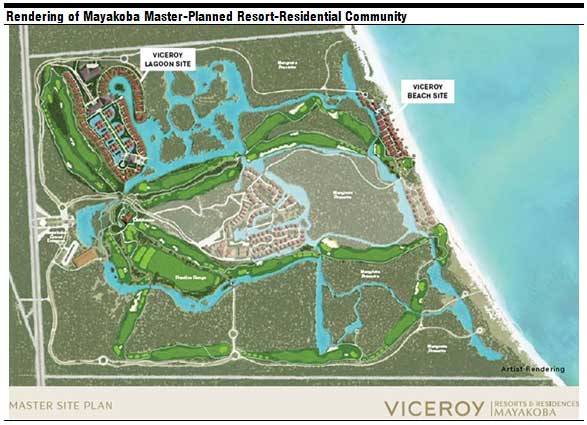

Soon after entering the gated entrance to Mayakoba in the Riviera Maya, one senses that this is not just another beach resort. Indeed, once within this highly manicured haven, enclosed by sumptuous greenery and meandering tributaries, one might easily forget that the beach is only a few steps away. Mayakoba, arguably one of the best master-planned developments in Mexico, forms a collection of four luxury hotel and residential brands, namely Fairmont, Rosewood, Banyan Tree, and Viceroy. Adding to the upscale ambiance, El Camaleón golf course, which hosts Mexico’s only PGA-sponsored tournament, winds tranquilly through the grounds. This "Village on the Water" features extensive man-made cenotes (freshwater lagoons unique to the Yucatan Peninsula). Guestrooms and villas of the four hotels extend from the beach to the inland, hidden by water and lush vegetation. As we shall see, the concept is idyllic for visitors and investors alike.

Mayakoba has been in the making for over a decade, and both the Banyan Tree and Viceroy components are in the final stages of construction. However, all throughout Mexico the trend toward exquisitely designed, master-planned resort-residential developments is well underway, and Mayakoba will soon be accompanied by similar and even more ambitious projects. Each community is expected to build upon some common fundamentals to create a unique experience. Master-planned communities are normally anchored by one or multiple upscale hotels, which are complemented by a mix of branded and non-branded residences, including custom home sites, villas, and condominiums located within a highly secure environment. Additional amenities may include signature golf courses and beach clubs, with facilities such as marinas and private landing strips becoming increasingly popular, particularly at the most-exclusive destinations.

History

Master-planned communities in Mexico date back to 1974, when the National Trust Fund for Tourism Development (FONATUR) began developing resort destinations in Cancún, Ixtapa, and Los Cabos. Over three decades, FONATUR’s basic mission was to provide the basic infrastructure and legal certainties crucial to a successful resort community and provide resources to assist investors in the development process. Operating on this premise, FONATUR’s efforts have helped keep Mexico at the forefront of the tourism industry. Cancún is now the most recognized tourism destination in Mexico, and its growth has spurred development in nearby areas such as the Riviera Maya, Cozumel, and Isla Mujeres. Combined, the surrounding markets now boast more hotel rooms than Cancún, which attests to the success of FONATUR’s visionary plans. This government-sponsored growth has served as a catalyst for other forms of development; in Quintana Roo and other Mexican states, the development trend has now shifted to the private sector.

From Acapulco to Zihuatanejo, master-planned resort-residential communities are beginning to form part of a larger demographic phenomenon that is expected to have a noticeable impact on future travel and tourism trends. During the past four to six months, the residential sales market in Mexico has experienced a slowdown, primarily attributable to greater fiduciary caution and stricter lending practices in the U.S. The ongoing crisis in the financial markets and its effect on investor wealth and consumer confidence are likely to further impact the short-term performance of many projects. Nevertheless, prospects for mid- to long-term development remain promising.

Benefits of Master-Planned Resort-Residential Communities

For investors, master-planned resort-residential communities offer:

- Diversified sources of income: Investors are able to create an environment that combines income-producing properties (hotels) and for-sale properties (residences). This allows investors to realize a faster return on investment. The prestige of luxury hotel brands exerts a two-fold influence by luring individual investors, buyers, and tourists, and by raising the value of surrounding residential property.

- Legal certainty: In countries where inconstant legal systems have traditionally been a weak link in the development process, developers of master-planned communities are able to offer improved legal benefits such as title insurance, secured zoning restrictions, and density restrictions for both third-party developers and individual buyers.

- A development platform: Third-party developers are able to build a hotel or residential development with the benefit of a well-designed master-planned community’s quality infrastructure.

- Flexibility in deal structuring: Master-plan developers are able to undertake a variety of deal structures within a single community. Developers can opt to manage the entire community independently; create joint ventures and offer the land to third-party developers; or sell portions of land, often called macrolotes, to third-party developers.

For tourists and buyers, master-planned resort-residential communities offer:

- Improved privacy and security: A tightly controlled environment offers a sense of privacy and security at a level that stand-alone residential developments rarely achieve.

- Ample amenities: Guests and residents benefit from additional amenities. Residents are able to utilize restaurant, spa, and other facilities and services associated with on-site hotels. Many master-planned communities also offer golf courses, marinas, or private landing strips for the benefit of both residents and visitors.

- Quality infrastructure: Many master-planned communities offer improved infrastructure such as well-built drainage systems, water-treatment plants, underground cables, and quality roads. These features offer great convenience to property owners and allow them to remain somewhat independent from local government services.

- Legal certainty: Like investors, home buyers can now benefit from an improved investment atmosphere in Mexico, with U.S.-based title insurance and mortgages becoming widely common throughout the country.

Many of these benefits can be passed down to future investors or buyers. As such, master-planned resort-residential communities constitute an exceptional platform for investors, developers, buyers, and tourists.

A Booming Generation

Baby boomers are playing a key role in creating demand for these luxurious havens. According to the U.S. Census Bureau, there were approximately 78.2 million baby boomers in the U.S. in 20051. Members of this generation, so defined as individuals born between 1946 and 1964, began turning 62 in 2008. Many are planning for retirement, relocation, the purchase of second homes, or simply traveling more often. According to an annual survey conducted by U.S. developer Del Webb Corporation in 2004, 55% of baby boomers plan to move upon retiring. In 2006, the National Association of Realtors estimated that over one million Americans owned a second home in Mexico.

Mexico remains an attractive relocation destination given its relatively low cost of living, proximity to the U.S., laid-back atmosphere, growing healthcare services, and American-style conveniences. Mexico is now rated at the pinnacle of retirement destinations for Americans, according to International Living’s 2007 Global Retirement Index2. U.S. and Canadian retirees are attracted to the high-quality amenities and security provided by master-planned developments—and not just those along the coast. The interior of Mexico is experiencing an influx of similar developments competing for the U.S. and Canadian market. San Miguel de Allende, for example, has been welcoming U.S. and Canadian retirees for years. Prospective residents and visitors are attracted to the town’s colonial architecture, historic cobblestone streets, and relaxed atmosphere. Only time will tell what impact this growing population segment will have on tourism and residential trends in Mexico.

Selected Master-Planned Communities in Mexico

| Location | Community | Status | Features | |

|

Cancun/Riviera Maya

|

Mayakoba

|

Existing

|

Three luxury hotels (649 rooms), 197 residences, 18-hole golf course

|

|

|

Playacar

|

Existing

|

Multiple hotels (5,186 rooms), residences, 18-hole golf course

|

||

|

Puerto Aventuras

|

Existing

|

Multiple hotels (2,899 rooms), 900 residences, 18-hole golf course

|

||

|

Playa Mujeres

|

Existing

|

Three luxury hotels (672 rooms), 2,400 residences, 18-hole golf course, marina

|

||

|

Bahia Principe

|

Under Construction

|

Multiple hotels (2,562 rooms), 900 residences, 36 holes of golf

|

||

|

Capella Bahia Maroma

|

Under Construction

|

86-room luxury hotel, 112 residences, 18-hole golf course

|

||

|

Puerto Cancun

|

Under Construction

|

Five hotels (4,000 rooms est.), 2,500 residences, 18-hole golf course, marina

|

||

|

Grand Coral

|

Under Construction

|

Two hotels (999 rooms), 1,280 residences, 18-hole golf course

|

||

|

Los Cabos

|

Palmilla

|

Existing

|

172-room luxury hotel, 1,300 residences, 27-hole golf course

|

|

|

Cabo del Sol

|

Existing

|

Two upscale hotels (537 rooms), 1,700 residences, two 18-hole golf courses

|

||

|

Punta Ballena

|

Existing

|

50-room luxury hotel, 137 residences (phase I)

|

||

|

El Dorado

|

Existing

|

192 residences, 18-hole golf course

|

||

|

Querencia

|

Existing

|

172 residences, two 18-hole golf courses

|

||

|

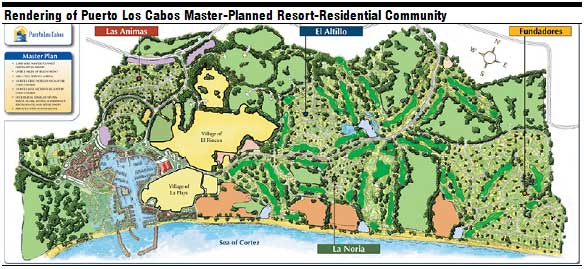

Puerto Los Cabos

|

Under Construction

|

Multiple luxury hotels (95 rooms U/C), 100 residences, marina, two 18-hole golf courses

|

||

|

Chileno Bay

|

Under Construction

|

150-room luxury hotel, 725 residences, marina, two 18-hole golf courses

|

||

|

Cabo San Cristobal

|

Under Construction

|

Three luxury hotels (455 rooms), 405 residences (phase I), two golf courses

|

||

|

Quivira

|

Proposed

|

Two hotels (154 existing rooms), 120 residences, two golf courses

|

||

|

Cabo Cortes

|

Proposed

|

Multiple luxury hotels, residences, 27-hole golf course, marina

|

||

|

Pacific Coast

|

Punta Mita

|

Existing

|

Two luxury hotels (293 rooms), 350 residences, 18-hole golf course

|

|

|

Nuevo Vallarta

|

Existing

|

Multiple hotels (3,228 rooms), 1,500 residences (est.), two 18-hole golf courses, marina

|

||

|

Flamingos Riviera Nayarit

|

Existing

|

Multiple hotels, 2,934 residences, 18-hole golf course

|

||

|

Tamarindo Costa Careyes

|

Existing

|

32-room luxury hotel, 150 residences (est.), 18-hole golf course

|

||

|

Isla Navidad Manzanillo

|

Existing

|

Two hotels (210 rooms), 500 residences, 27-hole golf course, two marinas

|

||

|

Litibú

|

Under Construction

|

Three hotels (500 rooms), 450 residences, 18-hole golf course, marina

|

||

|

Interior

|

Artesana San Miguel de Allende

|

Under Construction

|

65-room luxury hotel, 20 residences (phase I)

|

|

|

Ventanas de San Miguel

|

Under Construction

|

Luxury hotel, 700 residences, 18-hole golf course

|

||

Conclusion

Mexico’s capacity for reinvention keeps it at the forefront of tourism trends. The World Tourism Organization ranks Mexico among the world’s top ten tourist destinations, the sole Latin American country to earn this distinction. The character of modern Mexico combines a reliquary of historic cultures and natural beauty with the investment-friendly atmosphere of the world’s most prosperous nations. In the future, the country’s coastlines and some regions of the interior are expected to be dotted with master-planned resort-residential communities that incorporate multiple land uses while providing the utmost in privacy and security. In the coming years, Mexican resort-residential destinations are expected to exhibit greater segmentation by offering a variety of products to satisfy demand from potential second-home buyers and retirees across a socio-economic range. While the current turbulence in the global financial markets will likely dampen the short-term performance of many projects, mid- to long-term U.S. and Canadian travel and retirement trends are expected to provide a stable base for growth, and the country’s appeal as a vacation destination should endure for generations to come.

1 http://www.census.gov/Press-Release/www/releases/archives/facts_for_features_special_editions/006105.html

2 http://www.internationalliving.com/internal_components/further_resources/09_01_07_retirement