On a per-capita and per-square-mile basis, the intensity of capital deployment throughout Park City is arguably among the highest in the country. For investors, developers, and municipalities alike, the market offers a compelling case study in how a resort destination can reinvent itself through coordinated, high-quality growth. A key differentiator for Park City is accessibility. The market benefits from proximity to Salt Lake City International Airport, offering nonstop service to a broad range of domestic and international gateways. This logistical advantage is critical when compared to more remote mountain resorts and has meaningfully expanded the buyer pool for both real estate and hospitality assets. Park City’s combination of natural amenities, luxury infrastructure, and ease of access has become particularly compelling for executives, entrepreneurs, and investors seeking property in lifestyle-driven locations without sacrificing connectivity.

A substantial volume of hotel and residential development is underway across the greater Park City region, with the most concentrated activity occurring on the east side of Deer Valley Resort along the U.S. Highway 189/40 corridor. This growth includes The Stelle boutique hotel within the SkyRidge community; five hotel and branded-residential projects planned for the East Village at Deer Valley; two luxury hotels within the Deer Cove development; and a pipeline of thousands of new townhomes, condominiums, and single-family residences. Major residential projects currently underway or recently completed along the U.S. Highway 189/40 corridor include Cormont at Deer Valley East Village (approximately 350 condominiums), Marcella at Deer Valley (143 home sites, now sold out), Marcella Landing (50 luxury townhomes with pricing beginning near $9 million), Velvære Park City (115 units), and SkyRidge Park City (469 home sites). Hotels that have recently opened, are under construction, or remain in early planning stages within the Park City market are shown on the interactive map below.

New Lodging Supply in Park City

Source: HVS

Contextualizing the Growth

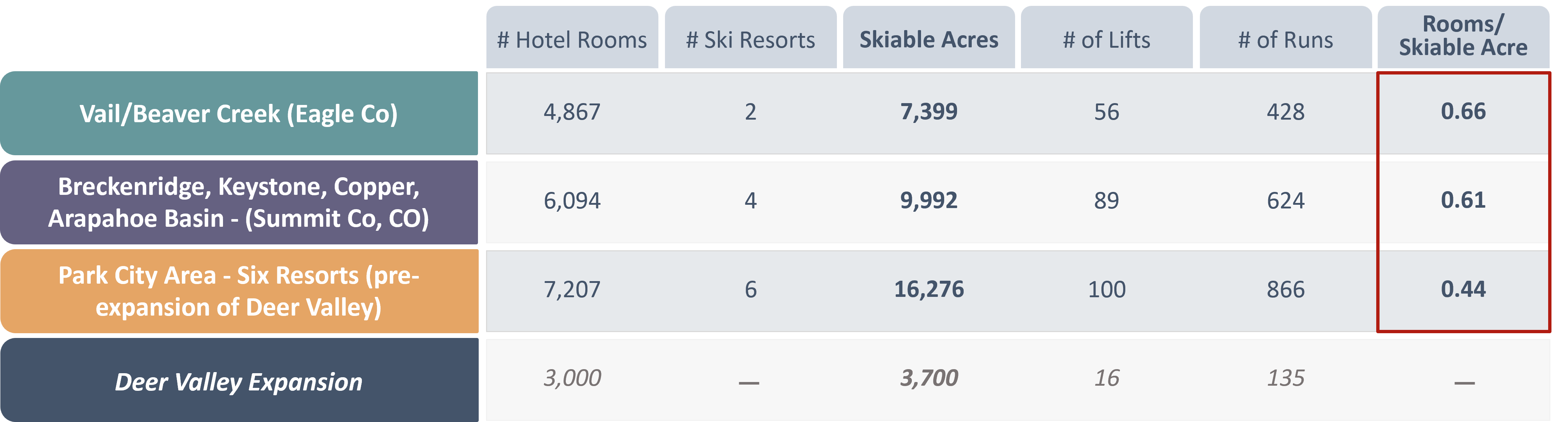

While the amount of new hotel inventory shown above may initially suggest elevated supply risk, this perspective does not capture the broader market context. In ski-oriented destinations, the scale of lodging is ultimately constrained and supported by the size and capacity of the ski resorts. Accordingly, it is important to evaluate Park City’s lodging supply and pipeline relative to total skiable acreage and benchmark the market against comparable high-volume ski regions, such as those in Colorado.The following chart illustrates key metrics for Park City and select resort markets in Colorado. For the purposes of this analysis, we have assumed a potential lodging supply increase of 3,000 rooms. However, the currently identified development pipeline is closer to 1,500 hotel rooms, suggesting additional capacity for lodging growth as the market continues to mature.

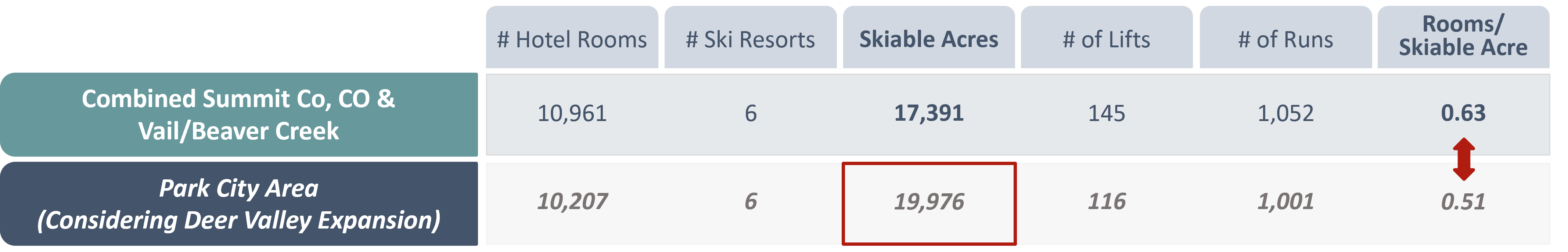

Given the size of Park City market, the combined metrics shown below were determined to be the most appropriate basis for comparison. Upon completion of the Deer Valley expansion, the greater Park City area will comprise nearly 20,000 skiable acres, exceeding the combined skiable terrain of Summit and Eagle counties in Colorado, which together encompass approximately 17,400 skiable acres.

Comparative Lodging Density Indicates Additional Capacity for Hotel Growth in Park City

When lodging inventory is evaluated relative to total skiable acreage, the Park City market remains under-penetrated on a rooms-per-acre basis. As illustrated above, even with the assumed addition of approximately 3,000 hotel rooms across the greater Park City area, the resulting lodging density would remain within the range observed in Summit and Eagle counties. This comparison suggests that the Park City market has sufficient recreational capacity, demand depth, and regional scale to support and absorb a meaningful increase in hotel inventory without materially impairing performance fundamentals.

Looking Ahead

Taken together, the scale of current and planned development, expansion of ski infrastructure, and comparative benchmarking against established Colorado ski markets underscore the depth and long-term potential of the Park City region. As investment, planning, and development activity continue to accelerate, informed market analysis will be critical for distinguishing sustainable growth from perceived supply risk.At HVS, we turn data into powerful insights that drive your success. For stakeholders seeking deeper insight into Park City’s evolving landscape, Katy Black, MAI, can provide tailored analysis based in on-the-ground market knowledge and resort-specific expertise that will offer meaningful guidance on positioning, timing, and long-term value creation.