Despite this recovery, one of the most important long-term drivers of Hartford’s transient demand remains the convention center, which plays a critical role in generating corporate and group business for the surrounding lodging market. Since the pandemic, however, hotel room supply constraints have limited Hartford’s ability to attract and accommodate large-scale conventions, creating a structural challenge for sustained growth.

Supply Challenges

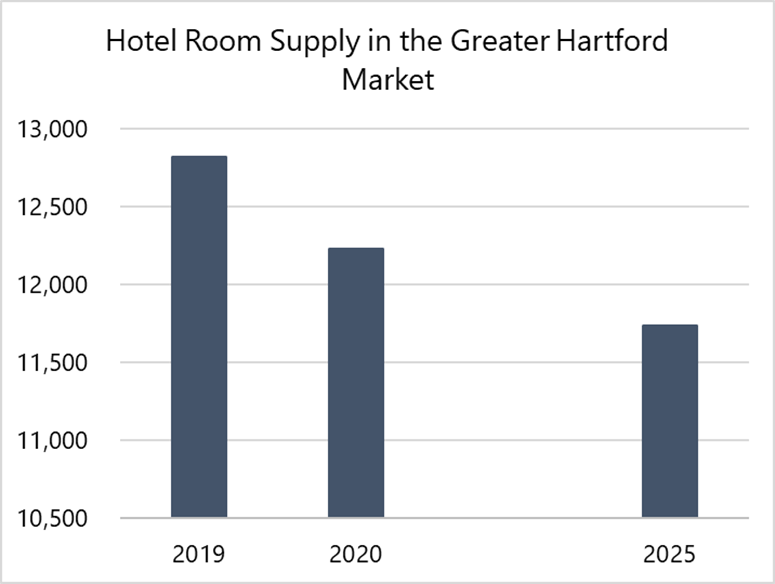

The Connecticut Convention Center (CTCC), the largest convention facility between Boston and New York, serves as a premier regional destination for conventions, trade shows, business meetings, and related events. The CTCC comprises approximately 540,000 square feet of total convention space, including 140,000 square feet of exhibit space, a 40,000-square-foot ballroom, and a 2,300-space parking garage. From a demand standpoint, the convention center benefits from a strong locational and economic foundation given its strategic position between New York and New England, as well as near several Fortune 500 companies and large corporate headquarters. Despite these advantages, inadequate hotel room supply has become a limiting factor, making Hartford less attractive for hosting large-scale conventions. As illustrated above, Hartford has struggled to maintain a stable hotel room supply since the pandemic, losing approximately 1,300 rooms between 2019 and 2024. While hotel closures during the pandemic were a nationwide phenomenon, Hartford was unable to replace the rooms lost during that period. Compounding this decline, several shuttered hotels have been repurposed for residential use rather than reintroduced as lodging supply. Most notably, the 22-story former Downtown Hartford Hilton was converted to dual hotel/residential use, with a DoubleTree by Hilton on the first eleven floors and the 147-unit Revel apartments on the upper floors. This conversion resulted in a loss of 223 hotel rooms. Similarly, the Homewood Suites on Asylum Street and the Red Lion near Dunkin’ Park were fully converted to residential use.Given the hotel supply decline, the convention center has faced increasing difficulty in attracting and accommodating large-scale conventions. For example, the annual New England Regional Volleyball Association (NERVA) Winterfest tournament, held at the convention center each January, draws more than 30,000 players, families, and spectators to Hartford. In 2024, however, insufficient hotel room supply forced event organizers to relocate two tournament weekends to Providence. Notably, the CTCC was able to recapture almost the full three-week event in 2025, with only one week split between Hartford and Providence, an encouraging sign of improved competitiveness despite ongoing lodging constraints. Nevertheless, Hartford faces not only a limited hotel supply but also increasing competitive pressure from hotels in nearby markets, including Providence and Springfield, as well as the Mohegan Sun casino resort, located approximately 35 miles from Downtown Hartford, all of which compete for a limited pool of regional events.

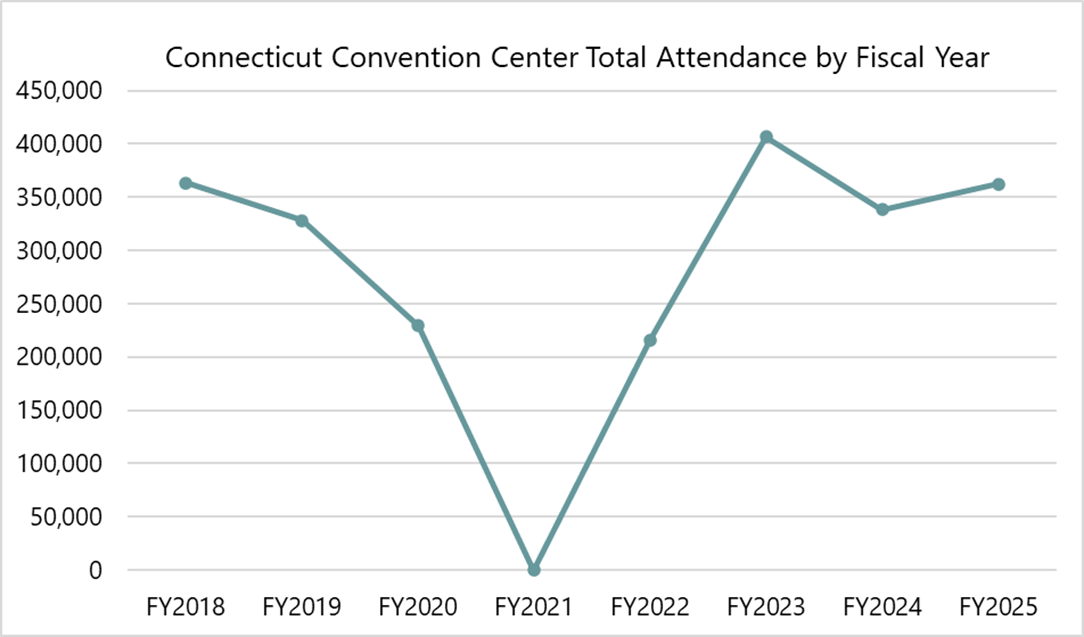

Consequently, the CTCC has shifted focus toward smaller-scale events with a greater local appeal and a more diverse event mix. Despite hosting only 108 events in 2023, compared to 166 in 2018, total attendance exceeded pre-COVID levels that year. A key contributor to this trend has been the increase in visitors attending exhibits for just one day. While this shift has been beneficial for convention-center revenues, it has generated limited spillover demand for Hartford’s lodging market, as day-trippers do not produce overnight demand.

Convention Center Attendance Rebounded After Pandemic Decline

Looking Ahead

Given the significant undersupply of hotel rooms in Downtown Hartford, expanding lodging inventory is critical to supporting the long-term viability of the convention center. A 2025 study conducted by Econsult Solution Inc. highlights elevated downtown office vacancies, totaling approximately 2.2 million square feet of Class A space. This presents a potential opportunity to repurpose underutilized office space into hotel accommodation. Such conversions align with initiatives outlined by the Capital Region Development Authority (CRDA) and have been identified as a priority strategy to support the CTCC’s financial sustainability and long-term competitiveness.At HVS, we turn data into powerful insights that drive your success. For more information about the Hartford market or for help making informed investment decisions that align with your goals and risk tolerance, please contact Jimmy Radwan.

Sources

https://static1.squarespace.com/static/65ba5913ca8e9f19928929ea/t/68812db6851b5326427ee889/1753296311512/ESI+-+Hartford+Office+Reinvestment+Strategy+7-9-2025.pdfhttps://www.ctinsider.com/business/article/ct-convention-center-rebounds-amid-hotel-shortage-19666482.php

https://www.metrohartford.com/newsroom/three-weekend-nike-new-england-winterfest-volleyball-to-bring-close-to-30000-and-nearly-11-million-to-hartford-area

https://crdact.net/wp-content/uploads/2025/09/CRDA-2025-Annual-Report-DRAFT.pdf

https://ctbythenumbers.news/ctnews/whats-next-for-hartford-new-analysis-looks-at-challenges-opportunities