Before the pandemic, the Coachella Valley typically welcomed over 14 million visitors annually. The tourism industry generated more than $7 billion in economic impact and supported 53,000 jobs in 2019. With major events canceled and many hotels closed for half of the year, Visit Palm Spring estimated a roughly $3.1 billion economic loss in 2020, inclusive of 25,000 jobs lost in the retail and services sectors.

Before the pandemic, the Coachella Valley typically welcomed over 14 million visitors annually. The tourism industry generated more than $7 billion in economic impact and supported 53,000 jobs in 2019. With major events canceled and many hotels closed for half of the year, Visit Palm Spring estimated a roughly $3.1 billion economic loss in 2020, inclusive of 25,000 jobs lost in the retail and services sectors.

Market Impacts of COVID-19

The following events and data highlight the impact of the pandemic on the Coachella Valley lodging market:- As a result of the statewide stay-at-home orders that took effect in March, a majority of the hotels in Palm Springs were closed from March through June, and many resorts stayed closed through August or September, as the summer months typically represent the low season in the Valley. The Miramonte Resort & Spa and Hotel ZOSO remained closed at the time of this article. The former Riviera hotel reopened in December as the Margaritaville Palm Springs and became the brand’s first West Coast location. The following table presents the 2020 monthly operational status of the full-service hotels in the Coachella Valley.

● Open; X: Suspended Operation

Given the recent regional Southern California stay-at-home order that was issued in early December, some hotels have decided to suspend operations again, including the Ace Hotel and Parker Hotel, while others may follow suit depending on demand levels.

- Our review of the year-to-date data through October 2020 shows that occupancy averaged in the low 40s, reflecting a roughly 30% year-over-year decline, while average daily rate (ADR) dropped by over $20 to roughly $140, reflecting a 10% decline over same period last year. Monthly data also illustrate that rates from July through October were similar to 2019 levels (or higher in some cases), primarily attributed to the nearly 20% decline in supply and the absence of group business, which is traditionally lower rated.

- Despite the decline in hotel occupancy levels, the City of Palm Springs reported nearly a twofold increase in TOT (Transient Occupancy Tax) collected from vacation rentals in 2020 (fiscal year starting in July). While no details have been distributed, the increase could be attributed to higher room rates, longer stays, and an influx of remote workers and city dwellers.

- Major events including the Coachella Valley Music & Arts Festival (Coachella), Stagecoach Country Music Festival, and BNP Paribas Open tennis championship were canceled in 2020. Reportedly, Coachella 2021, which was scheduled for April, is likely to be rescheduled to the fall of 2021. At the time of writing this article, tickets were on sale for the 2021 BNP Paribas Open to be held in March; however, tennis insider Jon Wertheim of Tennis Channel and Sports Illustrated reported on Twitter the event is expected to be postponed.

- The market was experiencing a period of supply growth prior to the onset of the pandemic, with construction activities noted throughout the Valley; however, multiple projects are currently on hold. The 150-room Andaz Hotel, which broke ground in 2017, had already stopped construction prior to the pandemic because of a dispute with the contractor. The lender of the project, Hall Group, has taken a controlling interest of the project, and the brand has been changed to Thompson Hotels (also affiliated with Hyatt); however, a completion date has yet to be announced. The 142-room Virgin Hotel was originally set to open in 2021 after being faced with multiple delays due to a corruption case. The project has now been postponed because of COVID-19, and the site will be used to build a 62-unit condominium property instead of a hotel. The incomplete Glenroy hotel has also faced delays and lawsuits, and construction on the project is currently halted. The following map presents the development projects in the Coachella Valley and their respective development status:

Source: HVS

- In 2019, the Agua Caliente Band of Cahuilla Indians and the Los-Angeles-based Oak View Group announced plans to develop a new, 10,000-seat indoor arena in Downtown Palm Springs; however, in September 2020, it was announced that the arena would be constructed in Palm Desert. The tribe had exited the development in March as the impact of the pandemic became clear.

- The Palm Springs Convention Center (PSCC) has been closed to the public since the beginning of the pandemic. Major events in 2020 were either canceled or postponed to the fall of 2021. It currently serves as a testing center for COVID-19. According to Visit Palm Springs, PSCC has become one of the few convention centers in the United States to earn GBAC STAR accreditation on outbreak prevention (hybrid/virtual event services are offered).

HVS Forecast and Market Outlook

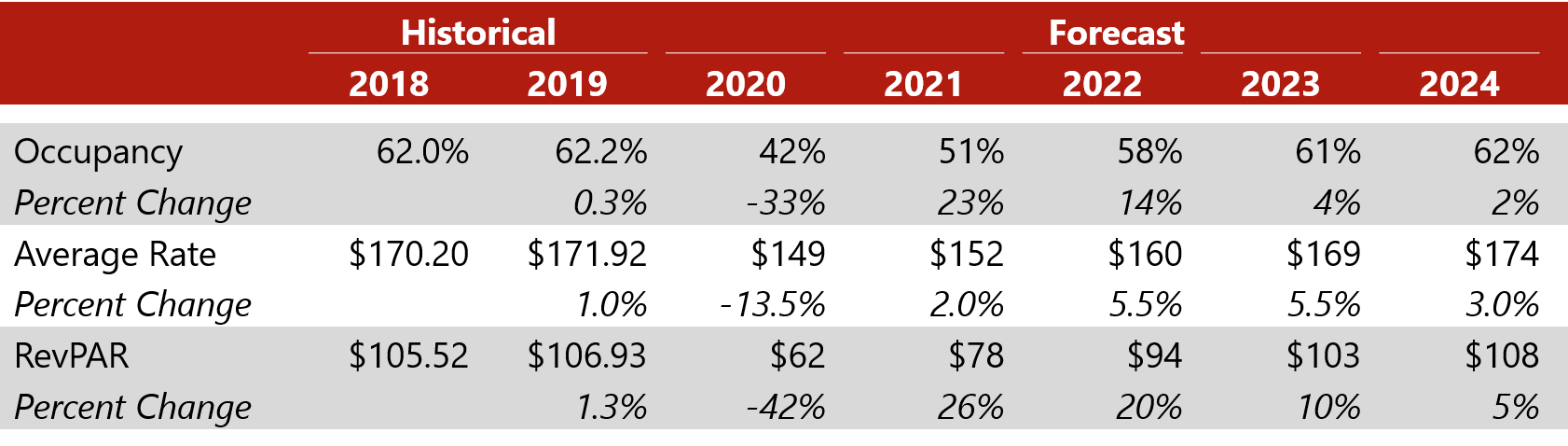

During the Great Recession, the greater Palm Springs area’s occupancy fell roughly 20% from 61% in 2007 to 51% in 2009. We forecast occupancy to drop from the 2019 level of roughly 62% to 42% in 2020, reflecting a 33% decline. It is important to consider the aforementioned closures from April through August or September when analyzing the trend. ADR declined from $125 in 2008 to $112 in 2010, reflecting a 10% decline. We forecast ADR to fall 13.5% in 2020 from the rate achieved in 2019.

Source: HVS

* The Greater Palm Springs Hotel Market, as defined by STR, includes all hotels located in the Coachella Valley (Indio, Indian Wells, Cathedral City, Desert Hot Springs, La Quinta, Palm Desert, Rancho Mirage, and Palm Springs).

Major factors contributing to our forecast are summarized as follows:

- The Coachella Valley market is highly seasonal, with occupancy being the strongest in the spring and late fall. Occupancy typically peaks in March and April because of special events such as the Coachella Valley Music & Art Festival and BNP Paribas Open. With special events and majority of group activities being postponed to the fall of 2021, occupancy is unlikely to rebound before the second half of 2021.

- Market-wide ADR was on par with the 2019 level from July through October due to the decline in supply in 2020. ADR recovery in the near term will be somewhat hindered as the larger, full-service hotels resume normal operations and ramp up their occupancy positions.

- The market is heavily dependent on leisure travel. While demand within this segment is expected to return sooner than the other segments, the Coachella Valley still faces seasonality challenges and lack of a strong corporate base, which normally supports weekday travel.

- During the last downturn, it took seven years for the destination to recover its occupancy level. Nonetheless, the Coachella Valley is likely to emerge from this downturn sooner given its popularity as a drive-to destination with open space and outdoor activities and its proximity to three major population centers (Los Angeles, Orange County, and San Diego).

- Airlines have recently added service at the Palm Springs International Airport. Southwest Airlines began serving the airport in November, with nonstop flights to/from Phoenix, Oakland, and Denver; JetBlue began seasonal service to/from New York in December; and Alaska Airlines also instituted nonstop service to/from San Jose, Reno/Lake Tahoe, and Boise in December. The additional airlift should bode well for the area’s visitation trends over the long term.

Southern California Regional Stay-at-Home Orders (Effective December 6, 2020, extended on December 29, 2020)

- All Retailers: May operate indoors at no more than 20% capacity.

- Gatherings: Prohibits gatherings of any size.

- Lodging: No lodging for out-of-state reservations for non-essential travel.

- Restaurants: The sale of food, beverages, and alcohol for in-store consumption is prohibited.

- Full information is available here.

About Kirsten Z. Smiley, MAI

Kirsten Smiley, MAI, Managing Director, is the Director of the Southern California Region of the HVS Consulting & Valuation office in Los Angeles, California. She is an expert in markets throughout the Pacific West. Her past experience in hospitality includes marketing, management, and guest service roles at the Mayflower Renaissance hotel in downtown Washington, D.C.; the Atherton Hotel in Stillwater, Oklahoma; and the Dong Fang Hotel in Guangzhou, China. Kirsten graduated with a BS in Hotel Management from the Business School of Sun Yat Sen University in Guangzhou and a BS in Hospitality Administration from Oklahoma State University. Contact Kirsten at +1 (405) 612-6255 or [email protected].

0 Comments

Success

It will be displayed once approved by an administrator.

Thank you.

Error