At the 2019 Phoenix Lodging Conference, the HVS Team heard muted optimism and a view that growth in the next 24 months may vary widely across markets. We would encourage owners to investigate the sometimes overlooked top 50 MSAs that still could experience value appreciation in those 24 months.

Markets for Consideration

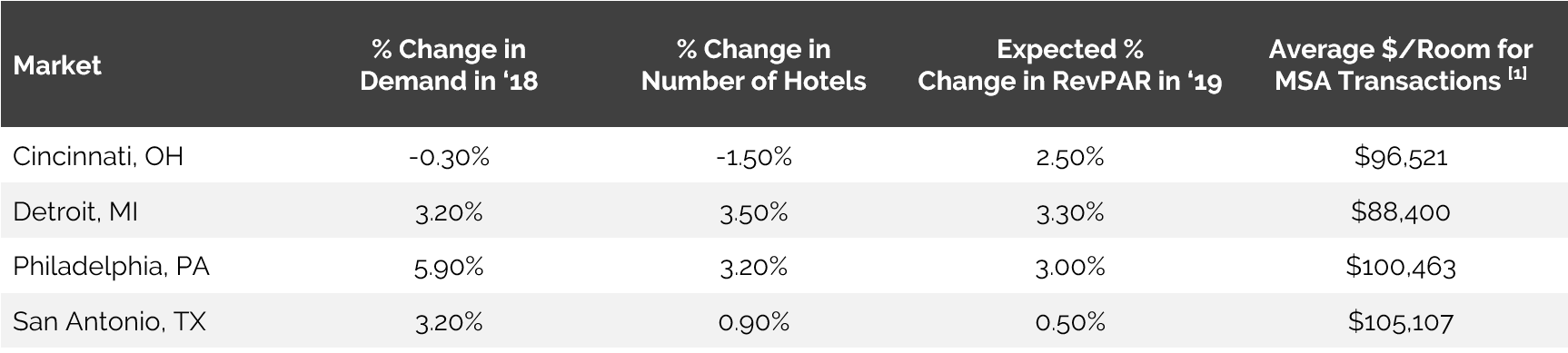

Source: HVS Research and the HVI

HVS reviewed multiple metrics to identify select top 50 MSAs that might offer good value to hotel investors. While these markets don’t necessarily have the cachet of, say, New York or San Francisco, they do offer potential growth and may not carry the competitive supply pressures of other locales. We looked at the MSA’s 2018 percentage change in demand, 2018 percentage change in number of hotels, 2019 expected percentage change in RevPAR, and average dollar amount per room for MSA transactions over the last four quarters. With our internal knowledge, and with these numbers as predictors, we identified four unique MSAs with strong future opportunities.

Cincinnati, OH (29th largest U.S. MSA): Cincinnati benefits from being at the intersection of three states (Indiana, Kentucky, and Ohio) and having a diverse base of corporate demand generators, including firms in aerospace, consumer products, and financial services. Cincinnati’s expected future growth (2.5% RevPAR in 2019), asset affordability, diverse industry, and new corporate presences (including Amazon) make it a strong market.

Detroit, MI (14th largest U.S. MSA): Detroit has experienced a substantial renaissance since its darkest point during the financial crisis and with GM’s bankruptcy. Detroit’s 2018 increase in demand, expected future growth (3.3% RevPAR in 2019), growing urban professional population, and new CBD development demonstrate that the market has significant upside possible in its immediate future.

Philadelphia, PA (8th largest U.S. MSA): Philadelphia is a city with a base of diversified hotel demand generators and a variety of colleges and universities that also create significant room-night demand. Philadelphia is also home to many major companies, including Comcast, multiple healthcare systems, and a myriad of major law firms. Philadelphia’s robust 2018 increase in demand of 5.9%, expected future growth (3.0% RevPAR in 2019), and its stable higher-education, medical, and corporate demand, as well as modest hotel supply growth, could signal major opportunities.

San Antonio, TX (24th largest U.S. MSA): San Antonio has the luxury of strong government and defense demand, which, when combined with a growing population and an expanding healthcare sector, offer a prime potential opportunity for hotel investment. San Antonio’s market affordability, strong recent demand (3.2% demand growth in 2019), population growth and varied, stable demand generators offer quite a strong argument as to why San Antonio is a market in which to consider hotel investment.

In closing, while there are many markets that could experience growth during the next 24 months, even as industry pundits are fearing a slowdown, Cincinnati, Detroit, Philadelphia, and San Antonio are strongly worth investigating. Each of those markets has major factors that could lead to increasing corporate demand, and each area also boasts a diverse set of demand generators.

HVS Brokerage & Advisory continues to work regularly in the markets mentioned above, with nearby consulting offices in Cincinnati, OH; Detroit, MI; Philadelphia, PA; and San Antonio, TX. Eric Guerrero, senior managing director of HVS Brokerage & Advisory, can also utilize HVS’s significant data resources to discuss any asset you may be evaluating for sale, transition, or recapitalization.

0 Comments

Success

It will be displayed once approved by an administrator.

Thank you.

Error