With the advent of the COVID-19 pandemic in the U.S. in early to mid-March 2020, hotel owners and managers watched demand for their rooms suddenly evaporate. Since then, tough decisions have been made regarding whether to remain open or temporarily suspend operations. Hotels that have temporarily suspended operations now need to decide when to reopen. This article addresses the considerations to be weighed in this process and provides one example of the calculus for a hypothetical hotel.

With the advent of the COVID-19 pandemic in the U.S. in early to mid-March 2020, hotel owners and managers watched demand for their rooms suddenly evaporate. Since then, tough decisions have been made regarding whether to remain open or temporarily suspend operations. Hotels that have temporarily suspended operations now need to decide when to reopen. This article addresses the considerations to be weighed in this process and provides one example of the calculus for a hypothetical hotel.Hotel owners and operators recognize that while we are currently living in a world of scant lodging demand, talk of reopening the country is the necessary precursor to a recovery in travel and the need for hotel accommodations. Just like cities and states need to plan, closed hotels must plan the “how” and “when” of their reopening. As in any business decision, the costs and benefits of remaining closed versus resuming operations must be weighed. During a time when travel is restricted and little can be done to stimulate demand, the primary objective is to limit operating losses through cost containment. At the same time, hotel owners and managers must prepare for an eventual recovery in demand and the reopening of their property.

Factors to consider are discussed below, followed by a case study of a reopening analysis undertaken for a sample hotel.

Stay on Top of Federal, State, and City Regulations

While the urge to reopen may be strong, if governmental restrictions are not adequately lifted, your hotel may remain nearly empty when you open your doors. Over the next several weeks and months, it will be critical to not only understand the restrictions set by your hotel’s local and state governments, but also those of feeder cities to your market. Furthermore, the federal government has put restrictions on in-bound travel to the U.S. that will limit demand from international travelers over the near term. If your hotel relies on international travel, these restrictions should be monitored. Government-mandated protocols, such as social distancing and face-mask requirements, also need to be factored into plans to reopen because they may include elements beyond those you were planning to implement. Will you be fully prepared to comply with any mandated protocols in terms of staffing, training, and equipment?Monitor Booking Trends

While monitoring the relaxation of restrictions around schools, sporting events, conferences, restaurants, and other activities that impact demand is important, the true signals of revenue potential will be bookings and intentions to book. Therefore, evaluating the status of a hotel’s key accounts and monitoring the pace of reservations and group bookings in the near and mid-term will be most important to assess an optimal time to reopen.- Review the hotel's new transient reservations for all future weeks through December 2020, beginning with the date tentatively identified as the reopening date. If you’ve chosen a fairly near-term reopening date, such as June 1, for example, monitor the new transient reservations for June 1 and beyond on a no-less-than weekly basis to identify demand patterns.

- Call or email all existing transient reservations made prior to the pandemic to confirm that they still intend to travel, assuming the hotel is open. Without this crucial information, actual results will vary significantly and materially from forecasts. Many hotels are experiencing much greater losses in occupancy than expected because hotel operators assumed that if guests did not cancel, the guests were, in fact coming; however, many guests assumed that the hotel should have known that they weren’t coming because of the pandemic.

- Reach out to your corporate accounts to get their input regarding when travel may resume. Like the government, companies have restrictions that will have to be lifted before their employees can get back on the road.

-

Ideally, you have retained at least some portion of your sales team on staff during the suspension of operations. They play a central role in ensuring a smooth transition back to opening operations, with revenue starting as soon as possible.a. Now that they’ve most likely taken care of the planners canceling or rebooking near-term events, you can track the responses to identify rebooking patterns. How willing were they to rebook and how far in advance? How firm are those new dates? For instance, if you offered very flexible rebooking terms as incentives, such as no cancellation or attrition penalties, the rebooking pattern might give false encouragement, and those events might cancel or reschedule again closer to the new dates.b. Call the event planners for all future events on the books for the remainder of 2020. Those calls will be appreciated by the clients but will also be crucial to understanding how reliable those events will be. The occupancy and revenue from those events will be incorporated into the forecasting to evaluate the reopening date.

- Use your revenue management and marketing resources to track trends. Below, we list some resources to help you investigate; the cost of some of these services are well worth the benefit they provide to help you navigate the uncertain waters ahead and to optimize revenue:

- ADARA

- Brand Revenue Management Programs

- Duetto Pulse Report

- Hotelligence360®

- Kalibri Labs

- STR

- Tourism Economics

- Travel Click

- U.S. Travel Association

Keep Tabs on Your Competitors

Touch base with your competitors to see when they plan on reopening. It may or may not make sense to reopen when they do, depending on the anticipated depth of demand at that time.Beyond their timing, are your competitors shifting their mix of business and/or distribution strategy? How has their pricing changed since prior to the crisis? Online research or market research providers will help you determine shifts in their marketing or positioning, or lack thereof, potentially providing you with alternate opportunities.

Evaluate Your Business Mix and Demand Patterns

For the U.S. market overall, drive-in demand is expected to be the first to recover, followed by domestic short regional flights, and then longer domestic flights. Inbound, international demand is anticipated to be the last to recover. The good news is that U.S. citizens are being warned to remain in the country, and foreign countries are restricting entry from the U.S. Therefore, once people feel comfortable enough to travel, they will remain within the country, generating demand to offset the loss from abroad. As a result, if you have historically relied on regional drive-in demand, you are likely to recover occupancy more quickly once travel resumes. If you have historically relied on international transient or tour/wholesale demand, you may have to shift your marketing to target different segments or delay reopening longer because repositioning has a natural delay before it generates revenue.Drive-to locations such as regional resorts are more likely to benefit, as well, due to the pent-up demand for vacations and weekend staycations. While urban destinations have historically attracted drive-in demand during a recession because consumers save money, compared with the costs of flying, city centers may have less appeal in this downturn until the fear of group mingling and dense locations diminishes. Urban hotels, particularly those with a group orientation, will have to find ways to adapt creatively to this new environment. Government lodging contracts for first responders, medical professionals, and quarantined individuals are helping many urban hotels survive this period of low demand.

Another consideration is the hotel’s historical transient vs. group mix, which will often parallel the amount of meeting and function space relative to the number of guestrooms. The more the hotel is dependent on group demand, the more it will be critical to see clear indications from planners of the intent to book in order to identify when to reopen. Transient travelers, whether they be corporate, leisure, or any other sub-segment, can make and implement travel decisions quickly, whereas the lead time for group demand is longer than that for the transient segment, making the lead time for reopening necessarily longer, as well.

Another factor to consider when weighing when to reopen is the weekly volatility of demand. Will you be opening to accommodate infrequent events that generate high occupancy temporarily and then be faced with abnormally low occupancy that caused you to close in the first place? Having to carry the ongoing costs of an open hotel may only be worthwhile if an adequate level of steady demand is sustainable. If this is a risk, opening just parts of the hotel, such as wings/floors or only certain outlets, could mitigate the financial exposure.

Operational Considerations

Procedurally, how a hotel takes care of its guests will change. It is widely believed that most will move toward touchless interaction to every extent possible throughout the hotel. Here are some of the expected changes or trends being discussed in the industry:

- Remote check-in/out as the default

- Increased use of room service, as guests may prefer to minimize interactions

- Tablets for ordering at tables and bars (versus waitstaff), as currently used in some airports

- Greater spacing of attendees in meetings and banquet functions

- New outlet hours of operation based on the changing habits of guests

- Limited occupancy of fitness facilities

- Limited housekeeping service for stays less than 3 or 4 days

- New housekeeping chemicals with sterilization components

- Mandatory black-light room inspections

- Surface sterilization in common areas

- Temperature checks

- Increased use of stairs, necessitating improved signage and appearance

- Heightened kitchen cleaning and sanitation procedures

- New industry certifications

- Plexiglass shields at the front desk and host stands

- Replacing traditional doorknobs with foot levers

- Social distancing markers in the public areas

It is strongly recommended that you identify what the hotel’s competitors are doing in regard to their own protocols and how they are communicating them to their prospective and in-house guests. This is new territory for all hotels, so the many ideas of what should be done and how it should be done are unfamiliar to everyone in the industry. As a result, everyone feels that they are “playing catch up,” creating their own evolving plans by watching, reading, and customizing those being developed by other hotels and other industries.

Because of these and other changes expected by the travelers and meeting planners, identifying the hotel’s planned operational changes, creating the associated procedures, and training the staff will require considerable time in advance of implementing them. Developing an execution plan for procedures, training, and then communication in such a way as to not only generate bookings but to also not scare people away will be critical to this process and should be factored into the decision of when to reopen. The reopening schedule should assume more than enough time to develop the procedures, implement the procedures, and then tweak the procedures when the training inevitably indicates flaws.

Conduct a Staffing Assessment

(Please note, the following comments do not necessarily apply to hotels subject to a collective bargaining agreement.)One factor to evaluate in your decision of when to reopen is to consider the employees who have been furloughed and to determine who will be brought back and when. Occupancy will most likely be lower than your hotel had experienced even during its slowest times; thus, maintaining a lean staff will be critical to minimizing losses. A detailed staffing analysis based on varying levels of occupancy patterns will help in this process.

Trained, productive employees will be expensive to replace no matter what the employment environment turns out to be. If you wait too long to reopen, your competitors might take the opportunity to hire your team (both hourly and management staff). If that is a risk in the local market and among the competitive set, perhaps retaining key team members is adequate reason to reopen, even if the economics of reopening are not optimal for several months. Many hotels have retained most of their Executive Committee staff during the suspension to protect their strongest human asset, but few were able to retain the next tier of managers, and they are critical to the success of the hotel.

Another consideration is that the hourly staff may not be willing or able to return to work. Perhaps the government assistance provides them with more compensation than prior to the pandemic, and likely more than they will receive while the hotel ramps up operations. Additionally, childcare will be an enormous impediment. Schools may remain closed, many summer activities are likely to be canceled, and/or senior parents may not be able to safely take care of the children. Each reopening date under consideration will require an assessment of the size, type, cost, and availability of the staff needed for the nature and amount of the demand expected to be accommodated during that period.

If you have access to a pre-opening, critical-path planning tool used to open new hotels, this will provide the model to calculate the cost and timing of all new staff recruiting, hiring, and training, which will be especially important to assume if your previous staff is no longer available.

Case Study

A case study has been prepared to illustrate the calculus of making the decision about when to reopen. Our case study is based on a hypothetical, upscale, 200-room, full-service hotel. In order to evaluate the optimal time for the hotel’s reopening, we have forecast EBITDA prior to a reserve for replacement by month for the remainder of 2020 under the following two scenarios: (1) the hotel remains closed, and (2) the hotel is reopened. Preparing a month-by-month forecast for the remainder of 2020 will provide clarity about the economics and optimal timing of reopening by incorporating the additional costs to complete the process successfully. EBITDA from the two scenarios are compared to assess the scenario that generates the most positive outcome each month (i.e., the lowest operating loss and positive operating income eventually under the “open” scenario). The breakpoint (i.e., when the open hotel’s EBITDA begins to exceed the closed hotel’s EBITDA) will be a benchmark to gauge the optimal time to reopen.The “open” forecast should be updated frequently, no less than weekly, in order to use the most current data for a comparison with the ongoing cost of remaining closed. The quality and reliability of data collection mentioned earlier will drive this analysis.

Note: An operating forecast using the Uniform System of Accounts for the Lodging Industry (USALI) is not the same as a cash forecast because the USALI assumes the accrual basis of recording revenue and expenses. For instance, real estate taxes might be paid in February but expensed 1/12 each month. Therefore, during the forecast for the remainder of 2020, there is no actual payment due for real estate taxes, even though it is included as an expense/subtraction. There are many expenses incurred by hotels, as in all businesses, which are paid annually, and many are paid in January. Similarly, for revenue, if the hotel forecasts substantive Group demand, the collection of that revenue will most likely not occur in the same month in which the corresponding expenses were incurred. However, if the same non-cash entries are included in both scenarios, the comparison will be valid. Consideration should be given to preparing both a cash-basis and an accrual-basis forecast for the “open” scenario because the differential might materially impact the decision.

Closed and Reopened Scenarios

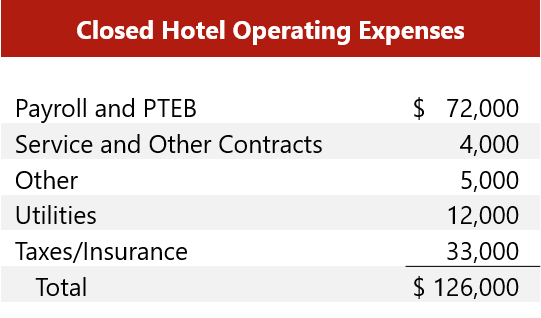

The ongoing carrying costs of the closed hotel are summarized in the following table.

The monthly cost to carry the hotel, before consideration of debt service, is $156,000. A skeleton crew of management and staff has been retained to care for the hotel during its closure and to provide basic property maintenance, sales/marketing, and security. These monthly expenses reflect no management fees and no franchise fees because the hotel is not generating any revenue. Reserve expense is also excluded due to the assumption that any mandated reserve funding has been suspended while the hotel remains closed, and there is no revenue against which to assess the mandatory reserve percentage.

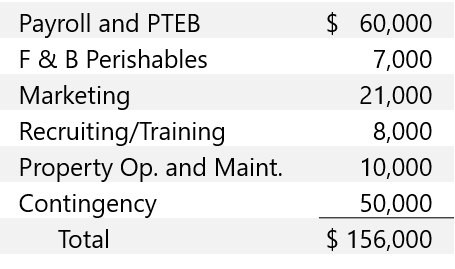

The cost to reopen the hotel must be considered in the decision-making process. A summary of reopening expense for the sample hotel, set forth below, includes a $50,000 contingency to cover physical alterations to the hotel for the prevention of virus transmission. The operating costs would typically be expensed on the hotel’s P&L statement but are set forth here separately for purposes of illustration.

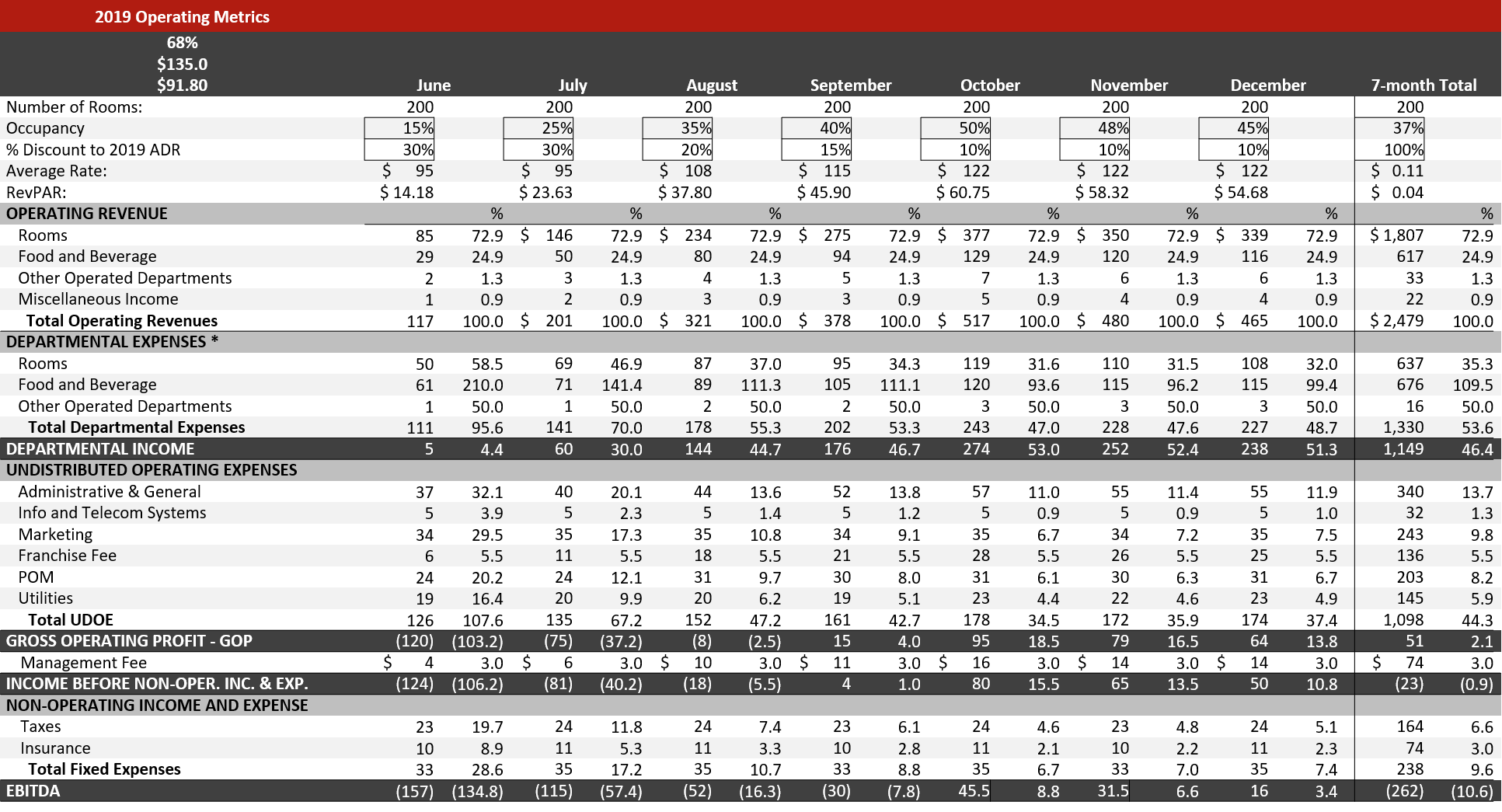

The hotel’s projected financial month-by-month performance for the remainder of 2020 is summarized below. The hotel is assumed to open on June 1, 2020, and ramp up thereafter, realizing an occupancy of 37% and ADR of $114.43 for the seven-month period, reflecting a RevPAR 54% lower than the $91.80 RevPAR achieved in 2019. F&B revenue is projected to be 20% lower than what would typically be achieved at the projected occupancy levels. No reserve for replacement is forecast, as it is assumed that any reserve requirements will continue to be suspended. The operating loss for the entire seven months totals $262,000, or 10.6% of revenue.

Source: HVS

This example illustrates that the hotel is projected to start generating an operating profit in October when the hotel’s occupancy reaches 50%. During the first month that the hotel is reopened, it generates a loss that is greater than the loss generated by the closed hotel; the operating hotel’s loss is on par with the closed hotel loss in July and starts to be substantially less than the closed hotel’s loss in August, the month a 35% occupancy level is achieved. As the hotel continues to ramp up, the financial benefit of operating the hotel continues to improve. Recovery will vary depending upon a hotel’s local and seasonal demand patterns.

Please note that the breakpoint will be earlier for a limited- or select-service hotel; in fact, many limited- and select-service hotels have not suspended operations at all because even a small amount of revenue triggers a benefit to remain operational given the low operating costs and low staffing needs.

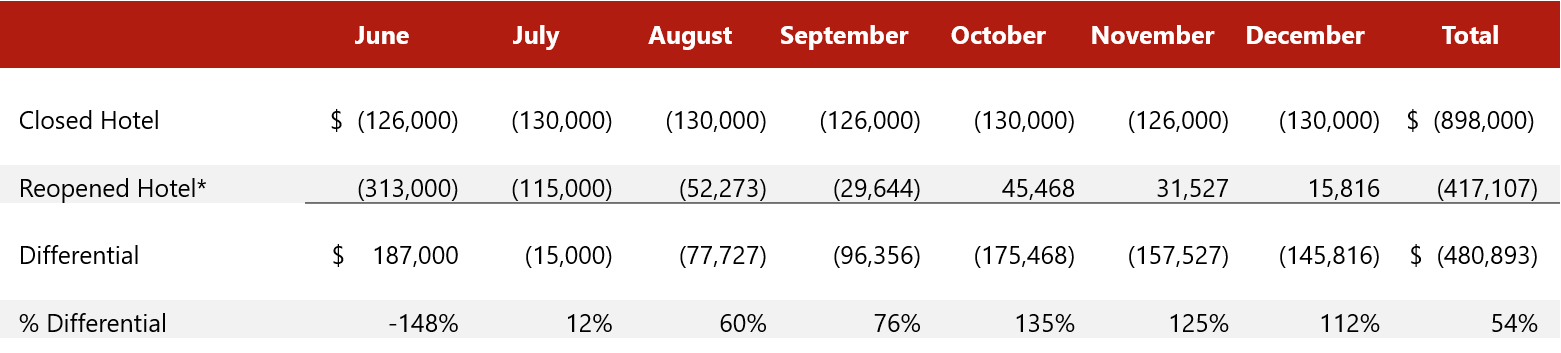

The next step is to compare the monthly carrying costs of the hotel with suspended operations with the operating loss/profit of the reopened hotel, including the cost to reopen, which is added to the June operating loss for “open” scenario even though it would be incurred in the month prior to opening.

Source: HVS

For the seven-month period, the open hotel is projected to lose 54% less than the closed hotel, including reopening expenses.

As this case study illustrates, the ramp-up is expected to be slow, similar to the opening of a new hotel. Owners should be prepared for the operating loss of an open hotel to exceed the carrying costs of a closed hotel for a few months as demand builds and if the forecast is not achieved. A reasonable question would be: Why not open in August (in this example) to eliminate the greater losses in June and July? Whichever month is targeted for resumed operations will necessitate at least one if not two months of escalated costs for the reopening costs and the delay in capturing demand. Therefore, it is not possible for a full-service hotel to avoid at least one if not two months during which the financial position goes backward in order to reopen the hotel. Deciding the optimal time to start this ramp-up process to minimize that potential will depend on the considerations noted above by meticulously monitoring the indicators for demand on a weekly basis.

Conclusion

Because these pandemic circumstances have never occurred before, data will be limited and unreliable as tools with which to make predictions. Preparation and scheduling will require frequent and detailed assessments of the various factors applicable to the individual hotel and its market. Waiting too long may mean missed opportunities and past guests being accommodated elsewhere. Opening too early risks losing more cash than planned and draining badly needed capital.The elements of the decision as to if and when to reopen a hotel are naturally property- and market-specific. The numerous factors identified here, including revenue and demand indicators, costs to reopen, new procedures, availability and training of staff, new regulations, and the actions of competitive hotels, among others, must be weighed according to their potential and relative impact on the results. Limited- and select-service hotels are likely to recover more quickly than full-service hotels, particularly upper-upscale and luxury properties, because the residual condition of the general economy, flexibility of the hotel’s expense structure, mix of transient and group demand capture, and staffing structure differ in terms of the impact on those property types. Along with carefully forecasting when to reopen, well-planned and well-implemented marketing, sales, policies, and procedures, as well as rigorous expense controls, will be key to minimizing losses and positioning the hotel for a successful and profitable 2021.

About Neil J. Flavin

With involvement in all ongoing projects, Neil is responsible for the overall operation of the Advisory, Asset and Hotel Management division of HVS. With 40 years of diverse hospitality experience with various brands and franchisors, including managing brand and owner relationships in the New York area for upscale and first-class hotels with IHG, his knowledge of the industry has assisted owners in maximizing value and return.

Prior to joining HVS in 2015, his other experience includes President of a management company, successful restaurant owner, Regional VP of Operations for Hyatt, transforming assets from AmeriSuites to Hyatt Place, organizing and implementing multi-unit management practices, Regional Director of Operations at IHG for Crowne Plaza Hotels & Resorts and numerous assignments as a General Manager with various corporate or management positions within Marriott, Ritz Carlton and other management companies.

Contact Neil at +1 (828) 279-3156 or [email protected].

0 Comments

Success

It will be displayed once approved by an administrator.

Thank you.

Error