Prior to March 2020, the Tampa and St. Petersburg (TSP) market had posted nine straight years of RevPAR growth. The depth of the market’s demand generators and allure of this sunny market were continuing to grow at the start of the new decade. A firm commitment by major stakeholders (public and private) in recent years to the development of the region’s amenity base, corporate relocations and expansions, stable and growing tech and finance sectors, population migration to the region, major infrastructure investments, development projects in Downtown Tampa and St. Petersburg, favorable weather, the presence of MacDill Air Force Base, and a host of other factors contributed to the attractiveness of the region to hoteliers, hotel brands, meeting and event planners, airlines, tourists, and other hotel guests.

For TSP, the full impact of the pandemic will not be realized until after the first quarter of 2021 given the historical seasonality trends of the region. The first quarter is typically peak season in TSP; as such, some of the strongest months in 2020 had passed prior to March, while peak season for a number of the top-25 markets occurs after the first quarter. Business and travel restrictions related to COVID-19 have also been looser in TSP than in other markets, resulting in transient demand and some group business throughout 2020. Considering these factors, the seasonality of the area provides a unique forecasting situation in which ADR is expected to be highly affected in 2021, as the peak season early in the year has continued to be affected by the ongoing COVID-19 pandemic.

For more information, contact John Lancet in the HVS Tampa office.

2020 and the COVID-19 Impact

The onset of the COVID-19 pandemic had a major negative effect on hotels in TSP in late March and April 2020; however, as the trends and tastes of travelers changed to fit this new reality, the TSP market began to show signs of improvement, and the TSP market achieved the highest average occupancy of STR’s top 25 U.S. travel markets in 2020 (at 51%), beating out similar markets, such as Phoenix. Aside from the sunny weather, some other reasons the region outperformed all other top-25 markets include the world-class beaches, relative proximity to major population bases (allowing for drive-to weekends/vacations), abundance of outdoor activities, the reluctance of the state government to “shut down,” and the presence of MacDill Air Force Base and Port Tampa Bay, as well as continued new construction and expansions in the region.For TSP, the full impact of the pandemic will not be realized until after the first quarter of 2021 given the historical seasonality trends of the region. The first quarter is typically peak season in TSP; as such, some of the strongest months in 2020 had passed prior to March, while peak season for a number of the top-25 markets occurs after the first quarter. Business and travel restrictions related to COVID-19 have also been looser in TSP than in other markets, resulting in transient demand and some group business throughout 2020. Considering these factors, the seasonality of the area provides a unique forecasting situation in which ADR is expected to be highly affected in 2021, as the peak season early in the year has continued to be affected by the ongoing COVID-19 pandemic.

Major factors contributing to the 2020 data are summarized as follows:

- The rock bottom for occupancy in TSP was reached mid-April. Since then, the greater TSP market has recovered slowly, and the different submarkets of the greater area continue to recover at varying paces. While the beach submarkets generally fared best, the Westshore and Downtown Tampa submarkets, which have historically been corporate-, airline-, and group-driven, continued to struggle as work shifted to remote status, passenger counts for air travel remained low, and major companies limited business travel. During assignments in the summer months, HVS associates saw waves of visitors on the beaches, with data showing near sellouts at leisure-driven beach markets, while the Westshore submarket’s major office complexes and parking lots were largely deserted. A boutique hotel in South Tampa began selling groceries, offering day-use passes to the hotel’s pool, and providing other unconventional services to drive revenue during the pandemic.

- During a recent meeting with Visit Tampa Bay, CEO Santiago Corrada reported that Florida remaining relatively “open” contributed to the market rebounding from the April low point, assisting in the region’s recovery and the ability to successfully promote the travel destination without interruptions. Tampa and St. Petersburg were busier than the better-known Florida destinations Miami and Orlando, which was likely helped by the area not feeling “crowded” and “over-touristy [sic] to the point where you can't enjoy yourself and feel safe,” Corrada said. Visit Tampa Bay leaned into this challenge and devoted a significant increase in marketing dollars to identify, target, and attract those who were eager to travel to Tampa Bay.

- A closer look at the data show that the best-performing submarkets in the region were the Pinellas County beaches and St. Petersburg. These two submarkets offer highly desirable picturesque beaches that consistently rank among the best beaches in America and the world. Their natural advantages drew strong leisure demand from throughout the region and nation. Furthermore, a large number of development projects continued, and the opening of the new St. Petersburg Pier mid-year 2020 added to the Pinellas County tourism infrastructure base.

- Meanwhile, the data show that the Downtown Tampa and Westshore submarkets experienced more occupancy and RevPAR declines in 2020 than the Pinellas County submarkets given the typical reliance on group and meeting demand, major events downtown, cruise ships departing from the Channel District, and commercial demand.

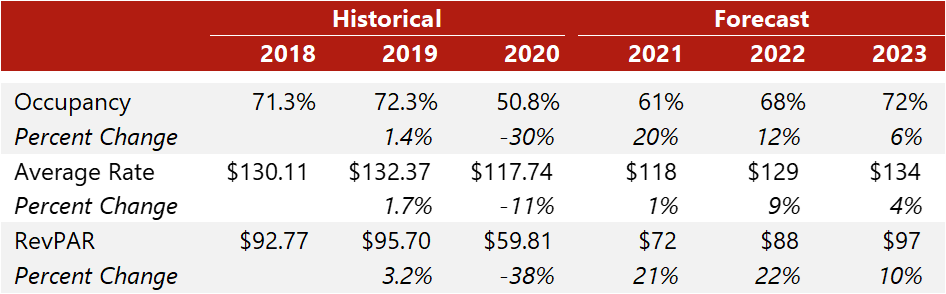

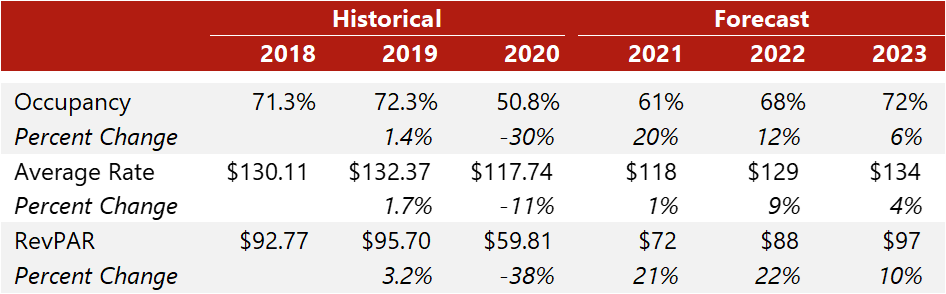

Tampa 2021–2023 Forecast

Source: Source: STR (Historical Years) and HVS (Estimate & Forecast)

Source: Source: STR (Historical Years) and HVS (Estimate & Forecast)

Looking Forward

- While widespread vaccine distribution is increasing in the region and country, first-quarter 2021 performance is expected to be depressed compared to the same period last year. In addition to reduced demand, especially among corporate travelers and groups, major events during the first quarter, such as Super Bowl LV in February, were forced to implement reduced-capacity measures. The Super Bowl has historically been a boon for hotel owners. However, the 2021 Super Bowl in Tampa, held amid the global pandemic, was far from what market participants had anticipated when it was announced in 2017, even with Tom Brady and the local team (Tampa Bay Buccaneers) playing. As a result of pandemic-related attendance limits, only 24,700 people attended the game at Raymond James Stadium, well under the facility’s capacity of 66,000. Furthermore, with the hometown team playing, a first in Super Bowl history, Tampa hotels captured less team-related demand. Nevertheless, Visit Tampa Bay officials reported that the presence of the Super Bowl in Tampa allowed hotels in the region to surpass the weekend performance from the same weekend in February 2020, prior to the onset of the pandemic. The performance also surpassed that of the two prior Super Bowls held in Tampa in 2001 and 2009, which were recessionary years.

- Another factor in our forecast of the region’s performance is the ongoing recovery of the group and meeting segment, which is a major driver in the Downtown Tampa submarket. This submarket welcomed its first five-star hotel in January 2021, the JW Marriott Tampa Water Street, and the dual-branded Hyatt House and Hyatt Place property opened in February 2021 as the only Hyatt product in the Downtown submarket. The Tampa Edition hotel will also open in 2021 with the highest-end product in this submarket. These new, strong branded hotels add a significant amount of guestroom inventory to Downtown Tampa, creating another hurdle to the recovery of this submarket; however, over the long term, the addition of the new supply, including the significant meeting and event space at the new JW Marriott, should allow local officials and hoteliers to compete for new and larger groups that previously would not have chosen the Downtown submarket given the limited room supply. We note that a promising trend has been this market’s ability to attract events and groups from other major markets in the U.S. during the ongoing pandemic.

- The uncertainty of the return of corporate travel, similar to most U.S. markets, remains a challenge for the Westshore and Downtown Tampa submarkets. However, significant long-term investment in new, Class-A office space in Water Street and throughout Downtown, as well as a growing downtown population and residential amenity base, provide optimism for the rebound of the corporate segment. The Downtown submarket should further regain its footing as cruise ships, major sporting and entertainment events, and large groups gradually return to the market in 2022/23.

- Interestingly, numerous new restaurants and bars opened in TSP, including the Downtown submarket, in 2020 and 2021, introducing new products from restaurateurs from other areas of the nation that were amid lockdowns. This tangible investment of real capital into the local economy during the pandemic is considered a positive indicator of the near- and long-term outlooks for the region.

- Tampa International Airport (TPA) and St. Pete–Clearwater International Airport typically bring a significant number of visitors to the TSP region, and each airport registered annual growth in the years prior to 2020. However, each airport experienced a significant decline in passenger traffic in 2020 as domestic and international travel restrictions were implemented and the appetite to travel via airplane remained depressed. The gradual uptick in domestic travel since May 2020 and the anticipated return of more international flights in 2021 is expected to allow the Westshore submarket, along with the overall TSP market, to bounce back. In recent positive news, Frontier Airlines announced plans to establish a new crew base at TPA this year that will include 250 flight attendants and 140 pilots when it opens in May 2021.[1] Frontier is among the fastest growing airlines at TPA, and company officials are optimistic about the future of the region.

Conclusion

Visit Tampa Bay officials and major hotel brand representatives remain confident about the long-term prospects of growth and vibrancy of the TSP market, noting that the region is well positioned for a healthy recovery as vaccine distribution continues and the pandemic is suppressed. The HVS Tampa team continues to monitor the various factors influencing the outlook for the TSP lodging market, including reviewing statewide trends and regularly engaging in conversations with participants in the regional market. Overall, we anticipate that the TSP market will rebound quickly and pick up where it left off prior to the COVID-19 pandemic in terms of its record pace of growth and attracting new investment.For more information, contact John Lancet in the HVS Tampa office.

[1]FlyFrontier.com, "Frontier Airlines Announces New Crew Base in Tampa and Future Plans to Establish Atlanta Base." Retrieved March 10, 2021.

0 Comments

Success

It will be displayed once approved by an administrator.

Thank you.

Error