We were especially encouraged by the strong presence of investment funds and financing vehicles—the true “holy grail” in the Caribbean—as well as the energy and professionalism brought by students from Florida International University, Boston University, and the University of Curaçao. Their participation added a meaningful dimension to the conference.

A few key takeaways from this year’s conference are presented below.

Strong and Stable Demand

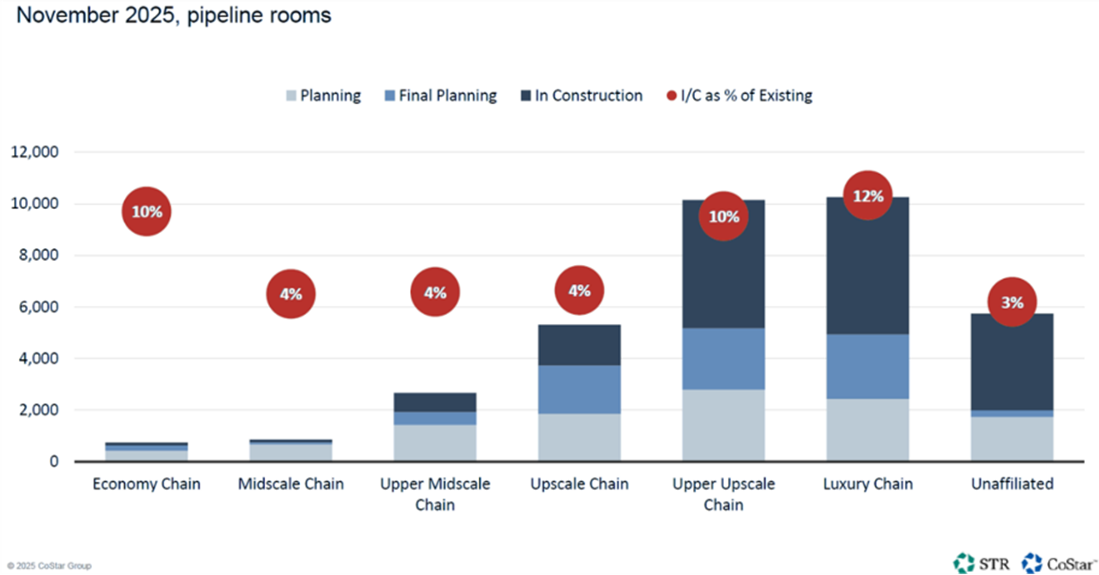

While RevPAR has begun to level off thus far in 2025, occupancy remains in the mid-70s and ADR is maintaining the historical highs achieved the prior two years, led by consistent growth within the luxury segment. However, the new supply pipeline, which is dominated by luxury and upper-upscale projects, could slow pricing power in the near term; additionally, a demand dip from United States travelers, a slow summer, and uncertainty related to tariffs raised concerns about short-term RevPAR growth.New Supply in the Caribbean

The impressive performance of the Caribbean since 2022 has led to an influx of new supply among all asset classes. Notable openings in 2024 included the Sandals Saint Vincent and the Grenadines, the St. Regis Cap Cana Resort, and the St. Regis Aruba Palm Beach Resort. The new supply includes numerous luxury mixed-use developments, which reduces overall risk for the owner, and all-inclusive hotel projects, which can compete with the popularity of cruise-ship packages. Roughly a dozen luxury and upper-upscale properties have opened or are anticipated to open in 2025, and more are in various stages of the development pipeline, as shown in the following table by CoStar Group.High-End Supply Growth in the Caribbean Remains Strong

Regional Leaders Sail These Waters

The Prime Minister of Curaçao, Gilmar Pisas, led an impressive slate of governmental representation at the conference. A panel of leaders from the Curaçao Tourist Board, Tourism Corporation Bonaire, Bahamas Investment Authority, and Invest Turks and Caicos discussed the outlook for their islands and the Caribbean as a whole, highlighting continually improving infrastructure and transportation capacity, local engagement, and sustainability as keys to build on recent success. Leaders from Hilton, Marriott, Hyatt, IHG, Mandarin Oriental, and Club Med agreed with those sentiments in their discussion panels.

The Prime Minister of Curaçao, Gilmar Pisas, led an impressive slate of governmental representation at the conference. A panel of leaders from the Curaçao Tourist Board, Tourism Corporation Bonaire, Bahamas Investment Authority, and Invest Turks and Caicos discussed the outlook for their islands and the Caribbean as a whole, highlighting continually improving infrastructure and transportation capacity, local engagement, and sustainability as keys to build on recent success. Leaders from Hilton, Marriott, Hyatt, IHG, Mandarin Oriental, and Club Med agreed with those sentiments in their discussion panels.

Potential Choppy Water

The Caribbean has long been a preferred destination for travelers from the United States, Europe, and Latin America. However, transportation and sustainability remain a concern for the region. While cruise-ship passenger activity continues to increase each year, airlift capacity and flight costs are hurdles for growing overnight stays on the islands. However, airports in the region have been expanding, resulting in increases in both the number of flights and the size of aircraft, which should facilitate stronger room-night capture.In addition to airfare costs, the region has other issues to work through. All-inclusive resorts and non-traditional lodging, such as short-term rentals, continue to cause a dispersion of demand. While interest in new hotel and resort developments is prevalent as demand remains strong, especially within the luxury segment, developers are facing a difficult financing environment and must be more creative with their capital stack. Higher insurance costs are another challenge for new developments, as well as existing assets. Nevertheless, the development pipeline remains robust, and the recent advent of luxury mixed-use properties has reduced the risk for developers. Progress is expected to continue on projects that have supporting components such as a feasibility study, quality sponsor, strong brand, great location, and strong equity contribution.

Conclusion

The Caribbean’s future remains highly favorable, with occupancy, ADR, and RevPAR performance metrics maintaining the region-wide historical highs realized in 2023 and 2024, as well as strong visitation from both air and sea arrivals in 2024 and thus far in 2025. Despite the uncertainty tied to U.S. tariffs and other challenges in the region, CHICOS participants described an optimistic outlook for the Caribbean in 2026.About CHICOS

The Caribbean Hotel Investment Conference & Operations Summit (CHICOS) is the premier hospitality conference in the region. Having completed its 2025 edition in Curaçao, CHICOS brings together nearly 300 regional and international investors and operators, as well as the region’s leading decision makers. Attendees or speakers include government representatives, opinion leaders, developers, developers seeking investors, bankers and other lenders, tourism officials, investment fund representatives, hotel brand executives, franchise and operations company delegates, public and private institution members, consultants, advisors, architects, and designers. Conference attendees network and discuss the region’s markets and possibilities, while analyzing the most important trends that can affect their investment decisions.For conference news, updates, and commentary, follow CHICOS on Twitter/X at @CHICOS_HVS, on LinkedIn, on Facebook, and on Instagram at @chicos_caribbean.