The energy boom in North Dakota has infused parts of the state with economic growth in the form of employment, production, and real estate development, both commercial and residential. The region’s hotel industry has transformed in turn, with new properties under development and many existing hotels realizing new peaks in performance as energy-related demand rolls in. The following market intelligence report examines the effects on North Dakota’s lodging hotspots, with a focus on the capital city of Bismarck.

North Dakota Oil Market Update

North Dakota has been through booms before. The first was in the 1960s, a decade after oil was discovered in the area. Skyrocketing oil prices brought another boom in the 1970s, then again in the 1980s. Brief lulls interspersed these booms, but by the late 1990s, there were no new wells in the state. A bust was inevitable and lasted for years until, in 2005, oil drilling and exploration resumed. In 2008, an oil and gas boom recommenced, primarily driven by more cost-efficient technology.

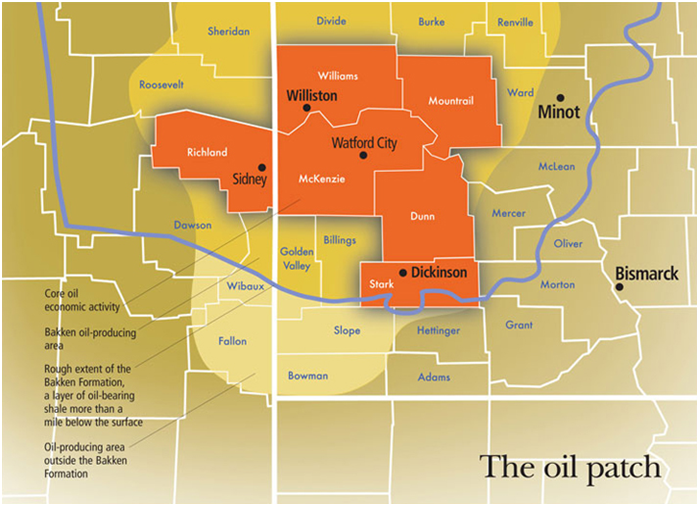

The Bakken Formation occupies approximately 200,000 square miles of the subsurface of the Williston Basin, covering parts of North Dakota, Montana, and Saskatchewan. According to the latest 2013 U.S. Geological Survey (USGS), the formation contains up to 7.4 billion barrels of recoverable oil. The USGS recently doubled its 2008 estimate, partly because of improved drilling technology and knowledge in the area. The breadth of the Bakken Formation is illustrated in the map below.

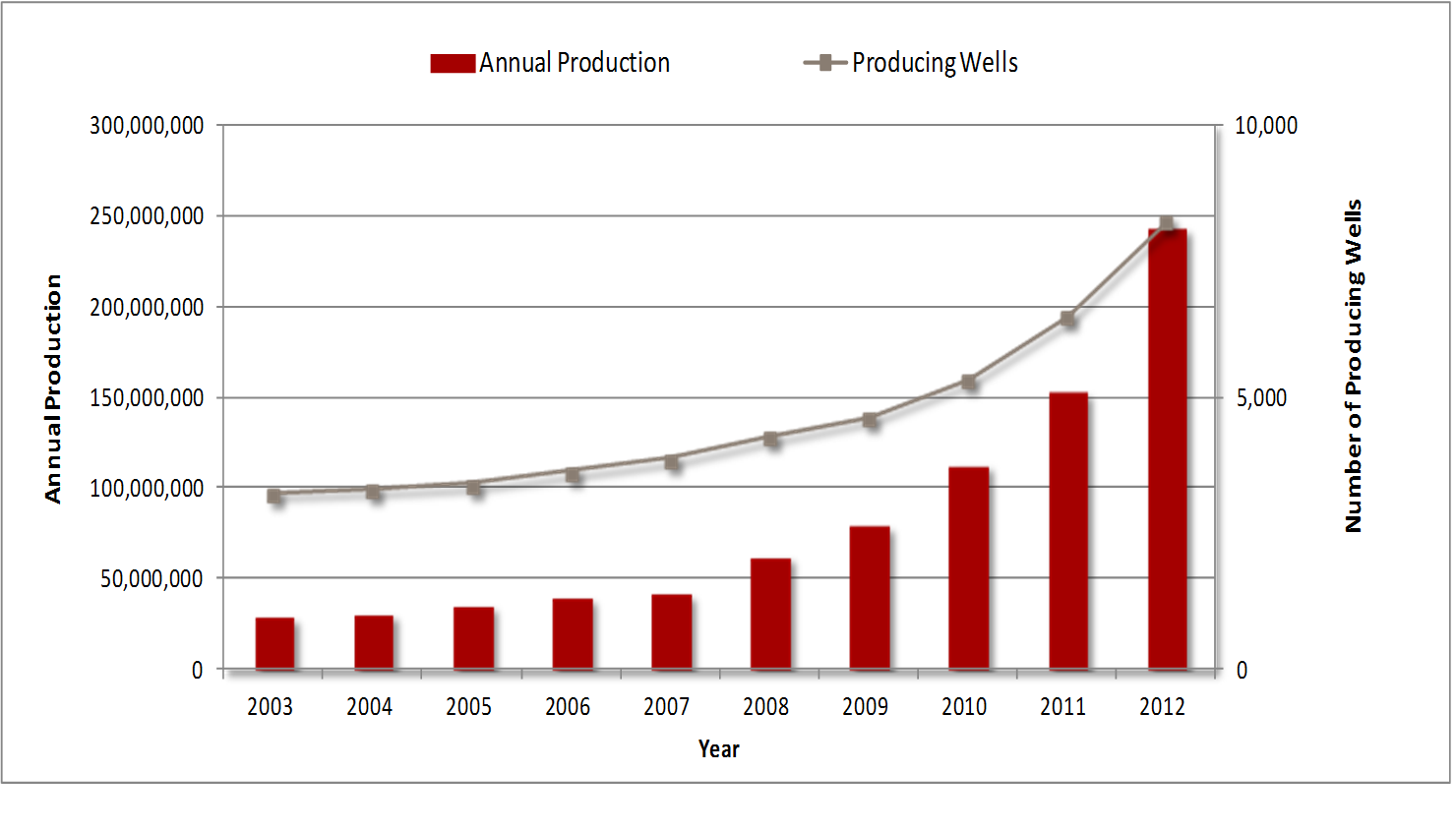

The following graph and table illustrate the increased activity in the region.

In 2011, a representative at Continental Resources, Inc. stated that ultimate oil recovery from the Bakken Formation is now estimated at 24 billion barrels. The combined use of horizontal drilling, hydraulic fracturing, and a large number of wells has made the increase in recoverable oil possible.2

In July of 2012, North Dakota became one of the top oil-producing regions in the country, just behind Texas and the Federal Offshore area. By the end of 2012, oil production reached record levels that surpassed the capacity to ship oil out of the Bakken. According to most predictions, another 30,000 to 35,000 producing wells are expected to be drilled over the next two decades.

The unprecedented rate of energy exploration and production is creating demand for more infrastructure to serve the oil wells and their workers, process oil and gas, and transport production to the rest of the country. Projects currently underway include a number of additions and upgrades to gas and electric infrastructure, the development of at least three refineries, and the expansion of industrial parks and rail yards.

Economy Update

Increased activity in the energy sector has created demand for qualified labor, housing, services, retail, and lodging. As a result, North Dakota has been the only state where unemployment rates, economic growth, and government budgets have shown recent and consistently positive trends. The state now accounts for 11% of U.S. oil production, and the state government currently has an approximately $3.8-billion surplus.

While Williston, Watford City, and Dickinson sit in the epicenter of the region’s petroleum industry, Bismarck has become a bedroom community for the oil, professional services, and construction industries’ managers and their families.

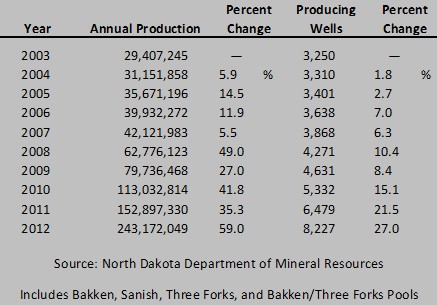

The following table sets forth Burleigh County’s workforce distribution by business sector in 2000, 2010, and 2013, as well as a forecast for 2020.

From 2000 to 2010, total employment grew at an average annual rate of 2.1% for the county and 1.7% for the MSA, a trend that strongly outpaced the national average. Total employment has increased 1.3% in the county and 1.2% in the MSA on an annual average from 2010 to the current year, reflecting the continuous growth within both the county and the MSA. Total employment in Burleigh County and the Bismarck-Mandan MSA is anticipated to grow by 1.7% and 1.6%, respectively, on average annually through 2020. This trend is expected to continue to outpace the rate of growth for the U.S. as a whole during the same period.

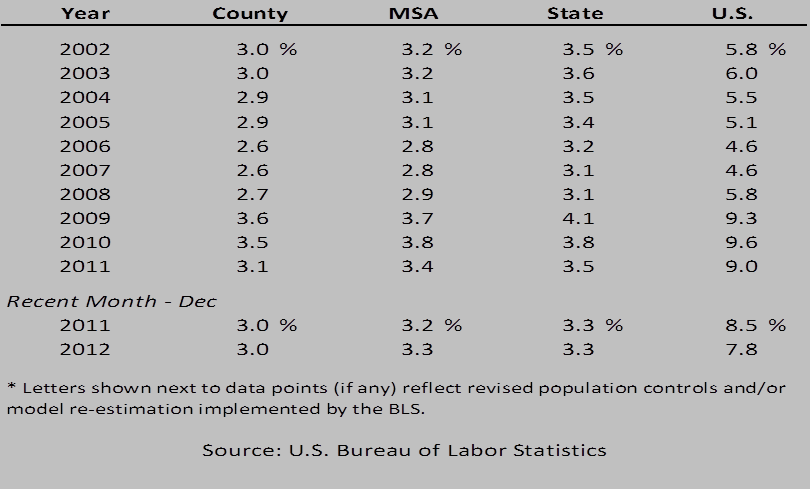

The following table illustrates unemployment statistics for Burleigh County, the Bismarck-Mandan MSA, the state of North Dakota, and the U.S. from 2002 through 2011.

UNEMPLOYMENT STATISTICS

Unemployment levels in this area have stayed well below those of the nation since 2002, largely owing to the presence of the state government in Bismarck, as well as major trade and medical industries and consistent hiring associated with the education sector. As the oil boom continues, city officials expect job growth to maintain pace, helping to secure a strong employment levels in the near future.

Healthcare, government, power and utility, agriculture, higher-education, retail, and professional services industries in the area represent the primary sources of demand for this market. The government also provides a significant and stable source of employment and hotel demand; legislative sessions occur every odd year and last approximately four months. In addition, a number of regional and state associations hold meetings and events in Bismarck. American Indian events and summits also provide a stable source of revenue and demand for local hotels.

Energy-related activity has extended as far as Bismarck and the Northern Plains Commerce Centre (NPCC), an industrial park with immediate access to road and rail transport. In 2012, Bobcat and partner Menlo Worldwide Logistics (MWL) announced the relocation and expansion of its compact attachment production facilities. Bobcat will also expand and renovate its former facility at the NPCC into an Innovation Center, which should be completed in 2014. Seven additional businesses have decided to buy or lease land at the NPCC, which will generate more jobs and bring additional revenue to the city over the long term.

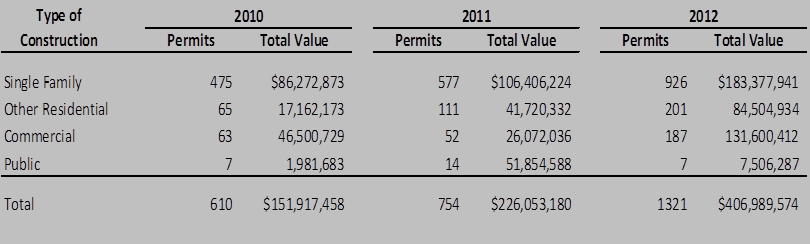

Bismarck and Mandan commercial, residential, and retail development activity continues to increase, as illustrated in the chart below.

NEW CONSTRUCTION ACTIVITY SUMMARY3

While oil and gas production has been the most energetic driver of economic growth in the Bismarck-Mandan area for the past several years, healthcare, government, agriculture, and higher education have proven stable industries that are expected to grow consistently in the near future. A growing population has led to expansions in the retail and services industries, as well as residential and commercial building permits. The University of Mary, Bismarck State College, and the United Tribes Technical College have also announced expansion plans. Improvements to Bismarck’s infrastructure are underway to accommodate this growth.

Hotel Supply and Construction Update

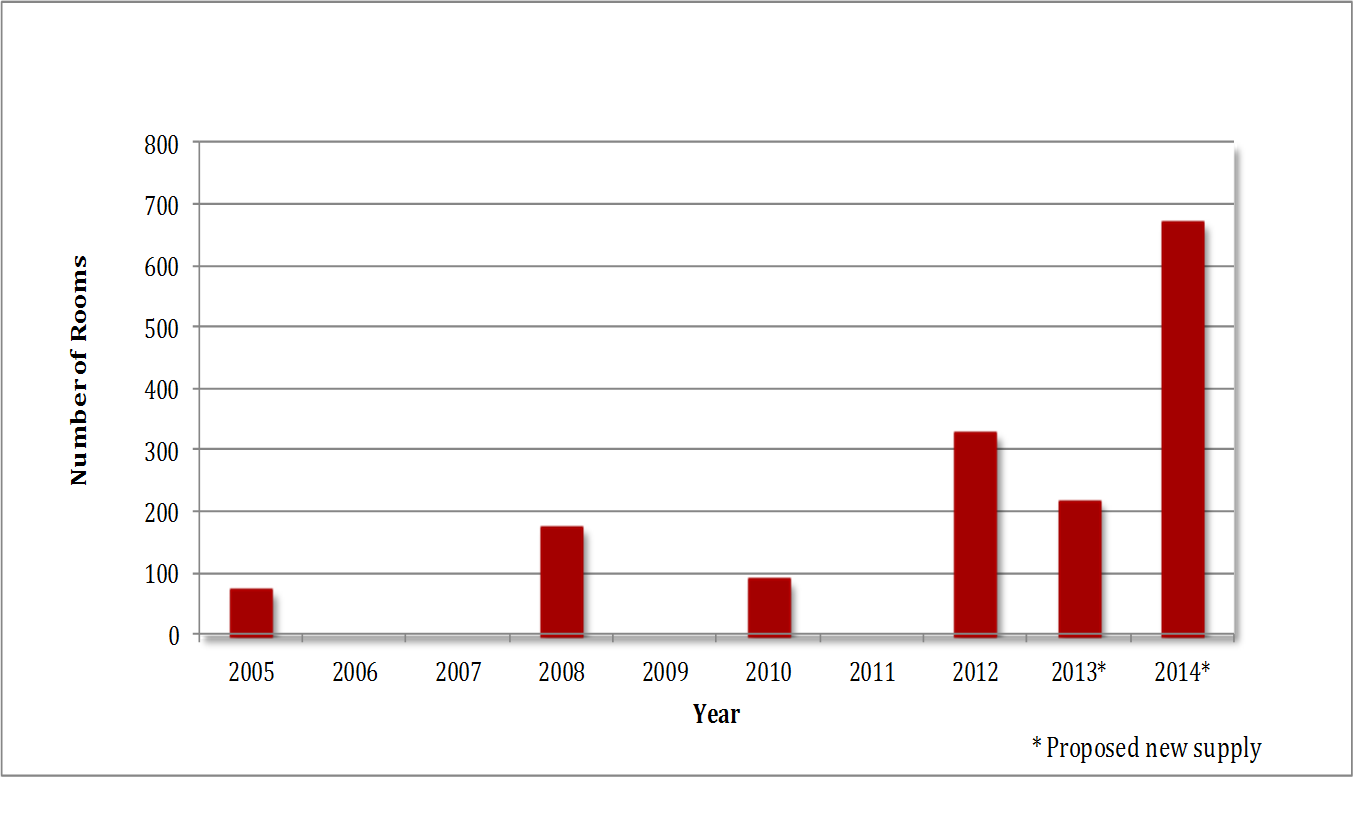

The Bismarck-Mandan area currently includes 33 lodging facilities encompassing 2,986 available rooms. Bismarck in particular has realized an increase of new supply in the last year, as illustrated in the following chart.

NEW SUPPLY—BISMARCK-MANDAN MSA

According to HVS research, four new hotels opened in 2012, adding 329 rooms to the market. One hotel, the 64-unit extended-stay My Place, opened on March 22, 2013. The following eight hotels are currently in the pipeline:

• Wingate by Wyndham (84 rooms)- expected to open in May of 2013

• Super 8 (70 rooms) – expected to open in June of 2013

• Holiday Inn (100 rooms) – expected to open in March of 2014

• Comfort Inn Mandan (86 rooms) – expected to open in June of 2014

• UTTC Hotel (160 rooms) – expected to open in July of 2014

• Hampton Inn & Suites (98 rooms)- expected to open in August of 2013

• Courtyard by Marriott (100 rooms) – expected to open in September of 2014

• Hilton Garden Inn (123 rooms) – expected to open in December of 2014

In November of 2012, the City of Bismarck placed a $90-million expansion of the Bismarck Civic Center on the election ballot; at that time, the City was also pursuing a 250-room full-service hotel to be located adjacent to the center. The project was not approved and the two hotel developers interested in the project withdrew their applications. As of April 2013, a downsized $27-million expansion plan has been approved; however, the City is debating expansion options after receiving an unofficial offer of land for an event center in the southeastern part of Bismarck. The inclusion of the full-service hotel in the project plans is not definite at this point.

Outlook on Market Occupancy and Average Rate

In 2010, demand spillover from Williston, Dickinson, Minot, and other cities in the Bakken Formation pushed lodgers into the Bismarck-Mandan area. In 2011, the Missouri River flooded the area, creating more demand from FEMA representatives, insurance adjusters, and displaced residents; the flood forced the evacuation of nearly 900 homes in Burleigh and Morton Counties. According to area representatives, the surge in room-night demand persisted for approximately eight months after the flood.

Data for 2012 illustrate a modest decrease in occupancy, though the addition of new supply allowed for a push in average rate. This trend suggests the market's supply growth is slightly outpacing demand, which was also confirmed by HVS market interviews, with area managers reporting decreases in the number of sold-out room nights during the week.

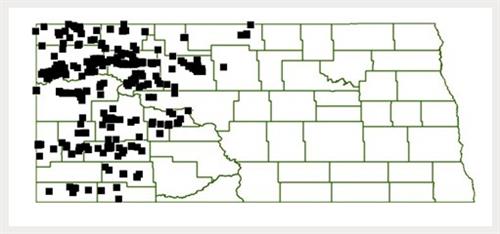

In August of 2012, the State of North Dakota began a project to map lodging locations of workers in the western part of the state. North Dakota has realized an increase in the number of lodging establishments being created in conjunction with the energy boom. The proliferation of workforce lodging establishments, which include crew camps, motels, hotels, RV parks, mobile home parks, and campgrounds, along with the new residential developments, is expected to ease unaccommodated demand. As a result, occupancy levels will likely stabilize and create a more competitive environment for local hotels in cities, including Bismarck, across the energy-driven parts of the state.

The following graphic illustrates the condensation of lodging establishments for energy workforces in western North Dakota.

WORKFORCE LODGING* LOCATIONS - 20124

* Crew camps are modular structures, new and used, constructed with the intention of providing temporary workforce housing over a period of time.

Recent Hotel Transactions

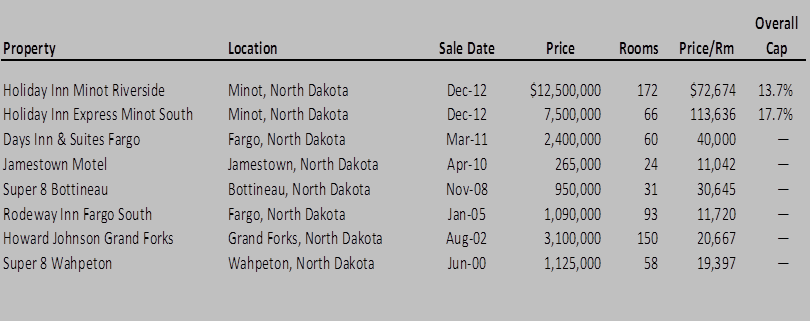

The following table summarizes hotel transactions in North Dakota over the past two years.

REVIEW OF HOTEL TRANSACTIONS

The number of transactions in North Dakota since 2000 has been minimal. HVS research revealed at least 15 lodging facilities for sale in North Dakota at asking prices ranging from $479,000 to $15,900,000.

Conclusion

Some experts expect activity across the Bakken Formation to continue for at least the next decade; others say it might last for 100 years. Nevertheless, price volatility, discoveries in other parts of the country, or changes in energy regulations could disrupt the potential for such continued, high levels of economic growth. In addition, the furious pace of housing and lodging starts could negatively affect hotel performance fundamentals in Bismarck and surrounding markets should supply outpace demand.

The uncertainty surrounding the energy industry and its past patterns of growth and decline create a number of challenges for new hotel developments. New hotel construction concepts that trim development timelines to 90 days (for example, the Shut Eye Hotel in Alexander, North Dakota) and developments of economy and/or midscale extended-stay hotels that can be turned into apartments are taking into account the potential for a downturn. Expert, focused advice can assist developers, hoteliers, and investors in envisioning projects in Bismarck and other North Dakota markets that can maximize profitability during and following the boom years.

___________________________

1 The Federal Reserve Bank of Minneapolis. The Bakken area. Detailed map of the oil patch in the Ninth District.

2 Oil & Gas Journal. February 16, 2011: http://www.ogj.com/articles/2011/02/continental--bakken.html

3 Bismarck-Mandan ND MSA 2012 Annual Economy at a Glance. Bismarck-Mandan Development Association.

4 Workforce Lodging Study. North Dakota Department of Health.