This is demonstrated by the latest figures released by the Property Council of Australia (PCA) in the form of its Hotel Valuation Index. The PCA Index is based on the perceived value movement of a notional 4-star, 250-room hotel in Sydney's CBD. HVS International is one of a number of hotel valuation specialists that contributes to the Index.

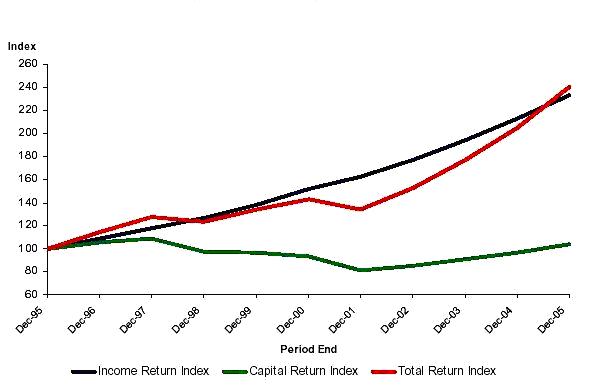

The PCA’s total return index, benchmarked against 1995 performance, indicates that hotel returns have increased substantially over the last decade. In recent years the sector’s performance has been driven by an annual income return of over 9% and capital returns averaging between 5% and 7% per year.

‘Having experienced four years of value growth, there is understandably some nervousness in respect of whether this level of growth is sustainable’ says Julian Whiston, Director of Valuations for HVS in Sydney. ‘In the past, value growth has been tempered by an expected surge in new supply. While a small number of potential new hotel developments can be identified, there remains some uncertainty as to whether these will in fact eventuate. All things being equal, it is likely that hotel property values are expected to grow further.’

HVS believes the key drivers behind the current market conditions include:

-

a sustained positive sentiment towards future earnings potential in the hotel sector;

-

a shortage of viable development sites, combined with prohibitive construction costs;

-

a continued significant weight of capital both from domestic and international funds and institutions which is focused on the property sector, including hotels; and

-

limited in-one-line hotel investment opportunities.