Lisbon, the capital of Portugal, stands as one of Europe’s most ancient cities, set within a metropolitan area that is home to around 3 million people. Celebrated for its rich cultural heritage, striking architecture, and bustling business scene, the city offers an array of attractions. To the west lies the Estoril coast, including Estoril, Cascais and the historic gem of Sintra, all teeming with leisure and recreational opportunities.

Source: HVS Research

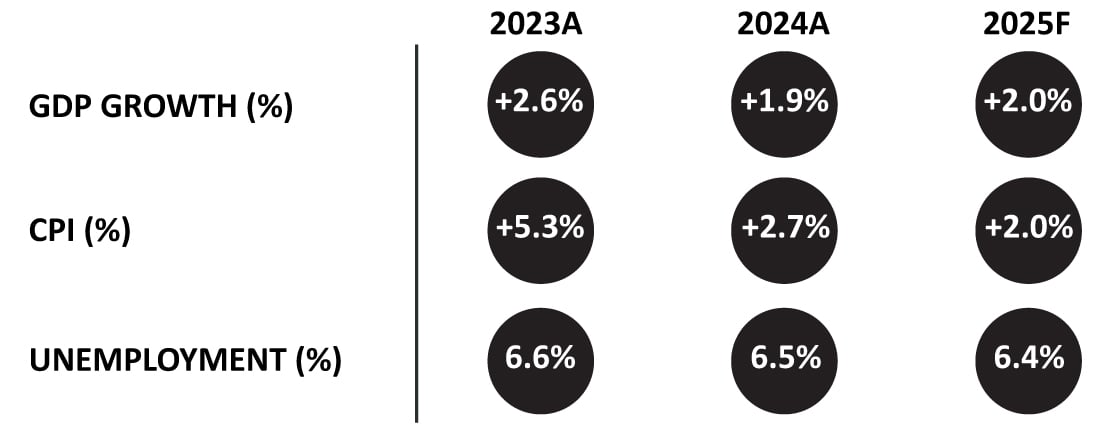

Economic Indicators – Portugal

Source: International Monetary Fund (IMF), April 2025

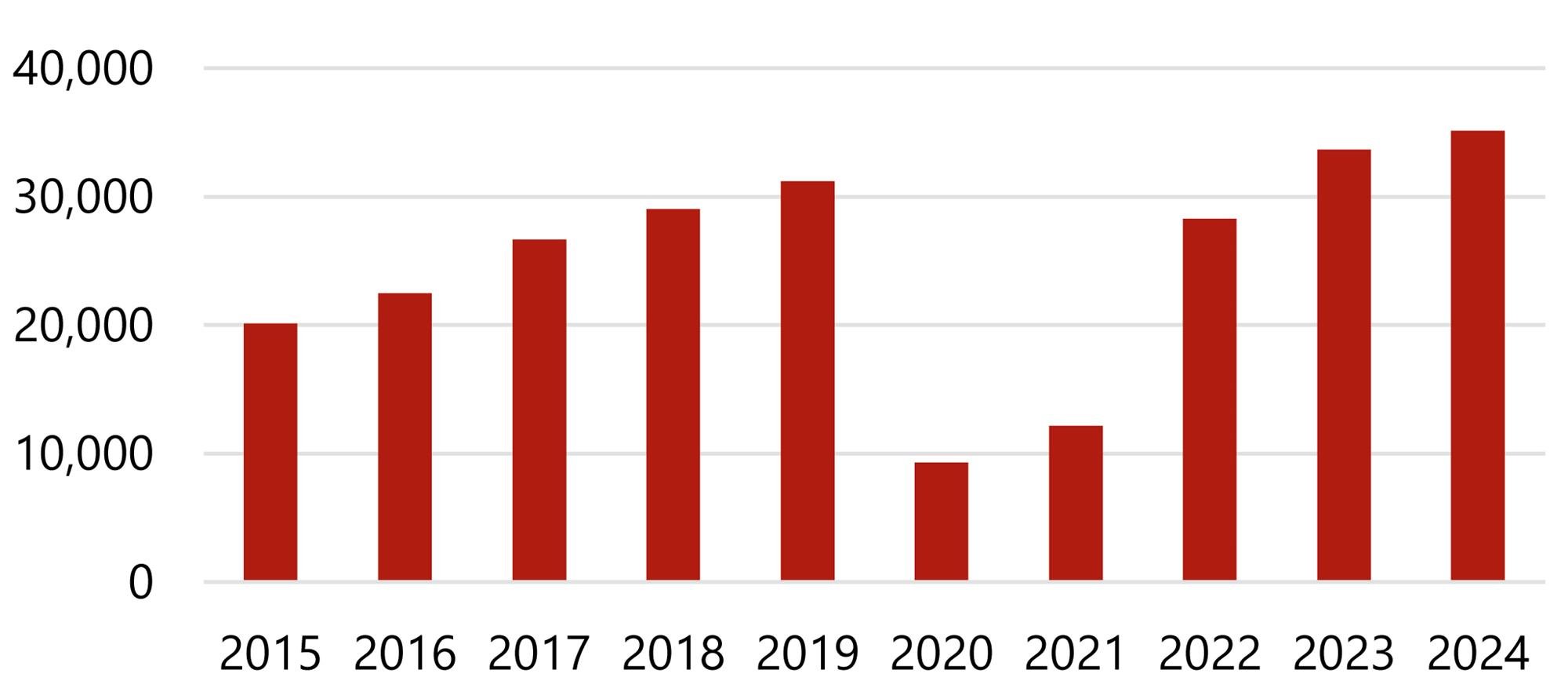

Tourism Demand

In 2023, Portugal was named Europe’s Leading Destination at the World Travel Awards, while Lisbon itself earned the title of Europe’s Leading City, a recognition it retained in 2024. These past couple of years, the country’s popularity has caused an influx of tourists resulting in the number of arrivals and bednights surpassing historical levels by more than 15%. The USA, Spain, Brazil, France and the UK have remained the main source countries of Lisbon’s tourists, with US demand soaring by nearly 90% over the last four years. This growth can largely be attributed to expanded air travel capacity between the USA and Portugal, as well as targeted promotional campaigns by Portugal’s national tourism authority. Additionally, the Rock in Rio Lisboa festival, which takes place every two years, drew 300,000 visitors from 106 countries in 2024. The next edition is due to take place in June 2026. Other major events driving demand to the city include the Web Summit, held in November, and Fish & Flavours Lisbon in early April.

An Exceptional Year for Lisbon – Arrivals and Bednights (000s)

Source: HVS Research

Transportation

Historically, Humberto Delgado Airport has seen strong passenger growth, recording a compound annual growth rate of 11% between 2014 and 2019. With 33.6 million arrivals in 2023, passenger traffic at the airport surpassed 2019’s record-breaking 31 million arrivals by 8%. This upward trend continued into 2024, with arrivals growing a further 4% year-on-year. To meet Lisbon’s rising demand, the construction of the new Alcochete Airport has been proposed, with completion expected by 2034, set to replace the current airport. Similarly, the Port of Lisbon exceeded the number of passengers pre-pandemic by 33% in 2023, growing an additional 1% in 2024. The port, which includes three berths for cruise ships, was recently named Best Atlantic Port in Europe. Alongside those modes of transportation, the rail network and underground metro system are well developed, facilitating convenient commuting for residents and visitors.

Highest Airport Passenger Counts in Ten Years (000s)

Source: HVS Research

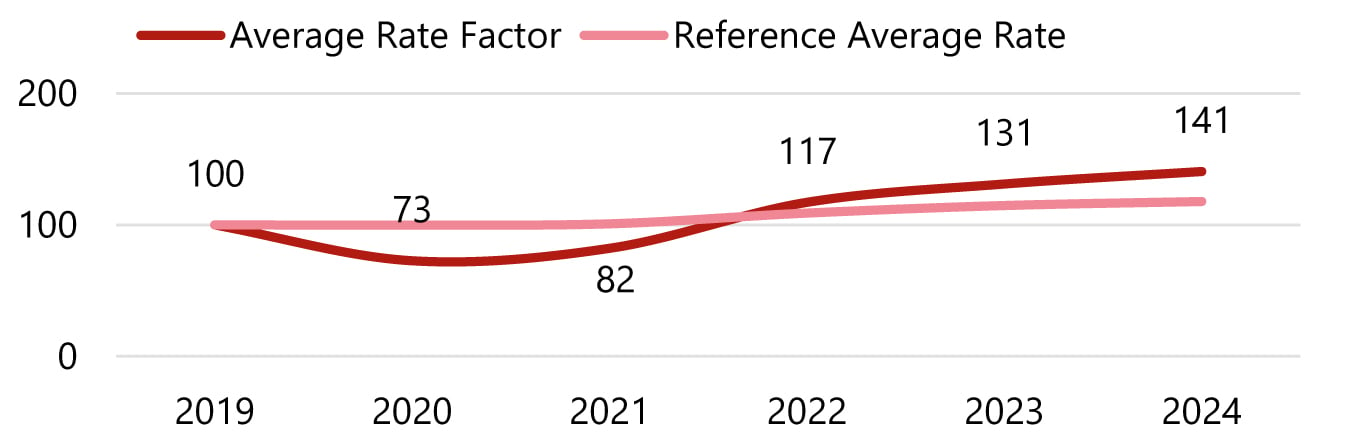

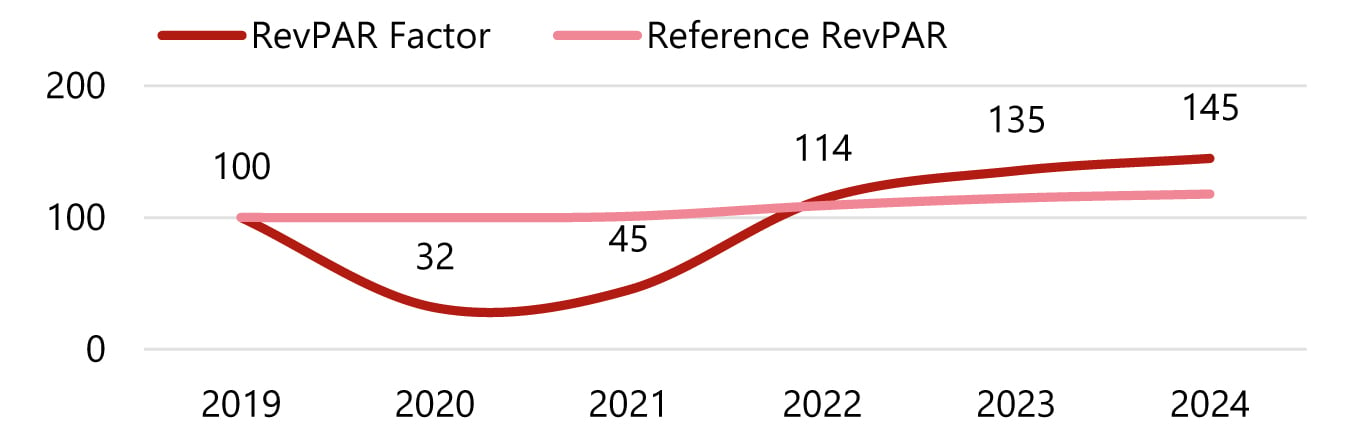

Hotel Performance

The evolution of hotel performances in the Lisbon Metropolitan Area is illustrated in the following charts, with 2019 used as the base year for comparison.

- As with other European destinations, occupancy levels in the Lisbon Metropolitan Area only returned to pre-pandemic levels in 2023, with the increase in supply in 2024 being absorbed by higher demand, resulting in stable occupancy;

- Despite high inflation and a first quarter in 2022 impacted by the Omicron variant of COVID-19, RevPAR recovered to normalised levels by year-end, driven by a 40% increase in average rate over 2021. In real terms, average rate surpassed 2019 levels by 5%;

- Driven by a double-figure compound annual growth rate in US visitation between 2019 and 2024, this strong momentum continued through 2023 and 2024, marked by record occupancy levels and significant rate growth. By the end of 2024, RevPAR exceeded 2019 levels by more than 20% in real terms.

Average Rates and RevPAR Recovered Above Inflation

Source: HVS Research

Hotel Supply

Total hotel supply for the metropolitan area of Lisbon stood at 32,000 rooms in 2023, growing at a compound annual rate of 3.0% between 2017 and 2023 (the 2024 supply had not been published by INE at the time of writing). Historically dominated by independent hotels, Lisbon’s market composition has been shifting in response to increasing international interest, particularly from US travellers, and has spurred rising demand from national and international brands.

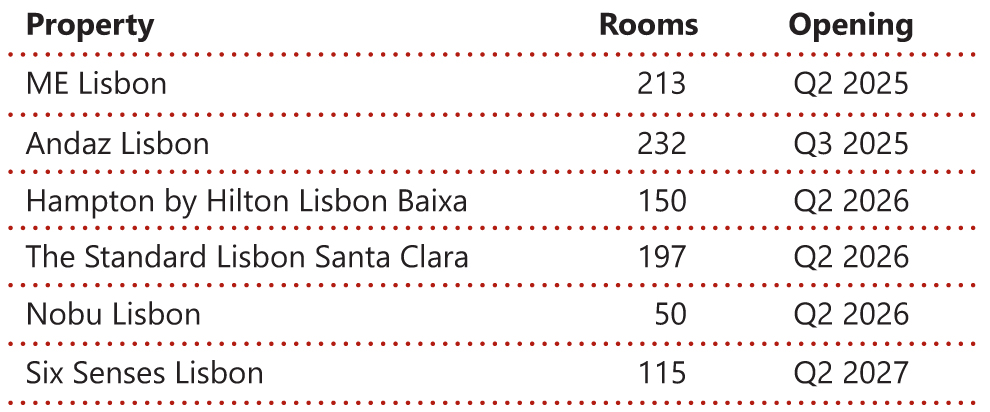

There are approximately 30 hotels in the pipeline due to be completed by the end of 2027, representing a 10% increase in the total number of rooms. Branded hotels represent nearly two-thirds of the new hotel supply, including brands from Marriott, Hyatt, Hilton and InterContinental Hotels Group. New openings in the next couple of years include the 213-room ME Lisbon, the 232-room Andaz Lisbon and the 150-room Hampton by Hilton Lisbon Baixa.

Hotel Pipeline

Source: HVS Research

Investment Market

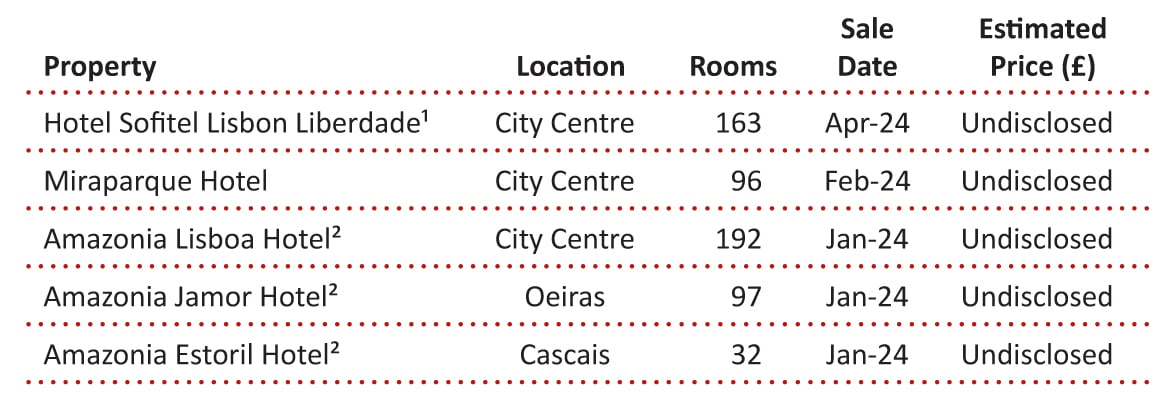

Transaction activity in Lisbon remained subdued throughout 2022 and 2023, with three transactions being recorded over these two years. Following a pickup in transactions in the first half of 2024, no deals occurred in the second half of the year. As per our HVS European Hotel Valuation Index 2025, Lisbon’s hotel market values benefitted from 7.8% year-on-year growth, surpassing 2019 levels for the first time since the onset of the pandemic.

Hotel Transactions

¹As part of a Sofitel portfolio deal with the Sofitel Roma Villa Borghese

²As part of four-hotel portfolio transaction

Source: HVS Research

Outlook 2025

Lisbon’s post-pandemic recovery has been exceptional, marked by a sharp rebound in tourism, increased visitor spending on hotel accommodation, and growing international appeal between 2022 and 2024. It is no surprise that the city was named Europe’s Leading City Destination for two consecutive years. The forthcoming hotel inventory reflects this renewed confidence, with high-quality developments poised to reinforce Lisbon’s upward trajectory. The outlook for the city remains highly optimistic, supported by strong fundamentals, continued investor interest, and a hospitality market ripe with opportunity.

Value Trends 2024 vs 2023

Source: HVS Research