In a recent assignment, HVS was asked to project the likely market behavior of a proposed luxury hotel in Zihuatanejo, Mexico. Presently, the Zihuatanejo market features two luxury and two upscale properties, with up to four new projects being proposed in similar or superior service categories. In conducting our analysis, several questions arose: Would a new luxury hotel in Zihuatanejo compete exclusively with properties in the local market or also with others in markets outside of Zihuatanejo? That is, would the proposed project be part of a self-contained local market, or rather part of a broader, more disperse market defined by factors other than location? If all of the proposed projects actually came online, would this redefine market dynamics such that the local market could be considered self-contained? If this were to occur, how would lodging demand behave and how can we model projections?

This article outlines a methodology for the analysis of supply and demand in emerging markets. Many smaller lodging markets, with a limited mass of product in particular asset class, are transitioning into self-contained markets, which are characterized by a critical mass and quality of lodging product. In smaller markets, hotels often compete not only with other local properties but also with hotels in alternative markets. In a self-contained market, hotels compete almost exclusively with other hotels within that same market, as defined by a geographical boundary or destination. Examples of self-contained markets in Mexico include Cancún and Acapulco.

We explore the nature of market transitioning below, a process that depends heavily on the introduction of new, often highly differentiated supply as a catalyst. We note that the current situation in the global economy and financial markets may slow the expansion of these markets, thereby lengthening the timetable for the described transformation. This circumstance, however, can be easily factored into the formula. As this supply-based transition occurs, several factors combine to draw and capture additional lodging demand, completing the process by which the market is more clearly defined. This methodological approach is especially appropriate for feasibility studies of proposed resort projects in Mexico, Central America, and the Caribbean.

A Case Study in Zihuatanejo, Mexico

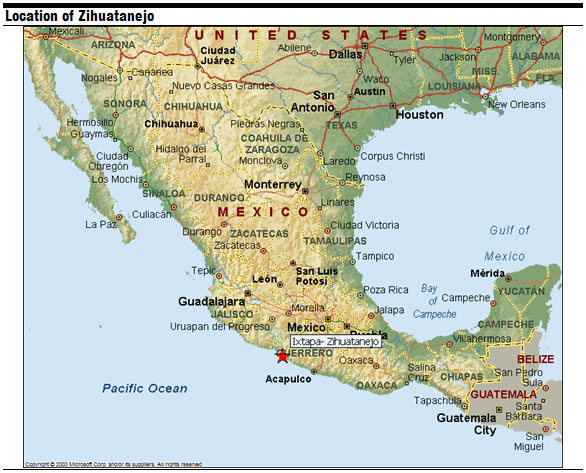

Zihuatanejo, located on the Pacific Coast of Mexico in the state of Guerrero, provides an example of a smaller market on the verge of significant growth. The town is part of the greater Ixtapa-Zihuatanejo beach destination that has long drawn foreign and domestic visitors alike. Zihuatanejo remains a quaint fishing village with attractive beaches and lush tropical vegetation, punctuated over the years by the development of low-density hotel and residential projects. It is positioned to capture high-end leisure demand in exclusive hotels with low room counts.

Ixtapa, which was conceived around the same time as Cancún, started operations in 1974 and was the second integrally-planned resort of FONATUR, Mexico's national tourism development trust. Ixtapa was selected with the aim of attracting tourists from the North American market and relieving the excess seasonal demand on Acapulco. It was the first tourism project financed by the World Bank. This area also boasts a significant critical mass of chain-affiliated European Plan and all-inclusive hotels, as well as residential, time-share, and condominium real estate markets.

Lodging trends in Zihuatanejo have been relatively stable. In 2007, the market experienced a slight setback, mostly attributed to increased competition from other destinations in Mexico as well as the resurgence of the Cancún and Riviera Maya markets after being heavily affected by Hurricane Wilma in late 2005. Occupancy levels decreased further in 2008 given the global economic crisis. Nevertheless, occupancy levels in 2009 still reflect an increase from levels prior to 2006. Regional highway improvements have positively impacted demand, which should continue in the future. Given the current global recession and expected decreases in travel, we expect a downward trend for average rate growth in the immediate future for the Ixtapa-Zihuatanejo market. Average rate levels are expected to improve in the following years as the market stabilizes.

Hotels in these markets have generally been able to establish consistent penetration levels because of limited increases in supply. As new upscale and luxury hotels enter the area, Zihuatanejo is expected to expand and consolidate its position as a self-contained luxury destination on Mexico's Pacific coastline.

The greater Ixtapa-Zihuatanejo lodging market is experiencing a new growth stage of its life cycle. Zihuatanejo’s luxury lodging market currently consists of roughly 200 hotel rooms, including the 70-room The Tides, the 24-room La Casa que Canta, and the 23-room Villa Vera Puerto Mio. Based on HVS primary research, we believe the luxury lodging market in Ixtapa-Zihuatanejo could expand significantly by 2013 with the addition of an estimated 600 hotel rooms. The new hotels planned for the market are expected to induce significant new demand. This is supported by historical trends that indicate that new product in different supply segments has generally been well received and absorbed in the market. More incoming flights, continuing improvements to roadway infrastructure, and the development of several residential projects will also contribute to this expansion. Hence, this increase in hotel supply is expected to catalyze Zihuatanejo’s transition from a smaller market whose luxury properties compete with those in alternate locations into a self-contained market.

The Market-Expansion Formula

We have developed a formula to illustrate how new hotel supply can combine with other market characteristics to enable transformations such as that expected for Zihuatanejo.

The market-expansion formula calculates induced demand, which represents the number of additional room nights that a specific event, demand generator, attraction, or infrastructure improvement can bring about to establish a favorable balance between supply and demand. As hotel rooms are added, we assume that chain affiliation, unique features, aggregate sales and marketing investment and, as appropriate, infrastructure and market access improvements will lead to a certain degree of induced demand in the market. As supply is added and demand is induced, the market’s position is consolidated and can be increasingly analyzed on its own merits, i.e., as a self-contained market.

The market-expansion formula takes such factors into consideration and assumes that induced demand is based on the number of rooms expected to enter the market each year. Based on such assumptions, we can then project the number of occupied rooms per year based on market-wide occupancy and the ability of hotels to induce demand based on estimated market segmentation. The formula is as follows:

((Number of occupied room nights (number of rooms x 365) x market-wide occupancy)) x estimated market segmentation x estimated induced demand in segment= Total induced demand in segment

Market segmentation divides overall market demand into individual segments based on the nature of travel. This method analyzes levels of induced demand based on estimated market segmentation. Demand for a typical beach destination market in Mexico is broken into three segments: wholesale, meeting and group, and free independent traveler. The total segmentation of the market is the cumulative number of room nights captured by each hotel per segment. The competitive weight of each hotel is also used in determining the overall market segmentation.

The total induced demand in each phase of market expansion is based on the opening date of each hotel and its expected strength and market abilities. It should be noted that each hotel entering the market is assumed to have its own weight and calculation for induced demand, and that not all hotels that enter the market are expected to induce demand. Key considerations include brand strength, expected market penetration, the stage of the market’s development as a “destination market,” and market conditions (including macro and micro economic conditions).

So what are the conditions that allow smaller, less-established markets to transform into self-contained markets with the addition of new hotel supply? Two models can help us visualize the transformation. The first model considers a market with considerable critical mass of European Plan and/or all-inclusive hotels, wherein one highly differentiated project comes online, begins to reposition the market and introduces a trend that new supply additions can build on. One notable example of this model is found in the development of the Mayakoba master-planned community in the Riviera Maya. The unique characteristics of Mayakoba and the addition of highly differentiated high-end brands, including Rosewood and Banyan Tree, resulted in repositioning the entire corridor, initiating a trend that would subsequently be leveraged by additional upscale brands, including Mandarin Oriental, KOR, Orient Express, and Capella. Hence, a small luxury market segment that competed for demand with luxury properties in other markets came into its own as a self-contained luxury destination.

A second model is found in Los Cabos, which from the start was positioned as an upscale lodging market. Properties such as Palmilla (later affiliated with One&Only), Ventanas al Paraíso, and Esperanza were developed in relatively early stages of the destination’s development and served to define it as a luxury market that would come to include additional properties, including Capella, Cabo del Sol Beach & Golf Resort, and Marquis Los Cabos. Los Cabos thus represents an example of a pre-planned, self-contained luxury market built from the ground up.

Conclusion

The active lodging sector in Mexico is changing the dynamics of markets throughout the country. Smaller markets are expected to expand and ultimately become self-contained with the addition of new hotel supply, adopting operational dynamics similar to those of the country’s more mature markets. New resort and hotel developments are actively underway as of the writing of this article, although the pace of new projects has slowed in league with clamped credit markets, constrained demand levels, and other negative effects of the recession. Even under the duress of the recession, the market-expansion formula, which also applies to destinations in the Caribbean and Central America, can be used to understand the potential transformation of markets given the addition of new hotel supply. By considering the condition of an existing local market and incorporating expected future trends, we can make vital insights into both emerging and established markets.