In a market like India, where land most often than not is mis-appropriately valued resulting in exaggerated project costs and hotel transactions are limited in number, the only viable methodology that remains relevant especially in the current uncertain & volatile market scenario is that of Discounted Cash Flows (DCF). Moreover, the current pandemic has had an unprecedented impact on the hospitality sector, with hotels being temporarily closed and the sector witnessing all-time low performance metrics, by the virtue of which, assessing the value of a hotel on current income fails miserably.

In a market like India, where land most often than not is mis-appropriately valued resulting in exaggerated project costs and hotel transactions are limited in number, the only viable methodology that remains relevant especially in the current uncertain & volatile market scenario is that of Discounted Cash Flows (DCF). Moreover, the current pandemic has had an unprecedented impact on the hospitality sector, with hotels being temporarily closed and the sector witnessing all-time low performance metrics, by the virtue of which, assessing the value of a hotel on current income fails miserably.Hotels are extremely cyclical in nature and unlike the previous cycles, the current decline is driven by demand and not supply, and our experience says that most hotels will recover their cashflows quickly. In our India Hotels Outlook Report, August 2020, we anticipate Occupancy & ADR to reach pre-COVID levels by 2022 & 2023, respectively. We also anticipate that the shift in cost structures due to COVID will continue to remain, which combined with the return in performance in 2023 will result in better yields for hotels, by which time we expect cap rate compression to occur.

(1).jpg)

Additionally, compared to the other methodologies, DCF also considers the micro and macro-economic intricacies as it acknowledges the fact that the market conditions may not be great in the initial years but would recover strongly post the pandemic. The DCF methodology also helps us understand that hotels are extremely cyclical in nature and can generate yields higher that other asset classes once they recover. So, while presenting a future scenario the DCF method recommends that hoteliers should adopt a hold and buy policy as the market will recover soon.

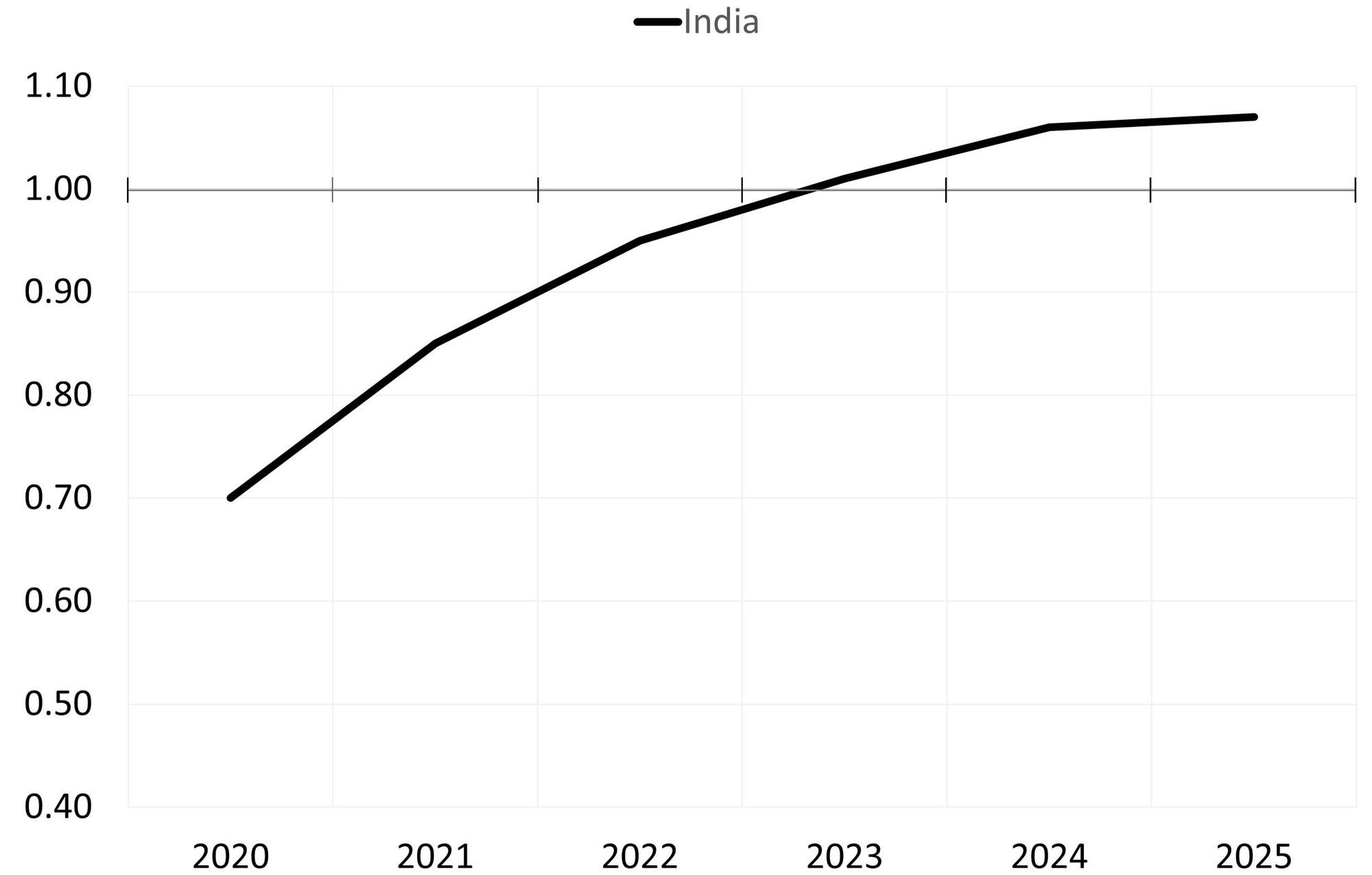

India Hotel Values

Source: HVS Projections, Indexed to 2019

The HVS Hotel Valuation Index suggests that hotel valuations in India will reach the pre-COVID levels by 2023, making this the best time to buy and invest in hotels.

About Akash Datta

Akash Datta, HVS Senior Vice President - Consulting and Valuation, leads consulting engagements, encompassing market studies, feasibility studies, strategic planning, valuation, and forecasting. Akash has spent nearly 13 years in the hospitality industry having successfully worked with International Hotel and Consulting firms such as Hilton, JLL and HVS in South Asia and the Middle East. In 2005, Akash started his Consulting career with HVS as an analyst following which he undertook his MBA in International Hospitality Management with concentration in Real Estate Finance from IMHI ESSEC in Paris, France. Known for his industry insights, Akash works with leading companies, private clients, industry groups, and global networks. Contact Akash at +91 989 9517 404 or [email protected].

About Dipti Mohan

Dipti Mohan, Associate Vice President - Research with HVS South Asia, is a seasoned knowledge professional with extensive experience in research-based content creation. She has authored several ‘point of view’ documents such as thought leadership reports, expert opinion articles, white papers, and research reports across industries including hospitality, real estate, infrastructure, cement, and construction. Contact Dipti at [email protected]

0 Comments

Success

It will be displayed once approved by an administrator.

Thank you.

Error