Highlights

- The success of the 2014 Commonwealth Games, which welcomed around 5,000 athletes, has bolstered Glasgow’s reputation as a destination with a full range of sporting facilities and a city capable of hosting international events, such as the 2015 World Gymnastics Championships, which attracted over 70,000 people. In 2018, Glasgow will be the stage for the inaugural European Championships expected to have a television audience of more than one billion.

- According to the International Congress and Convention Association (ICCA), 54 ‘association meetings’ were held in the city in 2015, a 50% increase on 2014. This is as much a sign that Glasgow is a more attractive destination with a strong retail offer as it is of improved economic conditions.

- The SSE Hydro arena was developed adjacent to the Scottish Exhibition and Conference Centre (SECC) in 2013 to attract global entertainment and sporting events. In 2015, it was ranked the third-busiest venue in the world in terms of ticket sales (with over one million sold), after the London O2 Arena and the Manchester Arena.

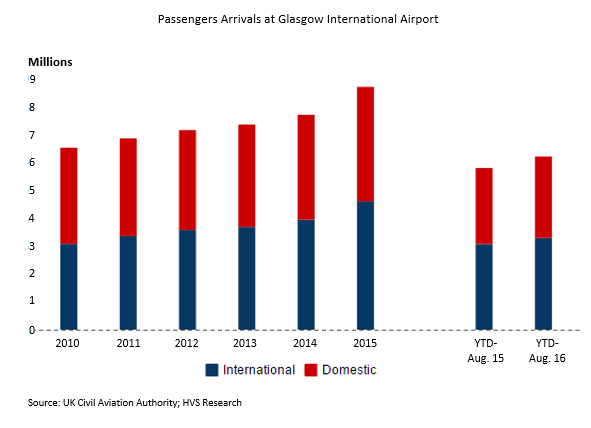

- Glasgow International Airport reported its fifth consecutive year of growth in terms of passenger arrivals, increasing by 13% to 8.7 million in 2015. Year-to-August 2016 numbers are similarly positive, with an increase of 7.3% to 6.2 million on the same period last year.

- The referendum on Britain’s membership of the EU in June 2016 brought a certain level of uncertainty to the real estate investment market, continuing a slowdown of investment in the UK. Glasgow was the epicentre of opposition forces at the time of referendum on Scotland’s membership of the UK in September 2014. The terms of Britain’s exit from the EU will be determined over the next few years which look set to lead to a second Scottish referendum on its independence, where Glasgow will again be a key player.

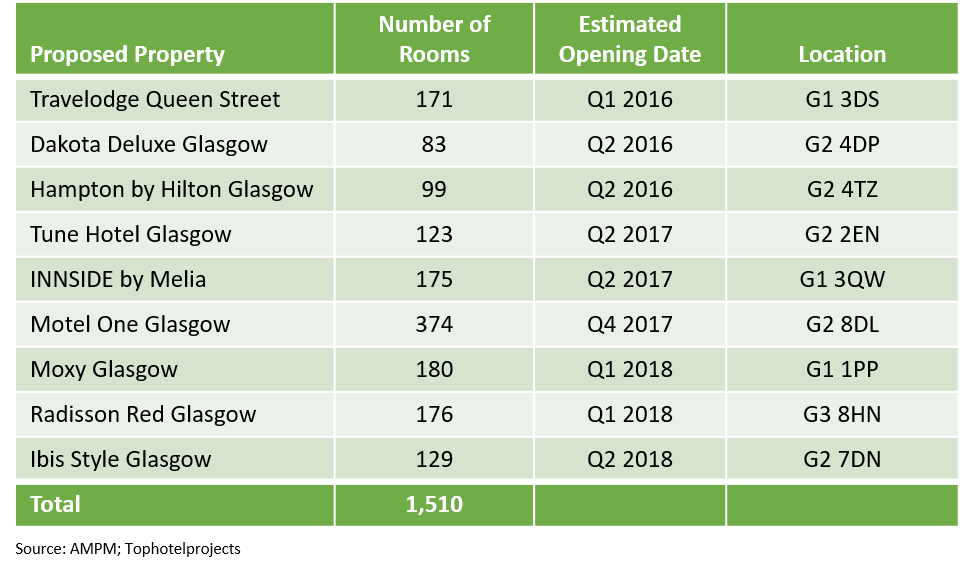

- Glasgow’s hotel market now has a substantial development pipeline. Over 1,100 new hotel rooms are due to enter the market by 2019, while more than 350 bedrooms were added to the city in 2016.

- Hotel investors have been buoyed by year-on-year RevPAR increases since 2013. Whilst there have been a limited number of recent hotel transactions, many of which have been part of portfolio sales with price allocations that are of little help to single asset buyers, positive sentiment in the business community and hotel development market is finally consolidating investment interest in Scotland’s second city.

Market Overview

Tourism Demand

Since the global economic slowdown in 2008 and 2009, the total number of passengers at Glasgow International Airport has been increasing year-on-year over the six years to 2015, resulting in an overall compound annual growth rate of 5.9%. 2015 was a very strong year with numbers returning to pre-crisis levels, owing to healthy growth in both international and domestic passengers, which increased by 16.8% and 9.0% respectively. Year-to-August 2016 figures indicate an increase of 7.3% on the same period last year.

FIGURE 1: PASSENGER ARRIVALS, GLASGOW AIRPORT

Even though the airport offers direct flights to and from numerous countries across Europe, the Middle East, North America and the Caribbean, the tourism sector in Glasgow is heavily reliant on the UK domestic market which accounts for approximately 75% of the total number of visits and 55% of the total number of bednights.

International Market Share

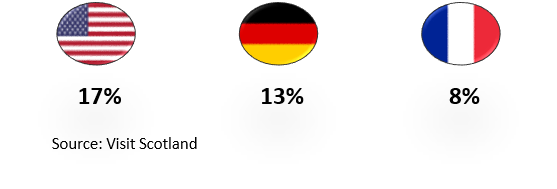

In 2015, the main international feeder markets in terms of arrivals were the USA (1st), Germany (2nd) and France (3rd). The following icons show the percentage shares of these arrivals.

FIGURE 2: ARRIVALS – INTERNATIONAL MARKET SHARE

Even long-haul feeder markets are top source countries that include the USA (1st), Australia (4th) and Canada (7th). Ancestral tourism is becoming an increasingly popular reason for tourism to Scotland as travellers come to learn about their ancestral roots before the mass emigrations to North America and Australia through the 18th and 19th centuries.

Length of Stay

According to Visit Scotland, the average length of stay in Glasgow has slightly decreased from 3.5 days in 2009 to 3.3 in 2015. Whilst the domestic market stays on average 2.5 days, international visitors generally stay 5.2 days, reflecting the longer travel distances.

Purpose of Visit and Seasonality

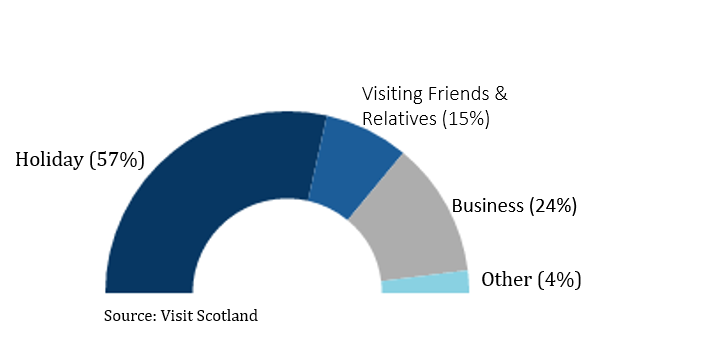

FIGURE 3: PURPOSE OF VISIT

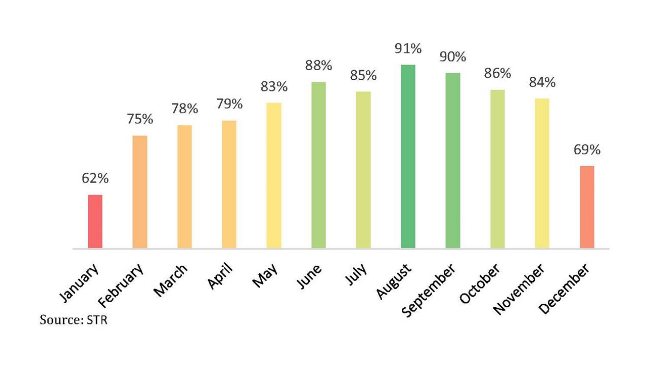

As the above chart suggests, Glasgow is predominantly a leisure destination characterised by a strong seasonality pattern. While the summer months of June, July, August and September are extremely busy with hotel room occupancy levels of around 85%-90%, the winter period tends to be more challenging with occupancy levels at around 65%.

FIGURE 4: ROOM OCCUPANCY – AVERAGE 2013-15

Market Performance

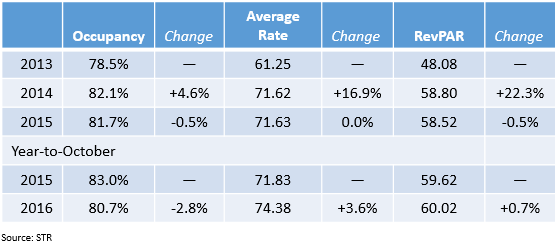

2014 was a fantastic year for hoteliers, owing principally to the Commonwealth Games. While occupancy increased by 4.6%, average daily rate recorded a 16.9% increase, resulting in an impressive rooms revenue per available room (RevPAR) growth of 22.3%.

FIGURE 5: MARKET PERFORMANCE

In 2015, whilst average rate remained stable at £72, occupancy decreased slightly to 81.7% and RevPAR largely held its position. Average rate expectations of centrally located full service hotels are broadly in the range of £80-£100, and for limited service hotels around £55.

Year-to-October figures indicate a continued downward trend in occupancy, likely impacted by the increase in supply and a solid growth in average rate.

Year-to-October figures indicate a continued downward trend in occupancy, likely impacted by the increase in supply and a solid growth in average rate.

Major Developments

The £1.1 billion Glasgow & Clyde Valley City Deal is an initiative by the UK and Scottish governments to invest in the Glasgow city region through infrastructure and connectivity projects. The Gigabit City fibre network, for example, will support Internet connectivity up to 100 times faster than the UK average, and the resurrected proposal to develop a ‘tram-train’ linking Glasgow Airport and the city centre is gaining support. If approved this month, the construction is scheduled to begin in 2022 with completion by 2025.

As part of the Edinburgh-Glasgow [transport corridor] Improvement Programme (EGIP), Glasgow Queen Street Station (Scotland’s third busiest station, handling around 55,000 passengers a day) is currently subject to a £112 million redevelopment designed to accommodate the expected increase of around 20,000 passengers a day by 2030.

The redevelopment of the station involves the demolition of part of the Millennium Hotel Glasgow and Consort House, the redesign of the main entrance, as well as the expansion of the platforms to accommodate longer eight-car trains. Completion is expected in March 2019 and the development is widely anticipated to enhance the surrounding area and increase Glasgow’s connectivity with its regions.

As part of the Edinburgh-Glasgow [transport corridor] Improvement Programme (EGIP), Glasgow Queen Street Station (Scotland’s third busiest station, handling around 55,000 passengers a day) is currently subject to a £112 million redevelopment designed to accommodate the expected increase of around 20,000 passengers a day by 2030.

The redevelopment of the station involves the demolition of part of the Millennium Hotel Glasgow and Consort House, the redesign of the main entrance, as well as the expansion of the platforms to accommodate longer eight-car trains. Completion is expected in March 2019 and the development is widely anticipated to enhance the surrounding area and increase Glasgow’s connectivity with its regions.

New Supply

Hotel supply is a balance of budget and full-service offers. The city’s hotel pipeline is more lifestyle-midscale orientated, appealing to a wider clientele. International hotel groups are choosing to implement their latest concepts in Glasgow, following the likes of CitizenM and Z Hotels. Over 1,100 new rooms are due to enter the market over the next 18 months.

FIGURE 6: NEW SUPPLY

Transactions

Recent hotel transactions have been largely part of portfolios with value ‘allocations’ of limited use to single asset investors. The 103-room Campanile Glasgow Airport was sold for £6.8 million in December 2015 to Whitbread Plc for conversion to a Premier Inn. The 100-room Blythswood Square Hotel (the only five-AA-star hotel in Glasgow) was sold to Starwood Capital in January 2015 for an undisclosed sum and has since been branded a Principal Hotel. Elsewhere the Loch Lomond Cameron House was purchased by KSL Capital Partners in November 2015.

These and other commercial property investments demonstrate the new familiarity foreign-based investors, including private equity firms, now have with Glasgow. The volume of new hotel supply is in some way a response to investor confidence in the operational market, which in terms of RevPAR is ranked seven out of 24 in the UK by STR.

These and other commercial property investments demonstrate the new familiarity foreign-based investors, including private equity firms, now have with Glasgow. The volume of new hotel supply is in some way a response to investor confidence in the operational market, which in terms of RevPAR is ranked seven out of 24 in the UK by STR.

Conclusion

The rapid success of the Hydro Arena and the city’s hosting of international events has increased global awareness of Glasgow as a tourist destination, and strengthened its position as a European MICE market. This exposure has led to the development of a cosmopolitan hotel pipeline which is a sign of greater investor confidence in the market.