Transactions

Hotel transactions that have occurred in the state since January of 2011 are summarized in the following table; the transactions within the Dallas/Fort Worth Metroplex are highlighted.

REVIEW OF HOTEL TRANSACTIONS

REVIEW OF HOTEL TRANSACTIONS - CONTINUED

The summary of hotel transactions illustrates a steady pace of deals during the last few years, across a variety of market segments and acquisition opportunities. The sales represent acquisitions of stabilized assets by institutional investors, as well as repositioning opportunities for entrepreneurial owner-operators.

Brokers’ Outlook

According to interviews with hotel brokers active in the Dallas/Fort Worth Metroplex, hotel transaction volume is likely to increase in 2013, albeit at a gradual pace. Transaction demand was centered on strongly flagged hotels throughout the first quarter of 2013. While the number of REIT purchases has slowed, many individual buyers are looking to purchase assets at a price that allows them to take advantage of future growth in the market. Owners also want to take advantage of the upswing in revenues and must decide on the right time to sell. According to several brokers, most potential buyers still struggle in finding a willing lender and closing a deal that satisfies both the buyer and the seller. As the banking sector continues to strengthen within the Metroplex and region, lending opportunities should continue to improve and the bid/ask gap should narrow. The emphasis on new development seems to be focused on mixed-use properties that feature retail, office, and apartment/condo living.

Conclusion

The Dallas market has proven fairly resilient in the face of economic challenges, its strength achieved largely on the foundation of its diverse economy. The city is experiencing revitalization efforts and new construction projects, including the entrance of new medical facilities, and convention activity is forecast to ramp up in the coming years. As such, the overall outlook for Dallas’s lodging industry remains positive.