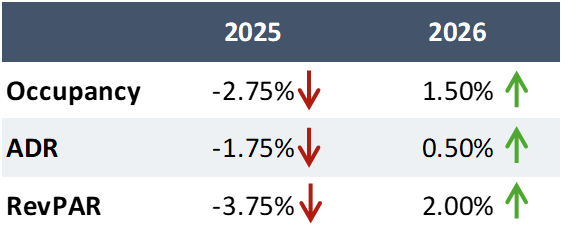

A modest uptick in September 2025 suggests occupancy is reaching a bottom, but the recovery path will be uneven, particularly given the federal government shutdown that began October 1, 2025. Year-to-date, average daily rate (ADR) has held up better than occupancy, as hotels generally maintained rate integrity until July or August 2025. However, ADR is now trending nearly 2.0% lower for the year, a typical late-cycle pattern as operators have begun offering discounts to stimulate shoulder and weekend demand.

Looking Ahead

The market still faces short-term obstacles given the October government shutdown. This shutdown has curtailed government travel, postponed some meetings, and created uncertainty in fourth-quarter booking patterns, particularly for properties reliant on government demand and related corporate segments. Until funding is reinstated, we anticipate weaker midweek performance and slower booking activity for programs scheduled in late Q4 2025 and early Q1 2026.For 2026, we expect occupancy to stabilize before ADR, with the September 2025 trend carrying into 2026. Occupancy growth should be supported by a stronger group booking pace and the normalization of leisure travel to pre-surge patterns. Rate growth should resume by April or May 2026 as the busier season begins and discounting abates; by then, stronger citywide events and seasonal demand should allow revenue managers to end rate discounting and shift demand mix toward higher-rated segments. In the greater Denver area, new supply was limited in 2025, and the pipeline remains light given current RevPAR levels and economic conditions throughout the metropolitan area.

Several Denver-specific factors support a cautiously optimistic outlook for the near term. The Colorado Convention Center’s late-2023 rooftop expansion—consisting of an 80,000-square-foot, column-free ballroom with added pre-function and terrace space—has increased the city’s ability to host large events. Convention officials reported record-setting booking performance in 2025 and attributed multiple future groups to the additional event capacity. The added citywide demand should translate to healthier compression across Downtown Denver and the walkable submarkets in 2026. Furthermore, Denver International Airport’s ongoing capacity and access improvements will support growth in market-wide visitation going forward.

Key short-term risks include a prolonged federal funding gap, slower recovery in demand near Downtown office buildings, and continued price sensitivity among certain traveler segments. Conversely, Denver could benefit from stronger convention bookings (facilitated by the new ballroom’s flexibility), expanded air service, and event planners moving meetings and conventions to the area from other states to take advantage of the city’s central location.

Bottom Line for Denver in 2026

We expect occupancy to mark a clear, if measured, increase from 2025 starting in Q1 and continuing through the summer; ADR growth should resume by late spring, as the demand mix improves and discounting recedes. For owners and operators, the best strategy for 2026 will be to maintain strong pricing during peak periods, build a solid base of group bookings to support midweek demand, and use targeted value-added incentives (rather than broad discounts) during the shoulder seasons to help boost RevPAR recovery.HVS Forecasts Modest Growth for Denver in 2026