Hotel investment activity experienced a bumpy ride in 2016. With a slowdown in RevPAR growth, a stalled CMBS market, and concerns about increased supply, cap rates rose and deal activity slowed. The year ended on a positive note as lodging REIT stocks rallied and economic growth is projected to strengthen. This article, which is published biennially, discusses trends in hotel capitalization rates and provides an outlook for 2017.

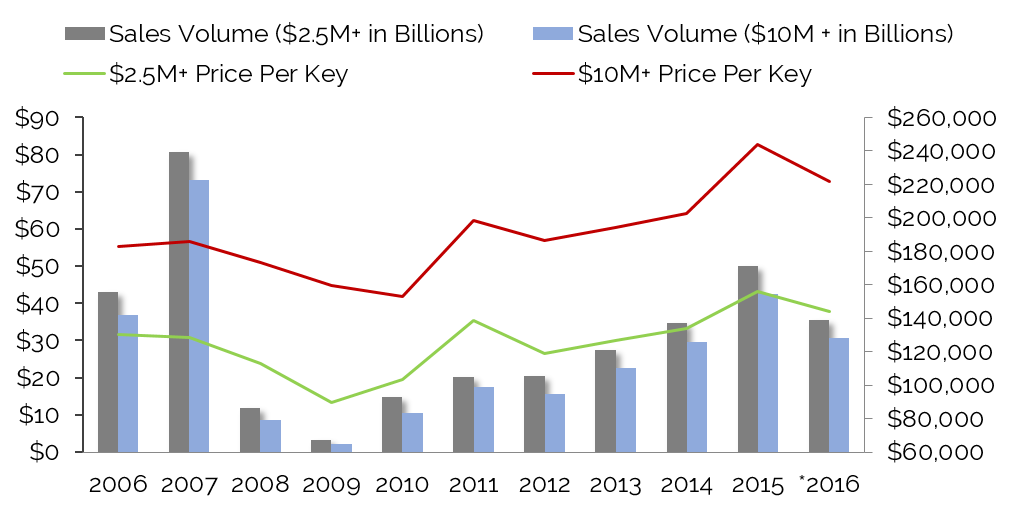

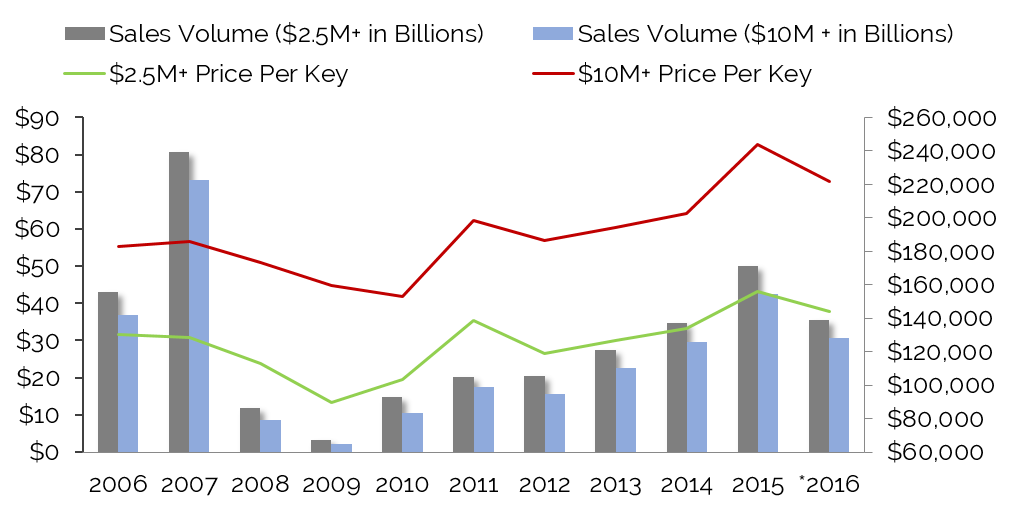

Following exceptionally strong hotel transaction activity in 2015, the market stalled in the first quarter of 2016 and then rebounded, ending the year with a healthy level of transactions, comparable to the level reached in 2014. Total volume in 2016, based on preliminary data reported by Real Capital Analytics (illustrated in the chart below), reached $35 billion, a decline of 30% from the $50 billion of hotel transactions in 2015, which represented a peak for the current cycle. Deal activity was put off during the first quarter of 2016, as investors and lenders reacted to the stock market correction. The Dow declined by over 8% in early January 2016 and did not fully recover until April. Transaction activity was down 60% and 43% year-over-year for the first two quarters, respectively, and then rebounded strongly in the third quarter of the year. Despite slowing RevPAR and net income growth, capital in search of yield and a safe haven continues to be attracted to the lodging industry. Hotel values continued to rise modestly in most markets over the course of the year, despite the rise in capitalization rates, due to continued RevPAR and NOI gains.

The average price per key derived from total sales volume declined by 8% from $156,000 to $144,000, due primarily to the profile and locational mix of assets that transacted. A smaller number of large, full- service hotels were sold during the year, affecting overall volume and average price per key. In addition, fewer hotels were sold in the major metro markets, while investors turned to secondary and tertiary markets such as Atlanta, Dallas/Ft. Worth, Phoenix/Scottsdale, Austin, San Antonio, Birmingham, Chattanooga, among others, in search of more affordable, value-add opportunities.

Major hotel sales, defined as those that sold for a price of $10 million and over, declined by 28%, and the average PPK declined by 9%, from $244,000 to $222,000 per room. The price-per-key trends should not be viewed as the value declines, as average sales price per key are greatly affected by the composition of assets sold.

Following exceptionally strong hotel transaction activity in 2015, the market stalled in the first quarter of 2016 and then rebounded, ending the year with a healthy level of transactions, comparable to the level reached in 2014. Total volume in 2016, based on preliminary data reported by Real Capital Analytics (illustrated in the chart below), reached $35 billion, a decline of 30% from the $50 billion of hotel transactions in 2015, which represented a peak for the current cycle. Deal activity was put off during the first quarter of 2016, as investors and lenders reacted to the stock market correction. The Dow declined by over 8% in early January 2016 and did not fully recover until April. Transaction activity was down 60% and 43% year-over-year for the first two quarters, respectively, and then rebounded strongly in the third quarter of the year. Despite slowing RevPAR and net income growth, capital in search of yield and a safe haven continues to be attracted to the lodging industry. Hotel values continued to rise modestly in most markets over the course of the year, despite the rise in capitalization rates, due to continued RevPAR and NOI gains.

The average price per key derived from total sales volume declined by 8% from $156,000 to $144,000, due primarily to the profile and locational mix of assets that transacted. A smaller number of large, full- service hotels were sold during the year, affecting overall volume and average price per key. In addition, fewer hotels were sold in the major metro markets, while investors turned to secondary and tertiary markets such as Atlanta, Dallas/Ft. Worth, Phoenix/Scottsdale, Austin, San Antonio, Birmingham, Chattanooga, among others, in search of more affordable, value-add opportunities.

Major hotel sales, defined as those that sold for a price of $10 million and over, declined by 28%, and the average PPK declined by 9%, from $244,000 to $222,000 per room. The price-per-key trends should not be viewed as the value declines, as average sales price per key are greatly affected by the composition of assets sold.

2016 Hotel Sales Transactions $2.5+ and $10.0 + Million

Source: Real Capital Analytics (RCA)

Source: Real Capital Analytics (RCA)

Sales volume of assets priced at $10 million and under (not illustrated here) declined by 38%, more than the volume of larger transactions, reflecting concerns about new supply and a tougher financing environment. Average price per key increased 4% from $52,000 to $54,000. A widening gap between buyer and seller expectations, coupled with stricter lender underwriting, caused market participants to sit on the sidelines at the lower end of the market.

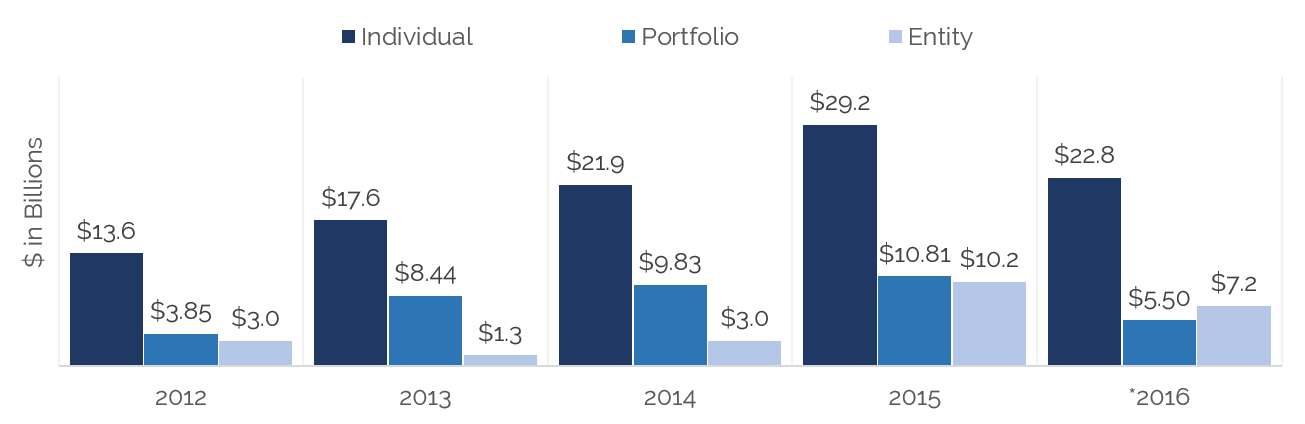

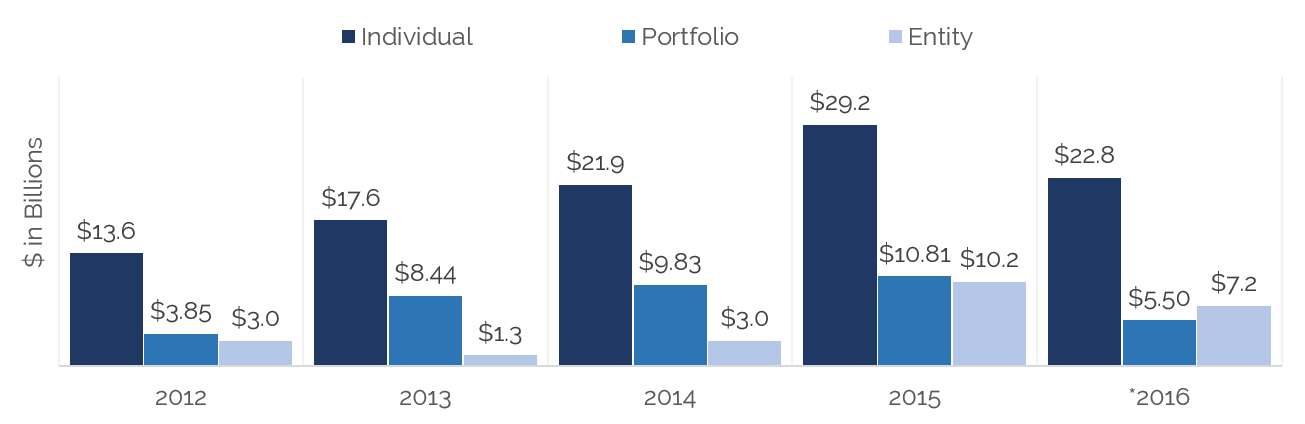

Both portfolio- and entity-level transaction volume declined by 38%, but continued to represent a significant portion of activity. Major portfolio and entity transactions during the past year included Blackstone’s sale of 15 hotels to Anbang Insurance Group Co. for $5.5 billion, and China Life’s $2-billion investment in Starwood Capital’s select-service hotel portfolio, representing 16% and 6% of total annual volume, respectively. Casino hotel activity increased, representing 6% of the year’s total volume. While 2015 was the peak of the current cycle, the total transaction volume of $80 billion in 2007 remains the historical peak for our industry. When an entity such as Starwood transacts, RCA reports only the allocated real estate values, not the intangible franchise and management businesses. Of the $13-billion Marriott acquisition of Starwood, $1.2 billion was attributable to real estate involving seven assets included in the total volume for 2016.

Both portfolio- and entity-level transaction volume declined by 38%, but continued to represent a significant portion of activity. Major portfolio and entity transactions during the past year included Blackstone’s sale of 15 hotels to Anbang Insurance Group Co. for $5.5 billion, and China Life’s $2-billion investment in Starwood Capital’s select-service hotel portfolio, representing 16% and 6% of total annual volume, respectively. Casino hotel activity increased, representing 6% of the year’s total volume. While 2015 was the peak of the current cycle, the total transaction volume of $80 billion in 2007 remains the historical peak for our industry. When an entity such as Starwood transacts, RCA reports only the allocated real estate values, not the intangible franchise and management businesses. Of the $13-billion Marriott acquisition of Starwood, $1.2 billion was attributable to real estate involving seven assets included in the total volume for 2016.

2016 Hotel Sales Volume: Individual Asset, Portfolio, and Entity Source: Real Capital Analytics (RCA)

Source: Real Capital Analytics (RCA)

Source: Real Capital Analytics (RCA)

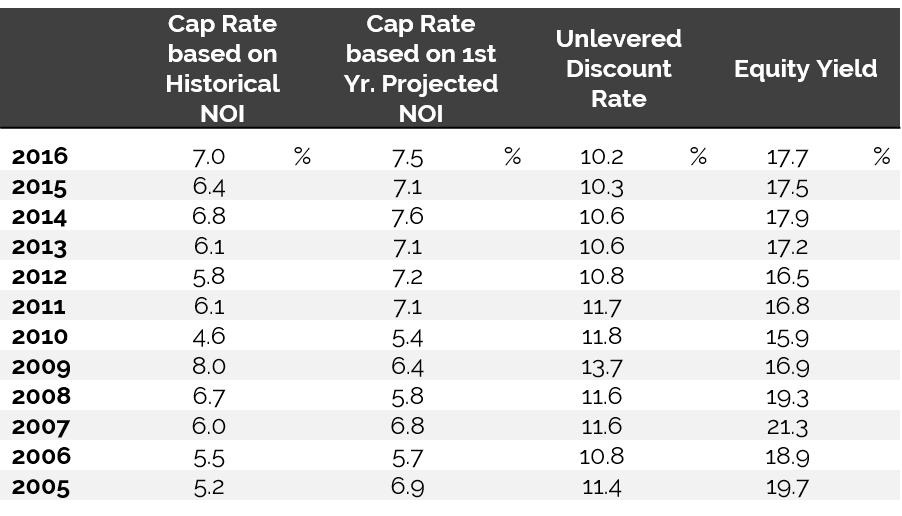

Source: Real Capital Analytics (RCA)According to HVS data derived from hotels appraised at the time of sale, overall capitalization rates based on historical net operating income (NOI) rose over the course of 2016, and now average 7% for full-service hotels based on historical NOI. We note that these are averages, and rates of return can vary signficantly for individual assets.

Full-Service Capitalization and Discount Rates Derived from Sales Transactions

Source: HVS

This same data are reflected in the following chart. Capitalization rates based on historic NOI remained above going-in capitalization rates based on projected first-year net income, but the gap between historical and going-in cap rates narrowed, reflecting the market’s anticipation of slowing RevPAR and NOI growth. Similarly, the differential between discount and capitalization rates has narrowed because of lower growth expecatations. Following RevPAR growth of 8.2% and 6.2% in 2014 and 2015, respectively, RevPAR growth slowed to an estimated 3.2% in 2016. Further slowing of RevPAR growth has been anticipated; however, given recent revised economic forecasts, the outlook may improve. Most hotel assets have continued to experience above-inflationary, year-over-year NOI increases, but we are likely to see more hotels with flattening and, in some cases, declining NOI in 2017.

Full-Service Capitalization and Discount Rates Derived from Sales Transactions

Source: HVS

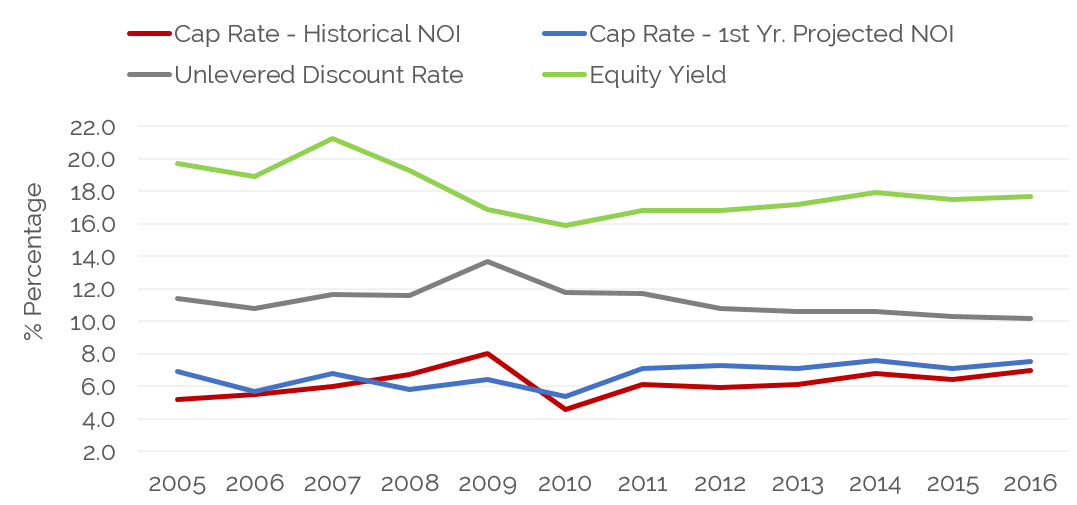

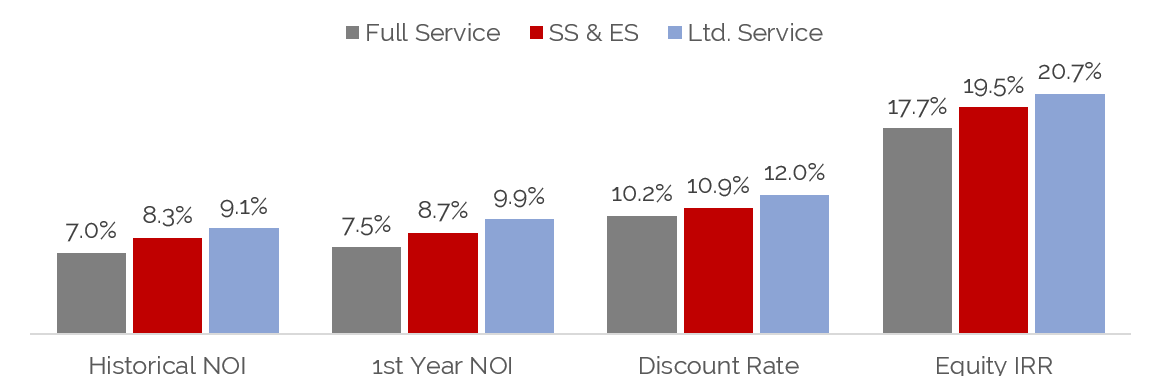

Cap rate data based on historical NOI, captured by HVS for full-service, select-service/extended-stay, and limited-service hotels over the past six years, are presented below. Select-service and extended- stay hotels reflect the branded, upscale STR chain scale, while limited-service hotels reflect the midscale and economy chain scales. Cap rates for full-service hotels rose 60 bps, while select- service/extended-stay rates increased 10 bps. Limited-service hotel cap rates remained stable. RCA reports that cap rates rose 10 bps (from 9.1% to 9.2%) for limited-service hotels in 2016, and 40 bps (from 7.6% to 8.0%) for full-service hotels in 2016. Note that RCA includes select-service hotels that serve food and beverage in their full-service hotel category.

Comparative Average Cap Rates Derived from Sales Based on Historical NOI

Source: HVS

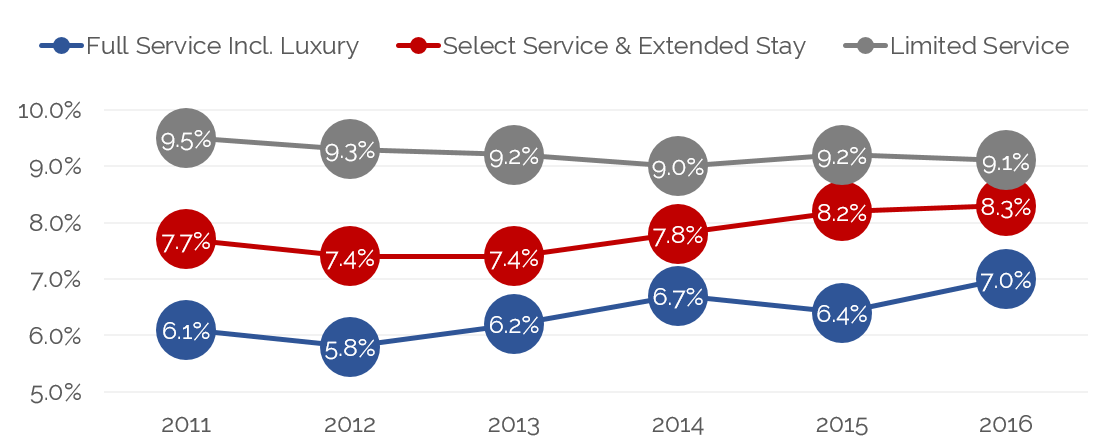

We caution that the derived capitalization rate data are dependent upon the individual sales transactions that comprise the data. The wide range in cap rates that comprise the HVS data averages is evidenced in the chart below. Individual sales transactions can affect the cap rate range and average.

Capitalization Rates Derived from Sales Transactions – Historical NOI

Source: HVS

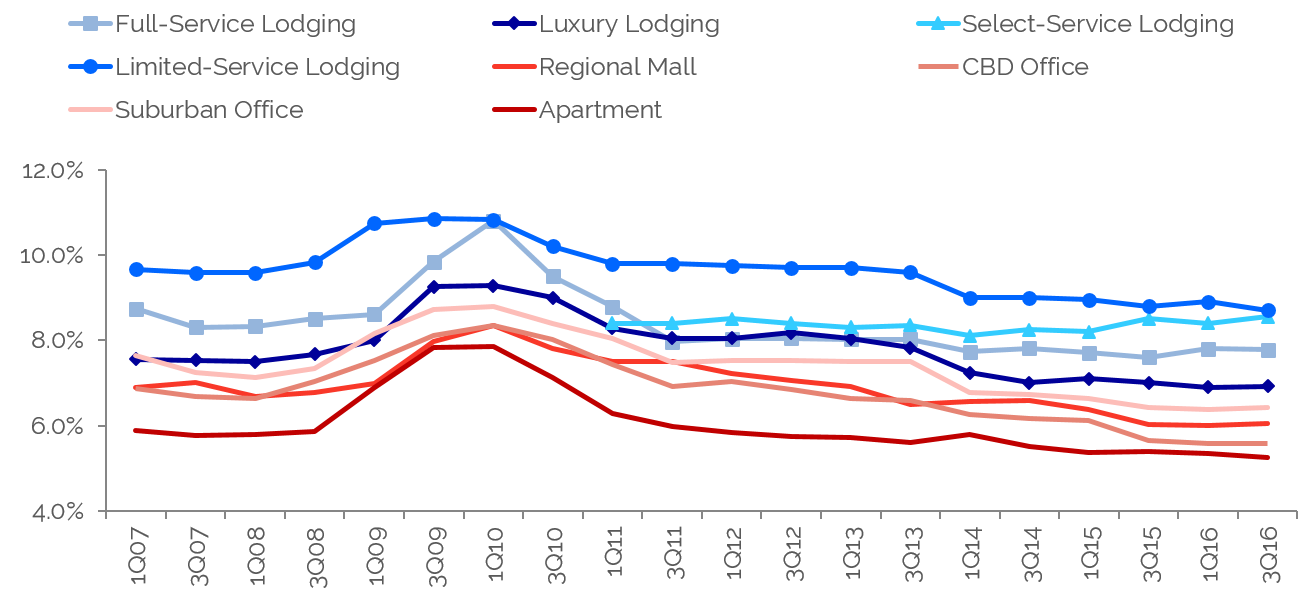

The following chart illustrates capitalization rates for the four hotel product types set forth the in the PWC Real Estate Investor Survey, which reports hotel rates of return based on surveys of investors the first and third quarter of each year. Cap rate trends for other forms of commercial real estate are set forth for comparison. While the survey rates generally support the trends evidenced by sales transactions, we note that a disconnect remains between cap rates for the luxury product category based on what investors say they want to yield (survey data) and the rates of return derived from actual transactions. The PWC survey reports luxury hotel cap rates at 7.0% in 2016, while luxury transactions reflect cap rates in the mid-4% to mid-6% range.

Hotels continue to retain their premium over other types of commercial real estate, as reflected by the hotel capitalization rates that occupy the top four lines in this chart. The premium pricing associated with luxury hotel assets relative to select-service/extended-stay and full-service hotels that returned in 2014 has been sustained, while capitalization rates for select-service/extended-stay hotels has been rising over the past two years, which we attribute to concern regarding supply increases. Despite the lower rates of appreciation anticipated for hotels in the near term, and the volatility of these assets, capital looking for yield continues to be drawn to our industry.

Hotels continue to retain their premium over other types of commercial real estate, as reflected by the hotel capitalization rates that occupy the top four lines in this chart. The premium pricing associated with luxury hotel assets relative to select-service/extended-stay and full-service hotels that returned in 2014 has been sustained, while capitalization rates for select-service/extended-stay hotels has been rising over the past two years, which we attribute to concern regarding supply increases. Despite the lower rates of appreciation anticipated for hotels in the near term, and the volatility of these assets, capital looking for yield continues to be drawn to our industry.

PWC Real Estate Investor Survey – Hotel Capitalization Rates

Source: HVS

Source: HVS

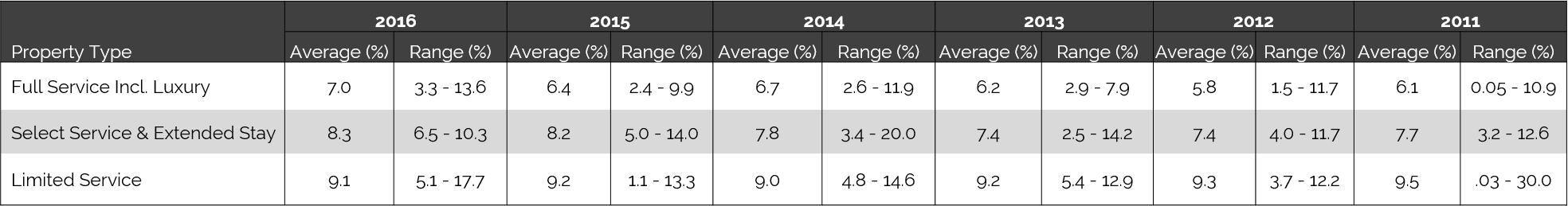

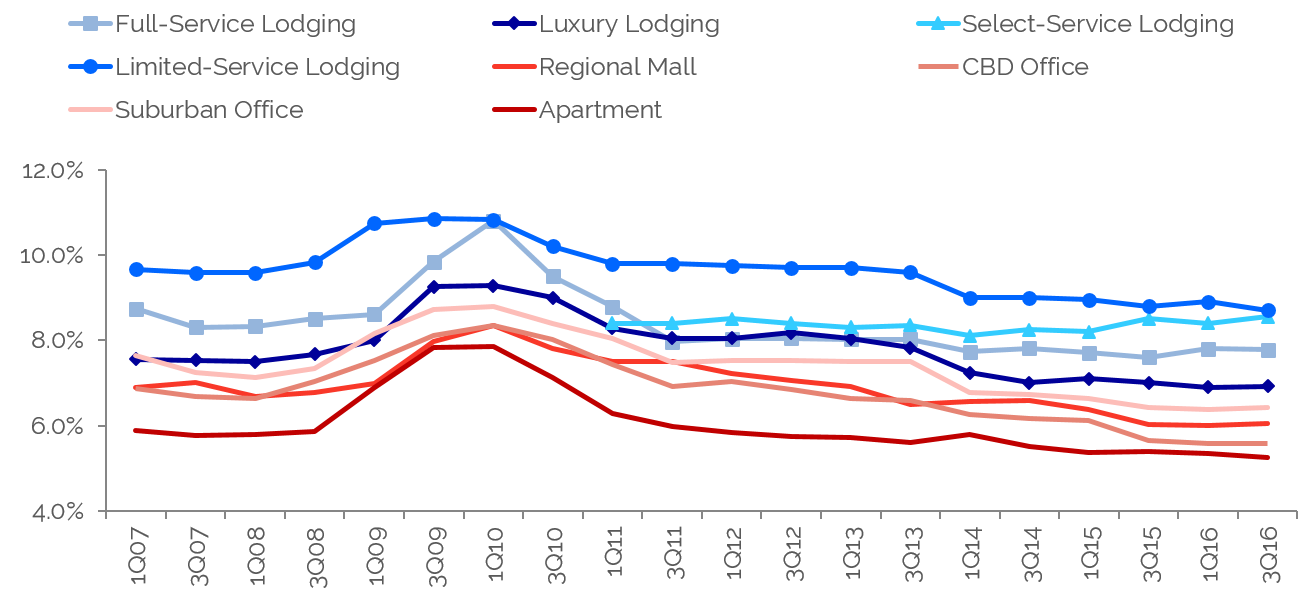

The following chart, which sets forth capitalization rates and internal rate of returns (IRRs) by product segment for 2016, reflects the step-up in rates of return from the full-service to select-service/extended- stay and limited-service sectors. “Going-in” capitalization rates, derived from projected first-year NOI divided by the purchase price, range from 40 to 80 bps above cap rates derived based on historical NOI, reflecting the expectation of future increases in NOI by investors. We note that the spread between historical NOI cap rates and “going-in” first year NOI cap rates has contracted, reflecting the expecation that NOI gains will be more modest going forward. Free-and-clear, unlevered discount rates have declined modestly across the board, and the gap between cap rates and discount rates has declined as cap rates have risen, reflecting the expectation of lower NOI gains going forward. Equity IRRs remained stable from 2015 to 2016.

Average Rates of Return Derived from 2016 Sales Transactions1

Source: HVS

The cost of capital is one of the primary driver of cap rate trends. With unemployment below 5% and inflation under control for the time being, the Federal Reserve has announced plans to raise interest three times in 2017. Fed representatives indicate that government economic policy is expected to take over the reins for driving growth, allowing the Fed to focus on a more sustainable monetary policy. The federal funds rate increased twice over the course of 2016, now standing at 0.75%. The decline in the U.S. equity markets in January 2016 led to a significant increase in spreads, which resulted in low CMBS origination volume from January until April. The CMBS market remained challenged in the second quarter of the year, as deals were repriced and became more difficult to close. While the market recovered in the second half of the year, CMBS volume is projected to have ended in the $65–$70 billion range, down by 30% from 2015 levels. With interest rates trending higher, and the added cost and complexity of the new risk retention rules, the expectation is that CMBS issuance in 2017 will remain at 2016 levels or rise modestly.

At the current time, industry prognosticators remain cautious about our industry; modest NOI gains could be offset by rising interest rates, resulting in little to no asset appreciation. Hotels remain a market-by- market, asset-by-asset investment, and the specifics of each property matter now more than ever. Over the last few years, the rising tide of strong RevPAR growth coupled with a low cost of capital has lifted all boats; that dynamic is no longer in place. Market- and property-specific factors, such as increasing labor costs, micro-market demand contractions, new additions to supply, and property tax reassessments can result in net income declines when RevPAR growth is not sufficient to be offsetting.

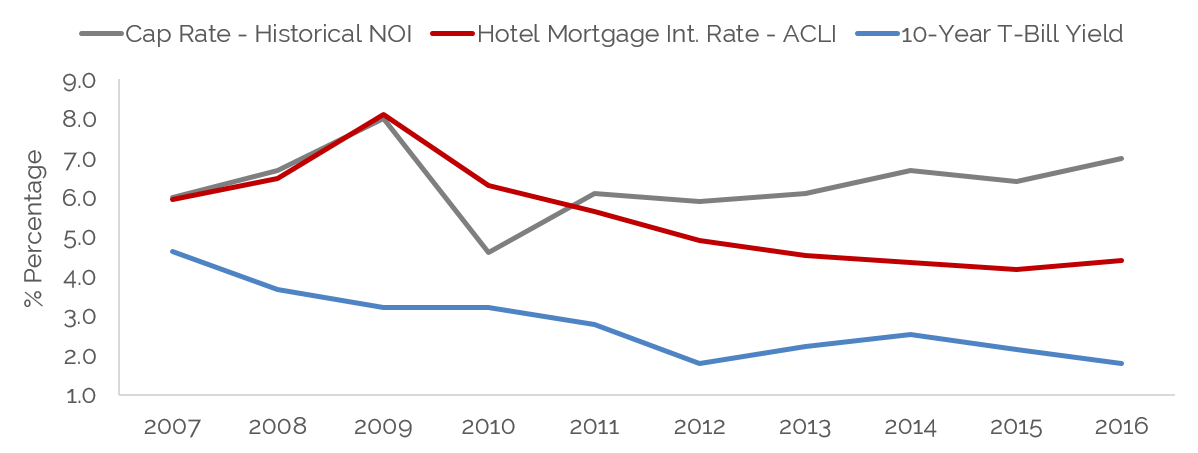

The following chart sets forth the derived capitalization rates for full-service hotels (green line), compared to the yield on the ten-year treasury and hotel mortage interest rates as reported by the American Council of Life Insurers. Cap rates, which reflect a weighted cost of capital, currently well exceed the cost of debt, allowing for an equity cushion over debt service. Cap rate and hotel mortgage interest spreads over the ten-year T-bill yield have widened over the past two years, reflecting a prudent posture by industry participants. The widened spreads are expected to provide some ability to counter the increase in interest rates that the Fed has promised for 2017. The ten-year T-bill yield has already risen by 80 bps, from 1.56 in the third quarter of 2016 to 2.36 as of January 12, 2017. If the stock market rebound holds, and hotel performance improves, lenders may reduce the premium over the T-bill yield, moderating interest rate increases.

At the current time, industry prognosticators remain cautious about our industry; modest NOI gains could be offset by rising interest rates, resulting in little to no asset appreciation. Hotels remain a market-by- market, asset-by-asset investment, and the specifics of each property matter now more than ever. Over the last few years, the rising tide of strong RevPAR growth coupled with a low cost of capital has lifted all boats; that dynamic is no longer in place. Market- and property-specific factors, such as increasing labor costs, micro-market demand contractions, new additions to supply, and property tax reassessments can result in net income declines when RevPAR growth is not sufficient to be offsetting.

The following chart sets forth the derived capitalization rates for full-service hotels (green line), compared to the yield on the ten-year treasury and hotel mortage interest rates as reported by the American Council of Life Insurers. Cap rates, which reflect a weighted cost of capital, currently well exceed the cost of debt, allowing for an equity cushion over debt service. Cap rate and hotel mortgage interest spreads over the ten-year T-bill yield have widened over the past two years, reflecting a prudent posture by industry participants. The widened spreads are expected to provide some ability to counter the increase in interest rates that the Fed has promised for 2017. The ten-year T-bill yield has already risen by 80 bps, from 1.56 in the third quarter of 2016 to 2.36 as of January 12, 2017. If the stock market rebound holds, and hotel performance improves, lenders may reduce the premium over the T-bill yield, moderating interest rate increases.

Hotel Capitalization Rate and Mortgage Interest Rate Trends

Source: HVS

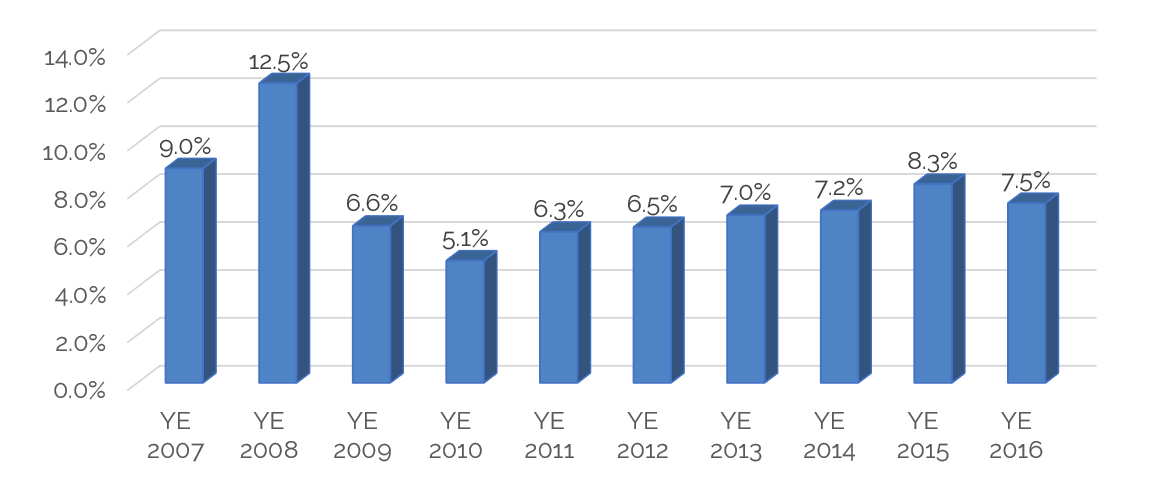

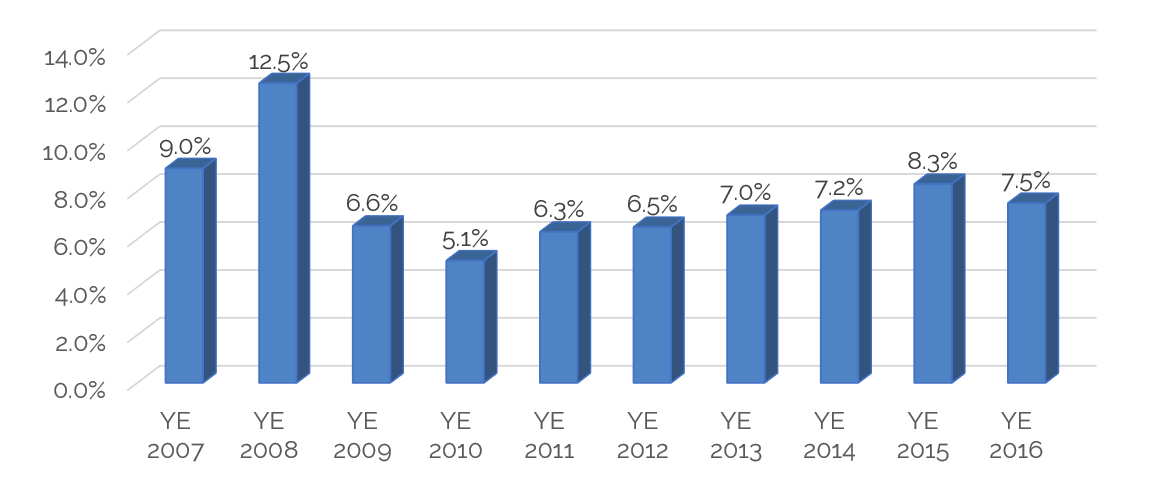

The stock market is generally viewed as a leading indicator, and capitalization rates derived from publicly traded REITs can provide insight into future trends. The following chart illustrates average historical implied REIT cap rates derived from investment banker bulletins, calculated as EBITDA divided by enterprise value (equity value plus debt) as of the calendar year’s end. Implied REIT capitalization rates have been trending up gradually over the past five years, as increases in earnings have moderated. The stock market correction in January, prompted by concerns of potential recession, caused cap rates to surge at the end of 2015, peaking at 9.0% in January 2016. This market uncertainty caused the CMBS and transaction markets to stall in the first quarter of 2016.

Capitalization Rates Derived from Select Lodging REIT Data

Source: Investment Banker Bulletins / HVS

Source: Investment Banker Bulletins / HVS

The anticipation of stronger economic growth that has fueled the stock market surge is not likely to be realized until later in the year, if then, and there is uncertainty regarding the impact of the Trump adminstration’s policies. However, on Monday, January 16, 2017, the International Monetary Fund announced that it had increased its GDP projections for the U.S. to 2.3% for 2017 and 2.5% for 2018; this compares with actual growth of 2.6% in 2015, and estimated growth of 1.6% for 2016. Economic growth fuels hotel demand, so the current soft landing may transition to another leg for this cycle. Stronger pricing for hotel REITs, the spin-off of the Park REIT from Hilton, and potential REIT consolidation are expected to stimulate investment activity by this sector. The data reflect that the public market is viewing lodging REITs more positively than a year ago. REITs are in a good position to acquire assets given their cash raised from divestitures and ability to raise public equity.

Greater activity by US hotel REITs and continued interest in hotel investments by off-shore capital will result in competitive pressures that should help to offset interest rate increases for quality hotels at the upper end of the spectrum. In addition, expectations of greater RevPAR and NOI growth will place downward pressure on cap rates. New supply, substantial PIP requirements, and stricter lender underwriting will affect transaction activity at the lower end of the market, as investors under no duress to buy or sell may decide to stand aside. Limited-service and select-service hotels in markets with low barriers to entry will likely be the most affected. Older, suburban, full-service hotels, particularly those encumbered with brand management agreements, will continue to be difficult to transact. Looking beyond 2017, the new supply pipeline will eventually slow due to the increasing difficulty of obtaining construction financing. In addition, the new adminstration’s policies may ultimately fuel stronger economic growth, particularly in those secondary and tertiary markets where hotel asset values have not fully recovered from the last recession. Moreover, stronger economic growth is likely to lead to higher inflation, one of the factors that attracts capital to the hotel industry.

Greater activity by US hotel REITs and continued interest in hotel investments by off-shore capital will result in competitive pressures that should help to offset interest rate increases for quality hotels at the upper end of the spectrum. In addition, expectations of greater RevPAR and NOI growth will place downward pressure on cap rates. New supply, substantial PIP requirements, and stricter lender underwriting will affect transaction activity at the lower end of the market, as investors under no duress to buy or sell may decide to stand aside. Limited-service and select-service hotels in markets with low barriers to entry will likely be the most affected. Older, suburban, full-service hotels, particularly those encumbered with brand management agreements, will continue to be difficult to transact. Looking beyond 2017, the new supply pipeline will eventually slow due to the increasing difficulty of obtaining construction financing. In addition, the new adminstration’s policies may ultimately fuel stronger economic growth, particularly in those secondary and tertiary markets where hotel asset values have not fully recovered from the last recession. Moreover, stronger economic growth is likely to lead to higher inflation, one of the factors that attracts capital to the hotel industry.

Outlook for 2017

The hotel industry is currently in flux, and the outlook is uncertain but cautiously opimistic. Weighing the opportunities and challenges facing our industry in the year ahead, we anticipate that overall transaction volume will duplicate the levels reached in 2016. Given the slowing of RevPAR growth and anticipated increases in interest rates, we expect to see modest value gains in 2017 for quality assets in markets with strong underlying fundamentals. Hotels facing major PIPs, impact from new supply, and other challenging asset issues may face value declines. As always, the value of a given hotel can only be measured by an evaluation of the specific property and market factors affecting the asset.

Suzanne R. Mellen, MAI, CRE, FRICS, ISHC is a Senior Managing Director, based in San Francisco, California. She has been evaluating hotels and other hospitality real estate assets for 40 years, has authored numerous articles, and is a frequent lecturer and expert witness on the valuation of hotels and related issues. Ms. Mellen has a BS degree in Hotel Administration from Cornell University and holds the following designations: MAI (Appraisal Institute), CRE (Counselor of Real Estate), ISHC (International Society of Hospitality Consultants) and FRICS (Fellow of the Royal Institution of Chartered Surveyors). Contact Suzanne at +1 (415) 268-0351 or [email protected].

0 Comments

Success

It will be displayed once approved by an administrator.

Thank you.

Error