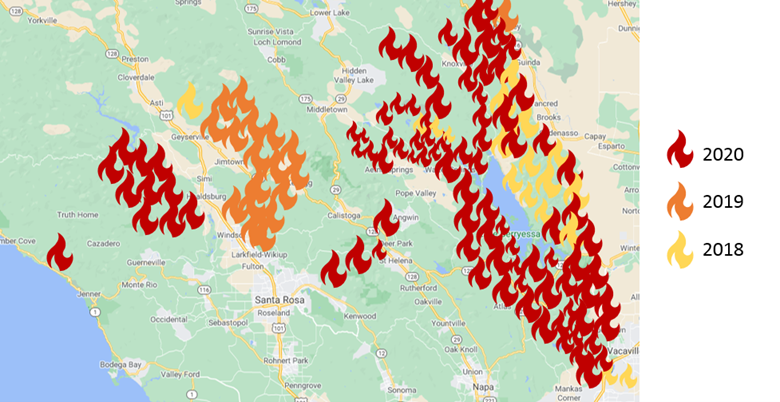

Recent Napa Valley Wildfires

STR data for year-end 2017 showed an occupancy increase of 6.8% and a total hotel revenue increase of 9.2% from the previous year. Furthermore, from 2016 through 2018, visitor spending in Napa Valley increased by 15.9%, and visitor growth increased at a rate of 8.9%, suggesting that the area quickly recovered from the minimal impact of the wildfires that occurred during that time.

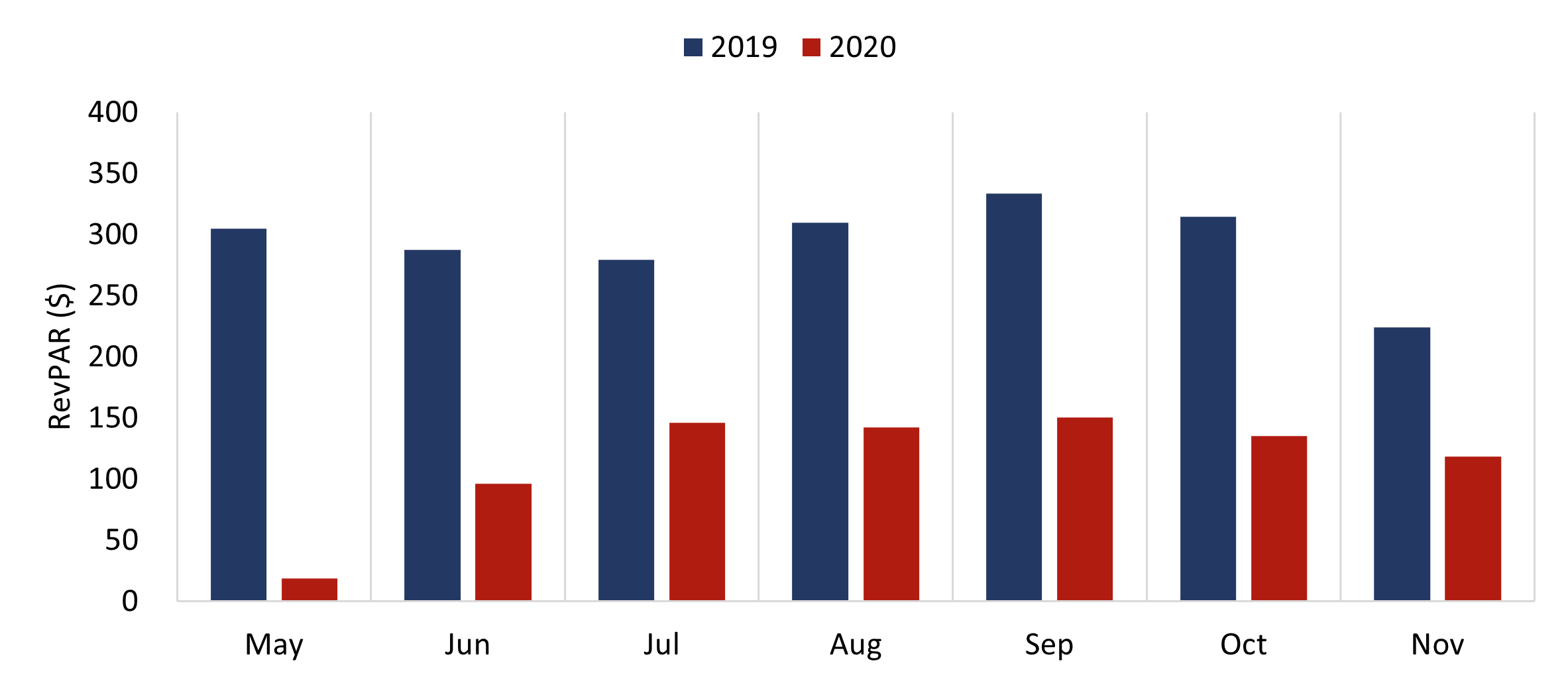

While the wildfires are short-term occurrences from which hotels can quickly rebound, the prolonged COVID-19 pandemic has significantly depressed the Napa Valley’s hotel performance since the end of March 2020. Revenue per available room (RevPAR) in Napa Valley dropped below $20 in May 2020, the earliest data publicly available for that year. Reportedly, some drive-to destination markets in the region, especially South Lake Tahoe, have experienced relatively rapid recoveries amid the pandemic, thanks to those markets’ outdoor attractions and activities. RevPAR in South Lake Tahoe dropped to approximately $3.00 in April 2020 but rebounded to over $80.00 by the end of August 2020, which is only $4.00 less than what was recorded in August 2019. Meanwhile, tourism in Napa Valley is closely tied to wineries and dining experiences, which have been highly restricted during the pandemic. Furthermore, the restrictions on international travel, limited domestic travel outside of California, and constraints on groups have greatly hindered demand. International travel has historically made up 20% of visitors in Napa Valley (with a high volume of spending), and meeting/group business has typically generated roughly a third of demand. Without the demand from these segments, the recovery of tourism in Napa Valley has been especially challenging in this unprecedented time.

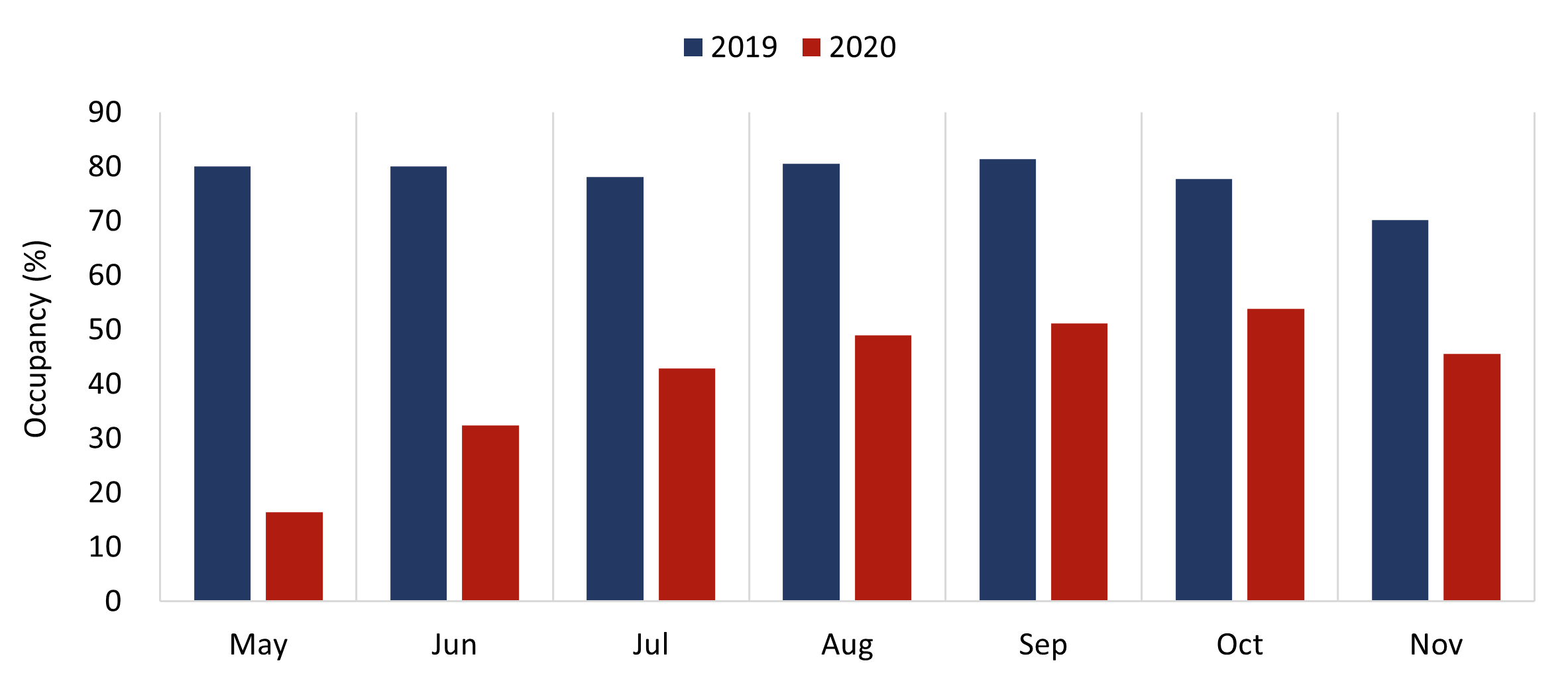

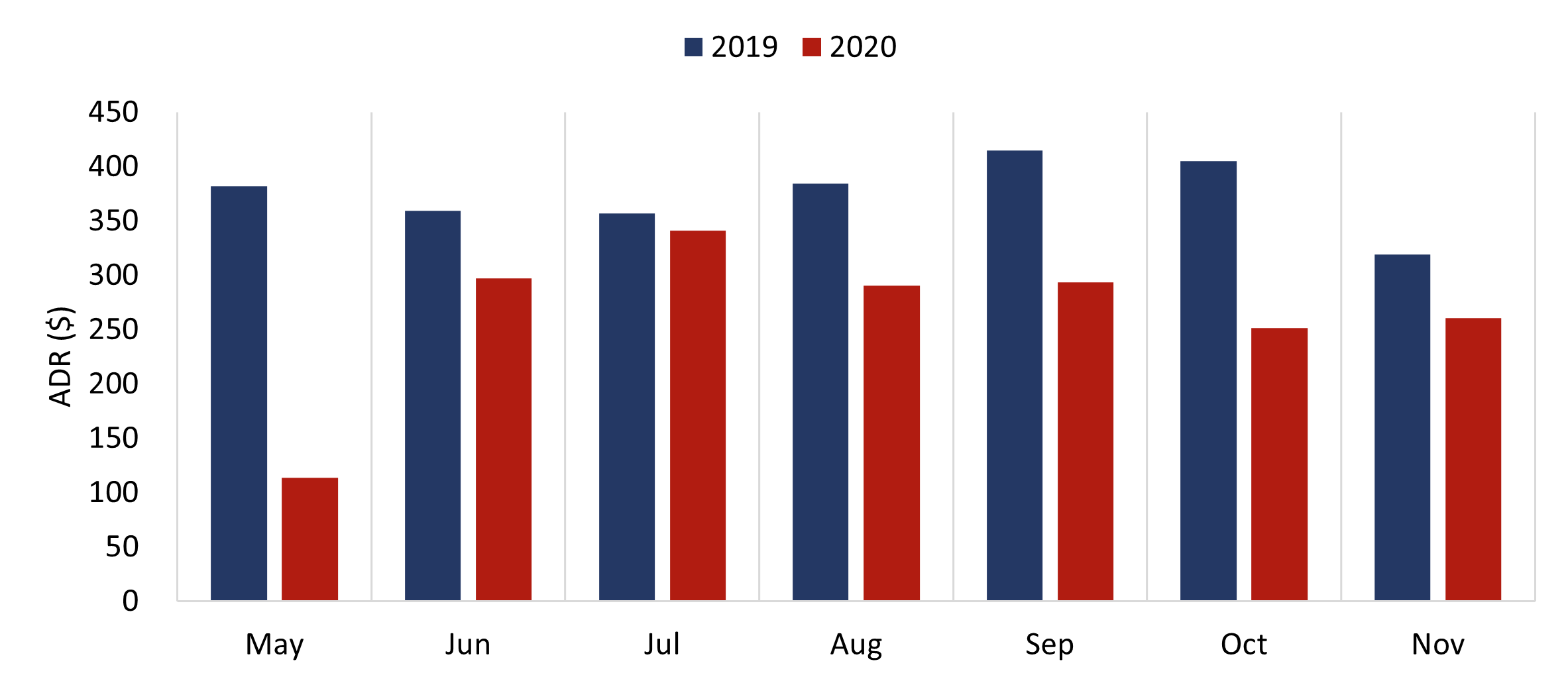

To further understand hotel performance during the COVID-19 pandemic, we reviewed Napa County’s hotel occupancy, average daily rate (ADR), and RevPAR from May through November 2020, comparing the levels to those registered in 2019.

Napa County Hotel Occupancy

Source: Visit Napa Valley, STR, and HVS

Napa County Hotel ADR

Source: Visit Napa Valley, STR, and HVS

Napa County Hotel RevPAR

Source: Visit Napa Valley, STR, and HVS

To understand the historical trends in occupancy, ADR, and RevPAR, as shown above, the demand mix, seasonality, and external factors on demand must be considered. May, June, and September typically represent the greatest periods of demand from group-related sources, while the July, August, October, and November are usually peak months for transient-related demand. Furthermore, demand is notably supplemented from the San Francisco Bay Area during the foggy and colder months of the year. Harvest, which runs from August through October, typically increases leisure demand, boosting ADR in the region. As such, the accommodated groups tend to be smaller and associated with higher-end incentive travel and executive-level meetings.

As illustrated above, both occupancy and ADR began to recover when businesses reopened in June 2020. Napa Valley experienced a surge of visitors around the Fourth of July holiday; moreover, ADR in July only registered a -4.5% YOY change from 2019. Thereafter, local hoteliers focused primarily on maintaining healthy occupancy, which hovered around 50% from August through October. However, the Glass Fire in Napa County, which lasted from late September through late October 2020, damaged world-class wineries and iconic resort properties, such as the Meadowood Napa Valley and Calistoga Ranch, an Auberge Resort; moreover, other areas in the region were affected by the smoke, which further deterred tourism in Napa Valley. Hotels accommodated fire crews, evacuees, and PG&E workers at discounted rates during the wildfire, resulting in comparatively high occupancy but low ADR in October. In November, RevPAR reached the greatest point of recovery in 2020 when transient travelers returned to the market after the fire.

However, due to the spike in COVID-19 cases, a regional stay-at-home order was imposed on December 17, 2020, prohibiting indoor dining and implementing stricter regulations at wineries in Napa County. Visit Napa Valley reported that hotel occupancy in Napa County has remained under 20% since the new stay-at-home order commenced in December 2020. Visit Napa Valley forecasts that hotel revenue in 2021 will still be down, about 30% from the 2019 level, and it does not foresee the market recovering fully until 2023 given the dissipated group businesses, cancellations of large festivals and events, and absence of international travelers.

Despite the impacts of the ongoing pandemic, market participants’ confidence in this market over the long term remains high. The Marriott Napa was sold in October 2020 at over $100 million (rounded at $364,000 per key), and new ownership plans to invest major capital to upgrade the property. In addition, several hotels in the greater Napa Valley area are under construction. The Four Seasons Resort & Residences Napa Valley is nearing completion and is anticipated to open in the early spring of 2021. Construction of the Stanly Ranch, an Auberge Resort, was placed on hold during the pandemic; however, per our market interviews, construction is anticipated to resume in the near future. Local planning officers also reported that developers’ interest in new development and expansion projects has remained strong despite the pandemic, indicating continued confidence in Napa Valley’s lodging market. Many of these projects include a residential component, which helps to make the projects financially feasible and provides an earlier cash flow to developers. Furthermore, second-home or resort-residential demand was notably high in 2018/19, with the Four Seasons Residences selling out at a rapid pace. However, the onset of the pandemic has driven demand even higher, as many San Francisco Bay Area residents have opted to buy in the Napa Valley.

In this unprecedented time, Napa Valley is no exception to the challenges that the tourism industry is facing around the world amid the pandemic. The market experienced months of low hotel occupancy and ADR, and the course of the pandemic, along with the lifting of restrictions on wineries, restaurants, large events, and group gatherings, remains uncertain. Nevertheless, developers’ and buyers’ interest in Napa Valley continues to be strong, and we expect Napa Valley to remain a top destination market over the long term.

Other Contributor: McKenna Luke, MAI

0 Comments

Success

It will be displayed once approved by an administrator.

Thank you.

Error